The daily business briefing: September 9, 2019

China reports drop in trade with U.S., Britain's bill against a no-deal Brexit is set to become law, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. China trade with U.S. dropped sharply in August

Customs data released Sunday showed that China's imports of U.S. goods fell by 22 percent in August from a year earlier in the latest sign that trade between the two countries has been hurt by their tariff war. China's exports to the U.S. dropped to $44.4 billion, a 16 percent decline from the same month last year. The two countries are the world's biggest economies, and the U.S. is China's biggest foreign market. Negotiators from the Trump administration and China are preparing for a new round of trade talks in October, after the latest round of new tariffs took effect on Sept. 1 and increased tensions. "The tit-for-tat escalation shows how unlikely a trade deal and de-escalation have become,” said Louis Kuijs of Oxford Economics in a report.

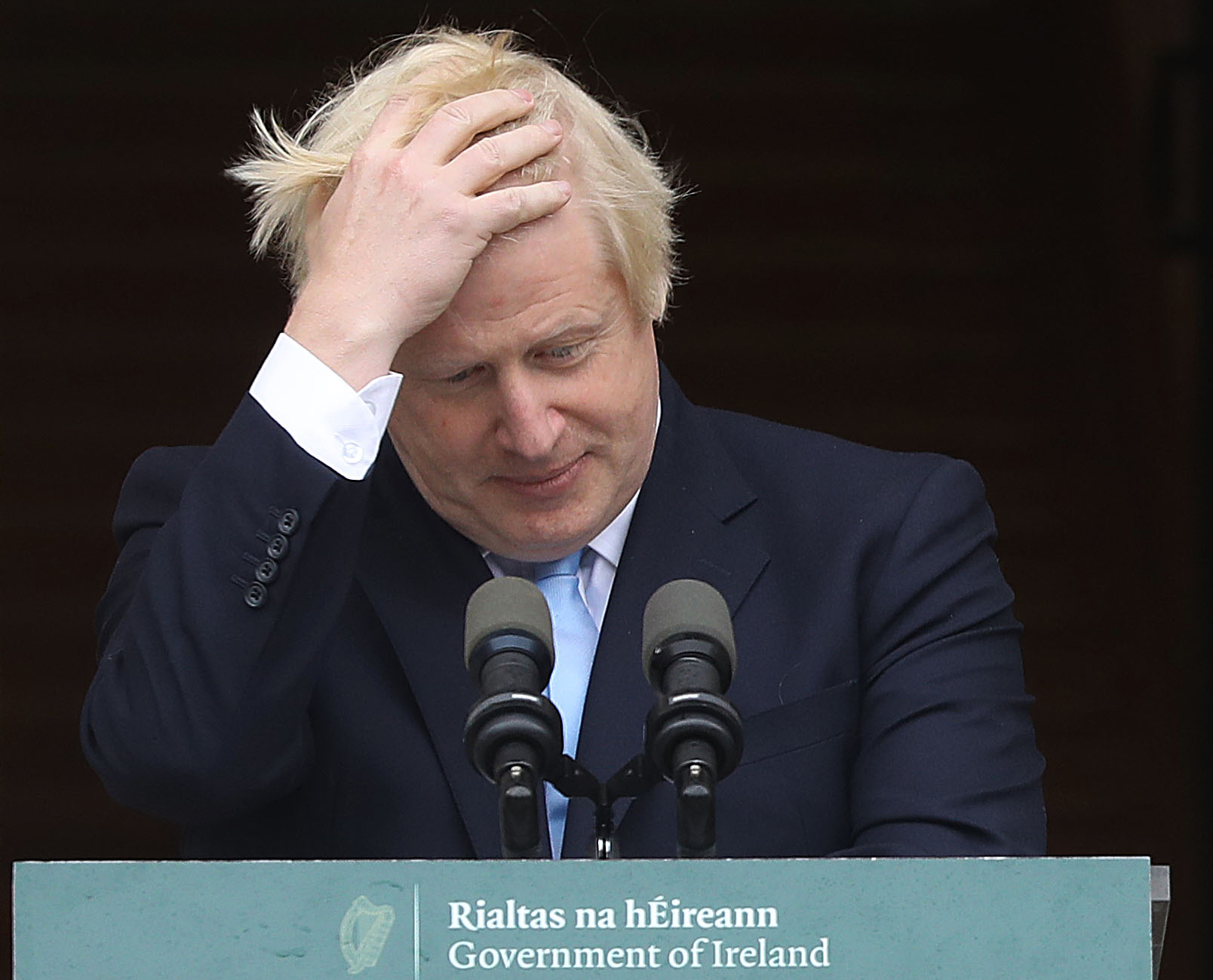

2. U.K. bill barring no-deal Brexit set to become law

Parliament's bill seeking to block a no-deal Brexit is set to become law on Monday over the objections of Prime Minister Boris Johnson. The legislation requires Britain to seek another Brexit extension from the European Union if lawmakers don't approve a withdrawal agreement by Oct. 19. Otherwise, the U.K. is scheduled to leave the trading bloc at the end of October. The opposition Labour Party and other groups also have said they would not back Johnson's call for early elections until he agrees to rule out a no-deal Brexit, which Johnson's rivals say would severely damage the British economy. Johnson last week expelled 21 members of his Conservative Party for defying him and joining opposition lawmakers seeking to prevent him from leading the country out of the EU even without a deal.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Hurricane Dorian insured losses estimated in billions

Hurricane Dorian probably caused several billions of dollars in insured losses, German reinsurer Munich Re said Sunday. Although that damage estimate was just a "rough guess," it appeared likely that the destruction in the Bahamas and the lesser damage in North Carolina and Canada would drive up insurance rates, Munich Re board member Torsten Jeworrek said. Rival Swiss Re also said rates were likely to rise in hard-hit areas. Dorian lashed eastern Canada on Sunday and entered the North Atlantic, after killing at least 44 people in the Bahamas and two in the U.S., and leaving as many as 70,000 homeless.

