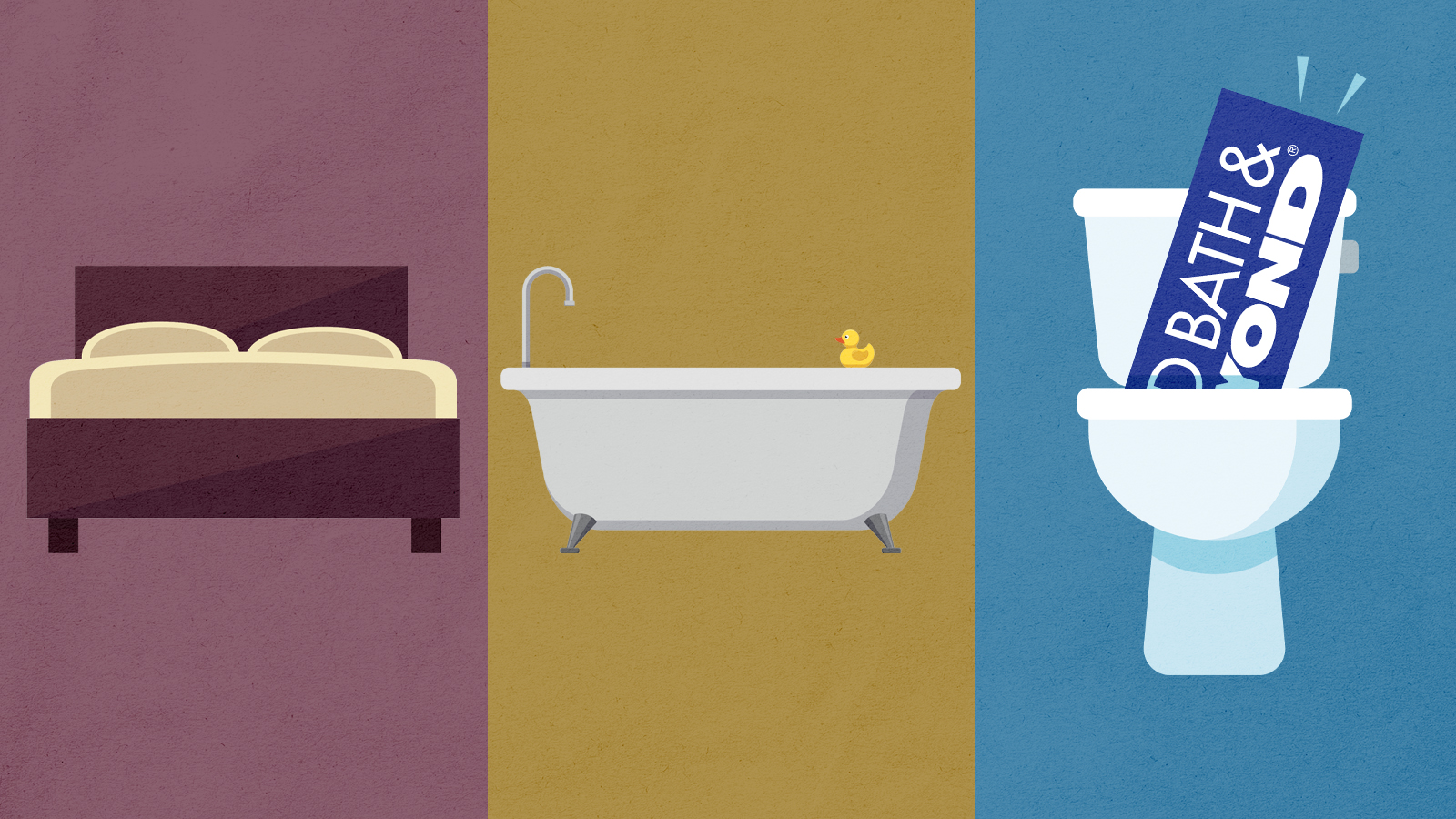

What's going on with Bed Bath & Beyond?

