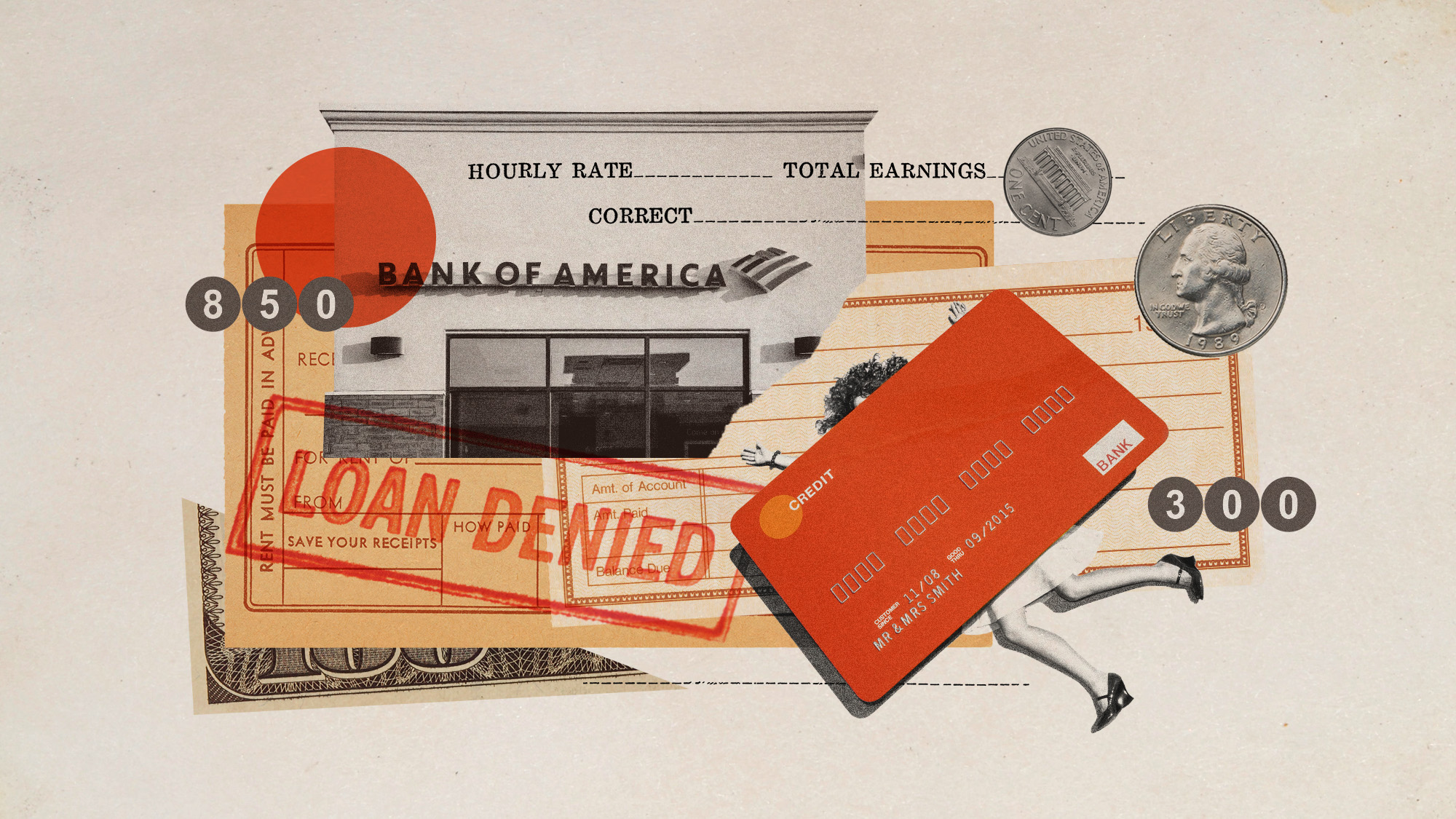

Gen Z is facing a credit score crisis

The average Gen Z credit score has dropped three points in 2025

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In another sign that the economy may be faltering, average credit scores across the country have taken a nosedive in 2025, according to a report released last week. And Gen Z is one demographic that's particularly feeling the pain of slumping credit. People in this age bracket have seen their credit scores drop by an average of three points this year, and economists are worried the numbers could keep dropping if historical trends hold.

Much lower than the national average

The average American’s credit score dropped to 715 in April 2025, according to a report from credit scoring institution FICO. The average American’s score had been “717 a year earlier, marking the second consecutive year-over-year drop,” said Bloomberg. This is largely due to the “resumption of reporting student loan delinquencies” by the Trump administration.

While the average score across all demographics remains 715, the situation is much more dire for Gen Z, a group defined by FICO as people ages 18 to 29. Gen Z Americans have an “average score of 676 — 39 points lower than the national average,” said FICO. This represents a three-point drop from Gen Z credit scores from the same time last year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Several factors are weighing down Gen Z scores. This includes the aforementioned student loan reporting: about “34% of Gen Z have open student loans — double the 17% of the total population that has an open student loan,” said FICO. And because they are younger, Gen Zers have “had less time to build savings and are less likely to benefit from stock market gains and home price appreciation.”

This also means that Gen Zers have more substantial swings in their credit scores than older people who've had more time to build credit. Gen Z was “most likely to see their scores fall dramatically, with 14% of the group having a score decrease of 50 points or more, compared to 10% of the total population,” said Bloomberg.

‘The one most important factor’

While dealing with lower credit scores, Gen Zers are also working around another obstacle: They are “contending with the most difficult job market in years for new college graduates,” said CNN. Many Americans across demographics are now having to make tough choices. Nearly one in five consumers, 19%, have either skipped bills or borrowed money from friends and family in the past year, according to a survey from the Federal Reserve Bank of Philadelphia.

“My credit score took a drastic hit because I had to compromise and take a job where I’m severely underpaid,” Dimitri Tsolakis, a 22-year-old who graduated from American University with a degree in international relations, told CNN. Tsolakis “owes $35,000 in student debt but has had to pause repayments to focus on making his car payments and paying for other living expenses.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But there are ways to improve the situation, experts say. The “one most important factor in the FICO score calculation is whether you make your payments on time. And that’s about 35% of the score calculation,” Tommy Lee, a senior director at FICO, told The Associated Press. A person’s credit score is “dynamic.” It changes based on “how you make your payments.” So if you ”want to maintain it or improve it, you can do so by exhibiting good credit behavior.”

Justin Klawans has worked as a staff writer at The Week since 2022. He began his career covering local news before joining Newsweek as a breaking news reporter, where he wrote about politics, national and global affairs, business, crime, sports, film, television and other news. Justin has also freelanced for outlets including Collider and United Press International.