The president's Venmo account

And more of the week's best financial insight

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Here are three of the week's top pieces of financial insight, gathered from around the web:

The president's Venmo account

"We found Joe Biden's secret Venmo account," said Ryan Mac at BuzzFeed News. Following "a passing mention in The New York Times that the president had sent his grandchildren money on Venmo," the popular peer-to-peer payments app, it took us less than 10 minutes to find Biden's account "using only a combination of the app's built-in search tool and public friends feature." The president had made his transactions private, overriding Venmo's default settings. However, there is no way to make Venmo's friend lists private, making Biden's identity easily verifiable through "the people he was connected to, including an account that appeared to be for his wife, Jill Biden." At least one person seems to have used Venmo's public directory to ask for money from Biden family members.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Child credit payments start in July

Roughly 39 million families will receive monthly child tax credit payments starting July 15, said Lauren Egan at NBC News. The monthly payments for most families will be $300 for each child under 6 years old and up to $250 for each child between 6 and 17 years of age. Those amounts are reduced for married taxpayers who file jointly earning over $150,000; $112,500 for heads of household; and $75,000 for all other taxpayers. The payments were passed as part of the $1.9 trillion COVID-19 relief package in March. It marks the first time that such payments, "normally given annually as tax refunds, will be distributed monthly." Most families will get the benefits by direct deposit into their bank accounts.

Social media's shopping perils

Social media is turning people into shopping addicts, said Emily Glaser at Vox. Already filled with consumer temptations, "integration of direct shopping capabilities into apps" has made Instagram and Facebook into minefields, especially for people already in debt. Studies now indicate "a direct correlation between social media use, credit card debt, and low credit scores." The worries about debt and consumerism are felt even by influencers who have made a living promoting products. Lifestyle blog author Jess Ann Kirby, with 138,000 Instagram followers, went through a "Marie Kondo–style reckoning" and now writes about how to cut your environmental impact. Nika Booth, who used to "swipe her credit card for impromptu trips to Miami with friends" now lets her 33,000 followers track her journey toward paying off her debt.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

-

The environmental cost of GLP-1s

The environmental cost of GLP-1sThe explainer Producing the drugs is a dirty process

-

Greenland’s capital becomes ground zero for the country’s diplomatic straits

Greenland’s capital becomes ground zero for the country’s diplomatic straitsIN THE SPOTLIGHT A flurry of new consular activity in Nuuk shows how important Greenland has become to Europeans’ anxiety about American imperialism

-

‘This is something that happens all too often’

‘This is something that happens all too often’Instant Opinion Opinion, comment and editorials of the day

-

Ports reopen after dockworkers halt strike

Ports reopen after dockworkers halt strikeSpeed Read The 36 ports that closed this week, from Maine to Texas, will start reopening today

-

Would Trump's tariff proposals lift the US economy or break it?

Would Trump's tariff proposals lift the US economy or break it?Talking Points Economists say fees would raise prices for American families

-

Will college Gaza protests tip the US election?

Will college Gaza protests tip the US election?Talking Points Gaza protests on U.S. campuses pose problems for Biden like the ones that hurt Lyndon B. Johnson in the '60s

-

Can Trump get a fair trial?

Can Trump get a fair trial?Talking Points Donald Trump says he can't get a fair trial in heavily Democratic Manhattan as his hush money case starts