The end is nigh for the big-box chain

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It could soon be time to say Bed Bath & Bye-Bye to Bed Bath & Beyond. The company has announced it will liquidate its stores and wind down operations after a string of last-ditch efforts failed to save it from bankruptcy. Its demise marks yet another casualty of the retail industry's broader pivot to e-commerce, as well as the end of an era for Americans accustomed to the chain's plentiful stock and infamous blue coupons.

What's happening?

On Sunday, longtime home goods retailer Bed Bath & Beyond said it was filing for Chapter 11 bankruptcy protection and would soon begin closing its 360 remaining stores. "Millions of customers have trusted us through the most important milestones in their lives — from going to college to getting married, settling into a new home to having a baby," company CEO and President Sue Gove said in a press release. "We deeply appreciate our associates, customers, partners and the communities we serve, and we remain steadfastly determined to serve them throughout this process." Bed Bath & Beyond locations, as well as the company's website — which currently displays a banner reading, "Thank you to all of our loyal customers. We have made the difficult decision to begin winding down our operations" — will remain open during the bankruptcy process. Storewide sales are scheduled to begin April 26.

How did we get here?

Though rumors of the company's impending insolvency began swirling in January, Bed Bath & Beyond has been in hot water for some time now, having struggled for years to pivot to e-commerce and compete with larger rivals despite its best efforts. Its most recent hiccup, however, was what The Wall Street Journal described as a "failed makeover," in which many name-brand goods were replaced by those of a BB&B private label — a strategic shift executives hoped would bolster lagging sales. But shoppers, unfortunately, were not impressed by the change-up, and a leadership exodus soon followed. Even as Gove took the reins, sales continued to slide in the lead-up to the crucial holiday season, "in large part because Bed Bath & Beyond did not have enough stuff on shelves from suppliers," according to CNN.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Per results released Jan. 10, net sales had fallen 33% from the previous quarter, when the company's net loss grew to $393 million — a 42% increase from a year prior. "Although we moved quickly and effectively to change the assortment and other merchandising and marketing strategies, inventory was constrained and we did not achieve our goals," CEO Sue Gove said of the quarterly data. And just a few days before that, Bed Bath & Beyond had warned in a regulatory filing that there was "substantial doubt about the company's ability to continue," given its dire financial situation. Sprinkle in a revolving door of executives in recent years, and you have yourself a recipe for disaster.

What did the company do to try and fix its problems?

When releasing the quarterly results on Jan. 10, Gove said Bed Bath & Beyond was taking steps to solve its inventory issues and explained "that credit constraints and vendors demanding better payment terms made it harder for the company to keep its shelves stocked during the [holiday] period," the Journal summarized. Further, Gove said the company was consulting with advisers "as we consider all strategic alternatives." Such efforts were in addition to broad layoffs, cost-savings tactics and store closures, which were later followed by stock offerings that ultimately failed to infuse the company with enough cash to carry on.

What happens next?

There is somewhat of a chance Bed Bath & Beyond emerges from the claws of bankruptcy, especially if it sells "some or all of its business" or successfully pivots to become an online-only retailer, according to CNN. But "if a buyer doesn't come forward, Bed Bath & Beyond will likely be liquidated entirely and go out of business." If it does somehow pull off a comeback, though, it will likely "be a shadow of its former self," Neil Saunders, an analyst at GlobalData Retail, told CNN.

Indeed, in filing for Chapter 11, Bed Bath & Beyond is saying "all possibilities remain open," Patrick T. Collins, an attorney specializing in bankruptcies, told The Washington Post. "But in the meantime, we're moving ahead with our store-closing sales because we're burning cash and we can't afford to stay open much longer."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Update April 25, 2023: This article has been updated throughout to reflect Bed Bath & Beyond's bankruptcy filing.

Brigid Kennedy worked at The Week from 2021 to 2023 as a staff writer, junior editor and then story editor, with an interest in U.S. politics, the economy and the music industry.