4. Apple: Allegations of China labor-law violations mostly false

China Labor Watch said in a report released Sunday that Apple and its major supplier Foxconn had violated Chinese labor laws, but Apple on Monday denied most of the allegations. China Labor Watch, a watchdog based in New York, said that the $295 base salary at the biggest iPhone factory in Zhengzhou, China, was "insufficient to sustain the livelihood for a family living in Zhengzhou city." The report also found that in August half of the workers at the factory were temporary employees, exceeding the legal limit of 10 percent. Apple said it had looked into the allegations and "confirmed all workers are being compensated appropriately, including any overtime wages and bonuses, all overtime work was voluntary, and there was no evidence of forced labor." It acknowledged that the number of temporary workers exceeded company guidelines.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. U.S. stock futures mixed after China trade, U.S. hiring weaken

U.S. stock index futures were mixed early Monday after new data from China showed that trade with the U.S. fell in August. Futures for the Dow Jones Industrial Average and the S&P 500 were up by 0.3 percent and 0.1 percent, respectively, while those of the Nasdaq were down by 0.2 percent. China's trade numbers reinforced concerns about weakness in the world's second biggest economy, and increased pressure for Beijing to act to boost businesses. Expectations of stimulus efforts by central banks around the world helped lift markets despite Friday's disappointing U.S. jobs report. The European Central Bank is holding a policy meeting Thursday and is widely expected to cut interest rates.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

American universities are losing ground to their foreign counterparts

American universities are losing ground to their foreign counterpartsThe Explainer While Harvard is still near the top, other colleges have slipped

-

How to navigate dating apps to find ‘the one’

How to navigate dating apps to find ‘the one’The Week Recommends Put an end to endless swiping and make real romantic connections

-

Elon Musk’s pivot from Mars to the moon

Elon Musk’s pivot from Mars to the moonIn the Spotlight SpaceX shifts focus with IPO approaching

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military