-

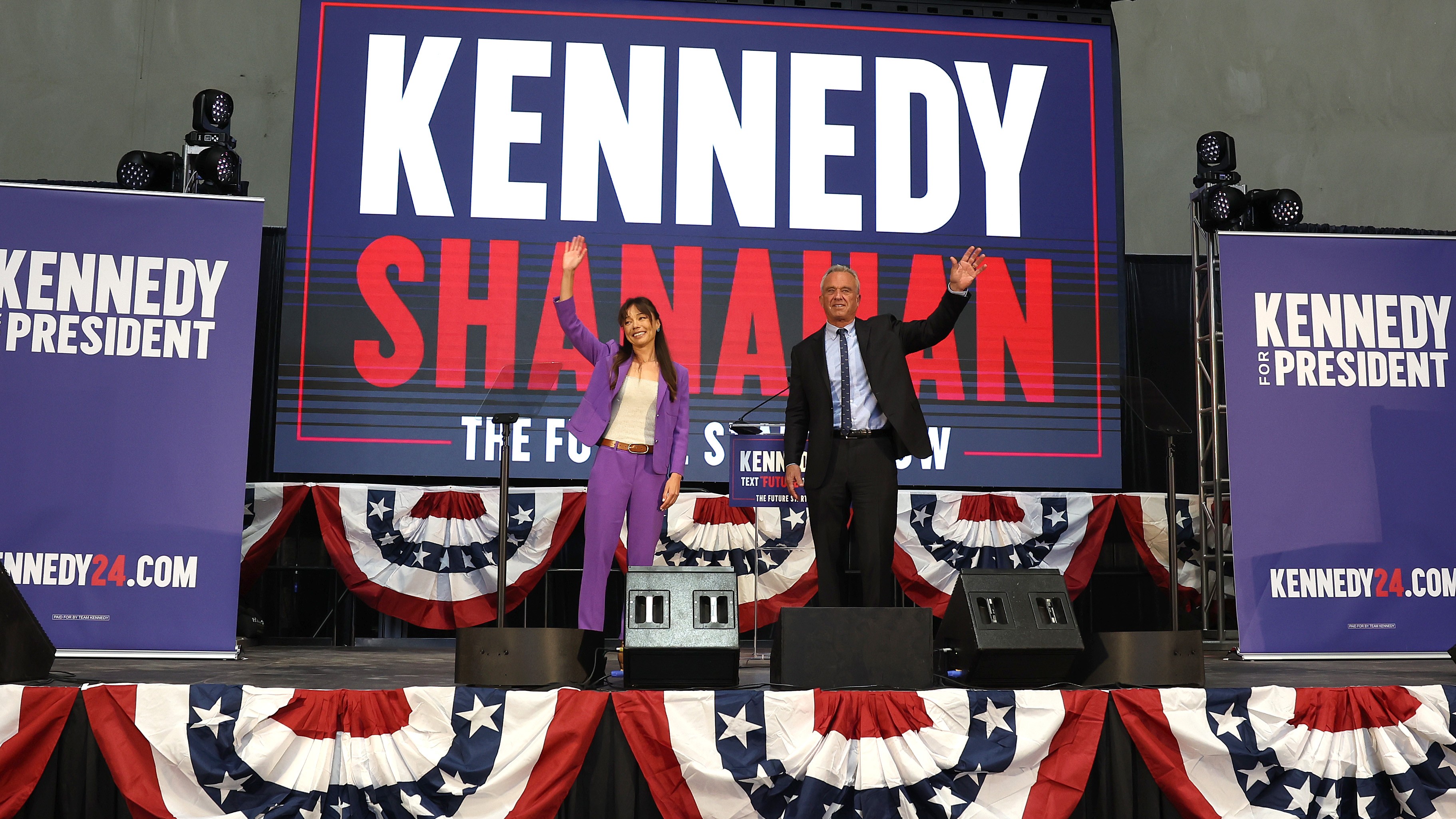

What RFK Jr.'s running mate pick says about his candidacy

What RFK Jr.'s running mate pick says about his candidacyTalking Points Robert F. Kennedy Jr.'s' running mate brings money and pro-abortion-rights cred to his longshot presidential bid

-

Housing costs: the root of US economic malaise?

Housing costs: the root of US economic malaise?speed read Many voters are troubled by the housing affordability crisis

-

Did the Biden impeachment inquiry just collapse?

Did the Biden impeachment inquiry just collapse?Talking Points Key GOP impeachment inquiry witness Alexander Smirnov says Russian intelligence fed him lies

-

Bidenomics: A roaring economy still filled with unease

Bidenomics: A roaring economy still filled with uneaseFeature Americans are doing better financially but still lack confidence in the economy