Celsius: crypto lender sparks manic meltdown

Total value of the crypto market is now below $1trn – down from almost $3trn in November

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Cryptocurrencies have become “emblematic” of the “flight from speculative assets”, as monetary policy has tightened around the world to fight inflation, said Bloomberg. This week delivered another “white-knuckle ride”. The latest trigger for big falls was “crypto lender” Celsius, which sparked panic on Monday when it froze withdrawals, citing “extreme market conditions”. In the ensuing turmoil, the values of all major coins were hit. Bitcoin dropped by 15% to $23,629; ether fell 17%; the ferocious sell-off prompted the world’s largest crypto exchange, Binance, to temporarily suspend bitcoin withdrawals. The value of the total crypto market is now below $1trn, according to CoinMarketCap – from almost $3trn in November.

Celsius, which bragged that its 1.7 million customers could “borrow like a billionaire”, had “seemed to offer the best of all worlds to crypto enthusiasts”, said Lex in the FT. Advertising “an annual percentage yield of 18.63%” on crypto deposits, it paid interest in crypto assets but also let customers borrow US dollars. The lender, which had estimated assets of $12bn in May, may now be insolvent, said Tim Hakki on Decrypt. So what happened? “The short answer: nobody really knows.” But the big worry is contagion. Unlike crypto’s last big blow-out – the collapse of TerraUSD in May – Celsius was intricately connected with many other crypto “ecosystems”.

The fear now, said Martin Peers on The Information, is “a self-perpetuating spiral, as investors liquidate their positions” to conserve capital. Most at risk are “real world” firms that have borrowed against their crypto holdings – such as MicroStrategy, a software business that has invested $4bn in bitcoin. This punishing bust may have much further to run.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Ex-South Korean leader gets life sentence for insurrection

Ex-South Korean leader gets life sentence for insurrectionSpeed Read South Korean President Yoon Suk Yeol was sentenced to life in prison over his declaration of martial law in 2024

-

At least 8 dead in California’s deadliest avalanche

At least 8 dead in California’s deadliest avalancheSpeed Read The avalanche near Lake Tahoe was the deadliest in modern California history and the worst in the US since 1981

-

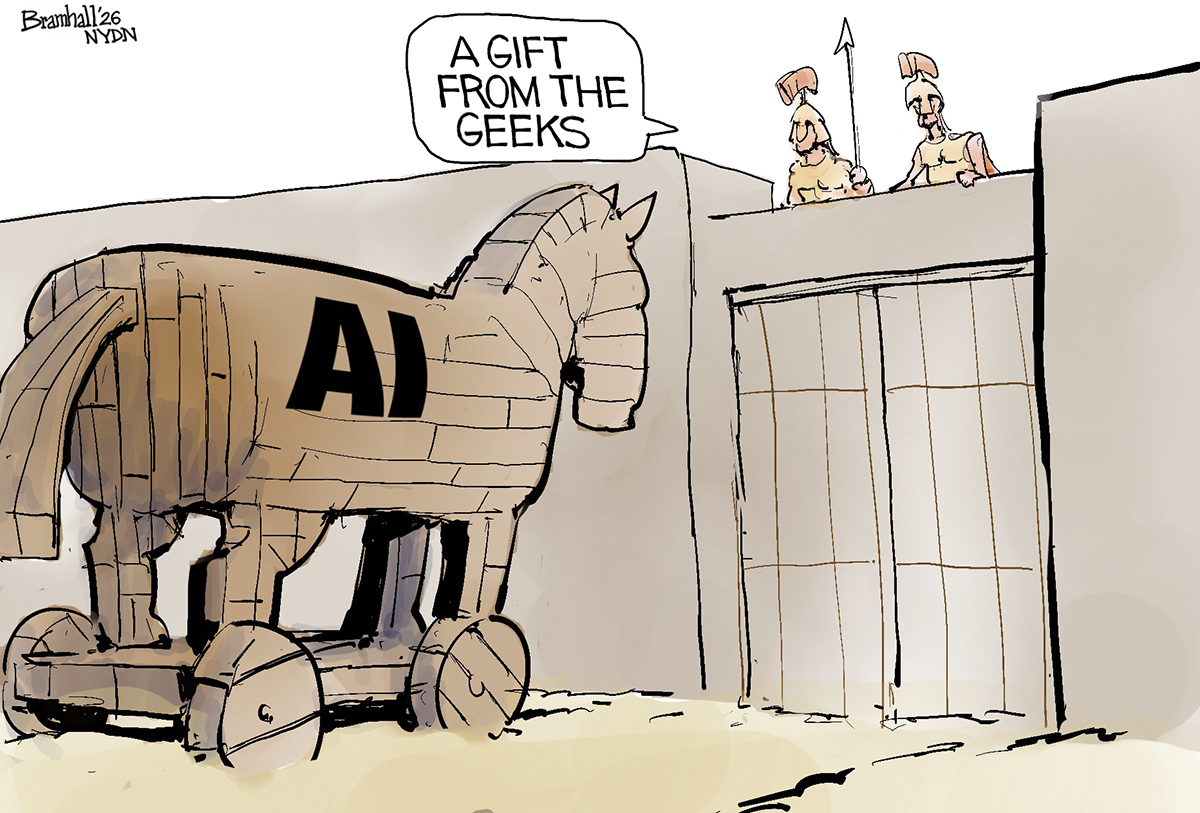

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Powell: The Fed’s last hope?

Powell: The Fed’s last hope?Feature Federal Reserve Chairman Jerome Powell fights back against President Trump's claims

-

Taxes: It’s California vs. the billionaires

Taxes: It’s California vs. the billionairesFeature Larry Page and Peter Thiel may take their wealth elsewhere