Foreign investors go bargain-hunting as pound hits record lows

The “UK is cheap” narrative has turned some of our best companies into 'sitting ducks'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

What is it about French tycoons and British phone companies? While Patrick Drahi lays siege to BT, another “French rebel”, Xavier Niel, has begun storming the ramparts of Vodafone, said Jamie Nimmo in The Sunday Times. Niel has built a 2.5% stake worth £750m in the UK mobile phone giant via his Atlas Investissement vehicle.

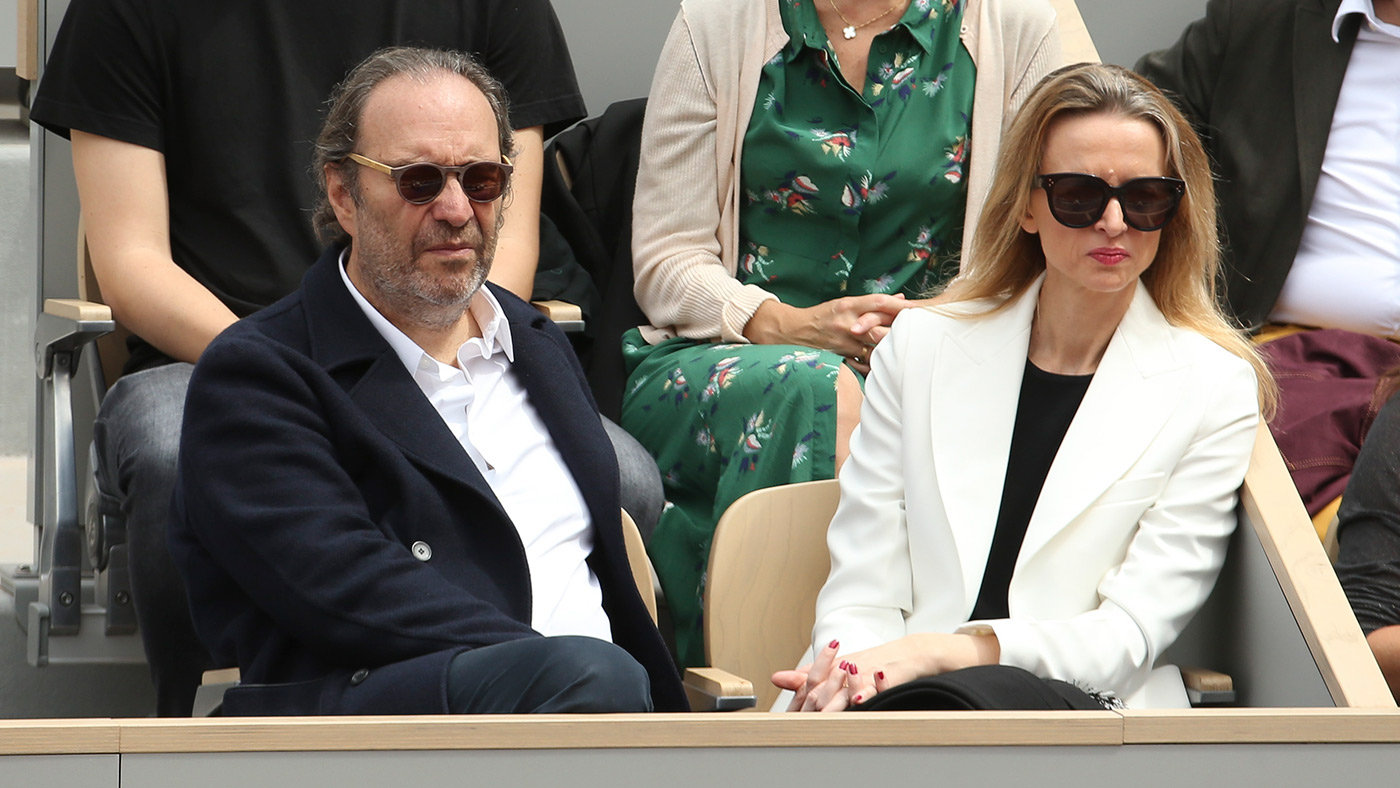

The founder of the Iliad telecoms empire is something of a celebrity entrepreneur in France, his profile raised by his long-term relationship with the heiress to the LVMH fortune, Delphine Arnault. Niel’s exact plan for Vodafone is anyone’s guess. He has left the market, and the company’s top brass, guessing.

“Brexit was supposed to awaken a latent buccaneering spirit,” said Tom Braithwaite in the Financial Times. “And so it has. For the French.” The Iliad/Vodafone tilt is just one of “a flurry of cross-Channel deals” struck on a single day last week, involving tech, satellite and recycling companies. Is this some kind of “dastardly” French plot? Bankers point instead to the relative decline in valuations and currency. Prepare for a rash of American companies to join the French “at the UK’s bargain bin”.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“Even before sterling got this low, foreign corporate and buyout bidders were taking advantage of relative dollar strength to pounce on London-listed companies,” said Chris Hughes on Bloomberg. Thanks to Liz Truss and Kwasi Kwarteng, this “UK is cheap” narrative has “gotten another leg”.

Analysts at Canaccord Genuity recently drew up a list of 100 companies it considers to be targets – including ITV, Next, Greggs, BAE Systems, Flutter and The Week’s publisher, Future, said Ben Marlow in The Daily Telegraph. The most “vulnerable” are the “cheap and cash rich”. The “rock bottom pound” has turned some of our best companies into “sitting ducks”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Anthropic: AI triggers the ‘SaaSpocalypse’

Anthropic: AI triggers the ‘SaaSpocalypse’Feature A grim reaper for software services?

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man