Budget 2017: stamp duty tax cut will ‘drive up prices’

Budget watchdog says Chancellor's plan to help first-time buyers will mainly benefit existing homeowners

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Tories applauded Chancellor Philip Hammond’s Budget plan to abolish stamp duty in order to help first-time home buyers – but according to experts, the move is likely to push housing prices higher.

The Office for Budget Responsibility (OBR) – the Treasury auditor – predicts that Hammond’s decision will probably ramp up prices up by about 0.3%, and will therefore mainly benefit those who already own properties. Some buyers with smaller deposits may be able to borrow more, “allowing them to buy properties that they otherwise could not afford – but more expensively”, the OBR says.

The Treasury argues that the tax break, which applies to the first £300,000 of homes worth up to £500,000, will be a “welcome boost”, with 95% of first-time buyers seeing a cut in the amount of stamp duty they pay, and 80% paying none at all, the London Evening Standard reports.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But according to the OBR, the stamp duty tax break may result in as few as 3,500 additional home purchases every year, while costing the Treasury more than £3bn by 2022-23.

Meanwhile, the Financial Times says that Hammond’s move does “nothing to unlock an illiquid housing market, which means there is not just a shortage of new homes but also of the many more existing ones for sale”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The people who raffle their homes

The people who raffle their homesUnder The Radar Offer the chance to win your house for £2 a ticket? It's simple and can make thousands but it's not stress-free

-

The end of leasehold flats

The end of leasehold flatsThe Explainer Government reforms will give homeowners greater control under a move to the commonhold system

-

Why baby boomers and retirees are ditching Florida for Appalachia

Why baby boomers and retirees are ditching Florida for AppalachiaThe Explainer The shift is causing a population spike in many rural Appalachian communities

-

The pros and cons of new-builds

The pros and cons of new-buildsPros and Cons More options for first-time buyers and lower bills are offset by ‘new-build premium’ and the chance of delays

-

How the Grenfell tragedy changed the UK

How the Grenfell tragedy changed the UKfeature Six years on since the government vowed to ‘learn lessons’ has sufficient progress been made?

-

Pros and cons of building on the green belt

Pros and cons of building on the green beltPros and Cons More housing and lower house prices must be weighed against urban sprawl and conservation concerns

-

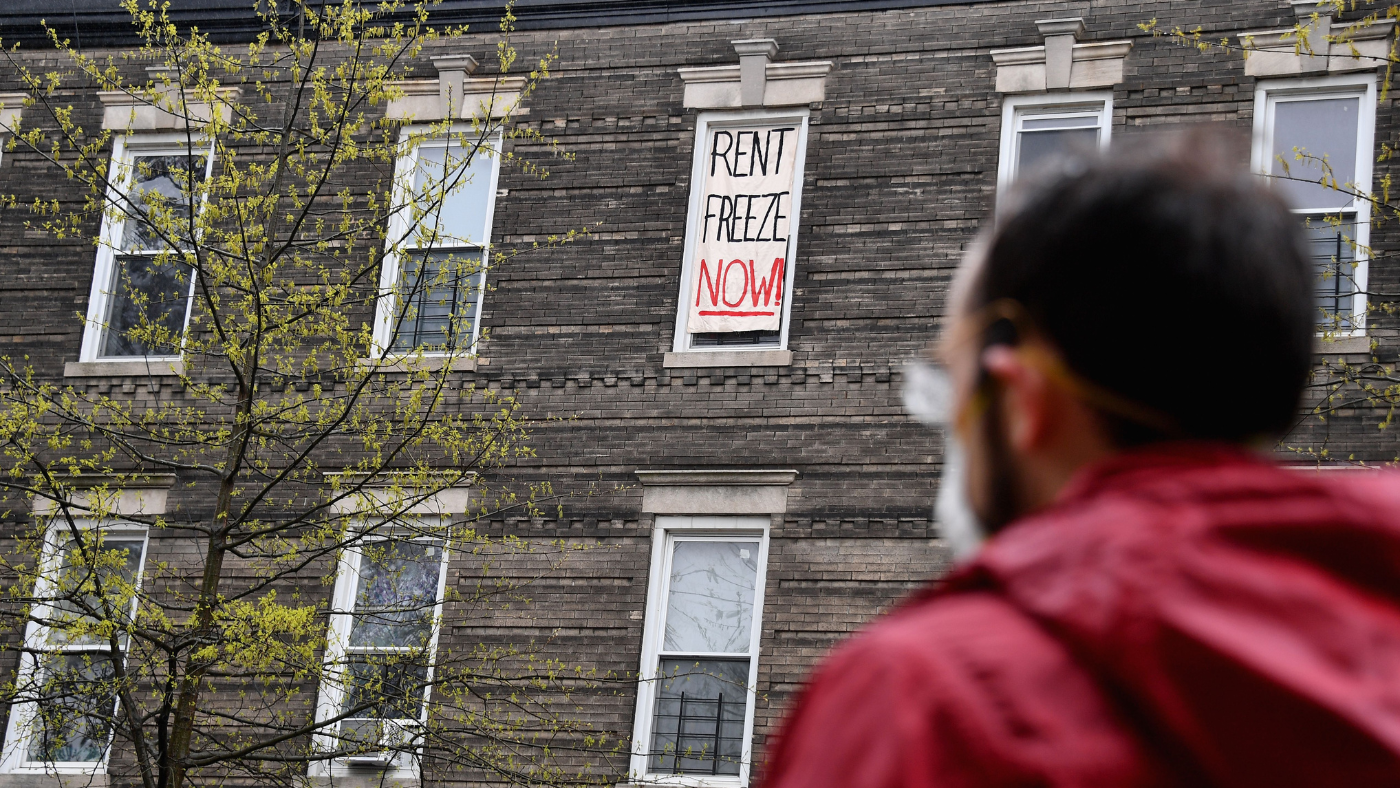

The pros and cons of rent freezes

The pros and cons of rent freezesPros and Cons Proponents say rent controls provide stability for tenants, but critics claim they won’t fix the housing crisis

-

Sport on TV guide: Christmas 2022 and New Year listings

Sport on TV guide: Christmas 2022 and New Year listingsSpeed Read Enjoy a feast of sporting action with football, darts, rugby union, racing, NFL and NBA