Is it worth trying to get the highest credit score?

Here's what to know if you are seeking a perfect 850

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

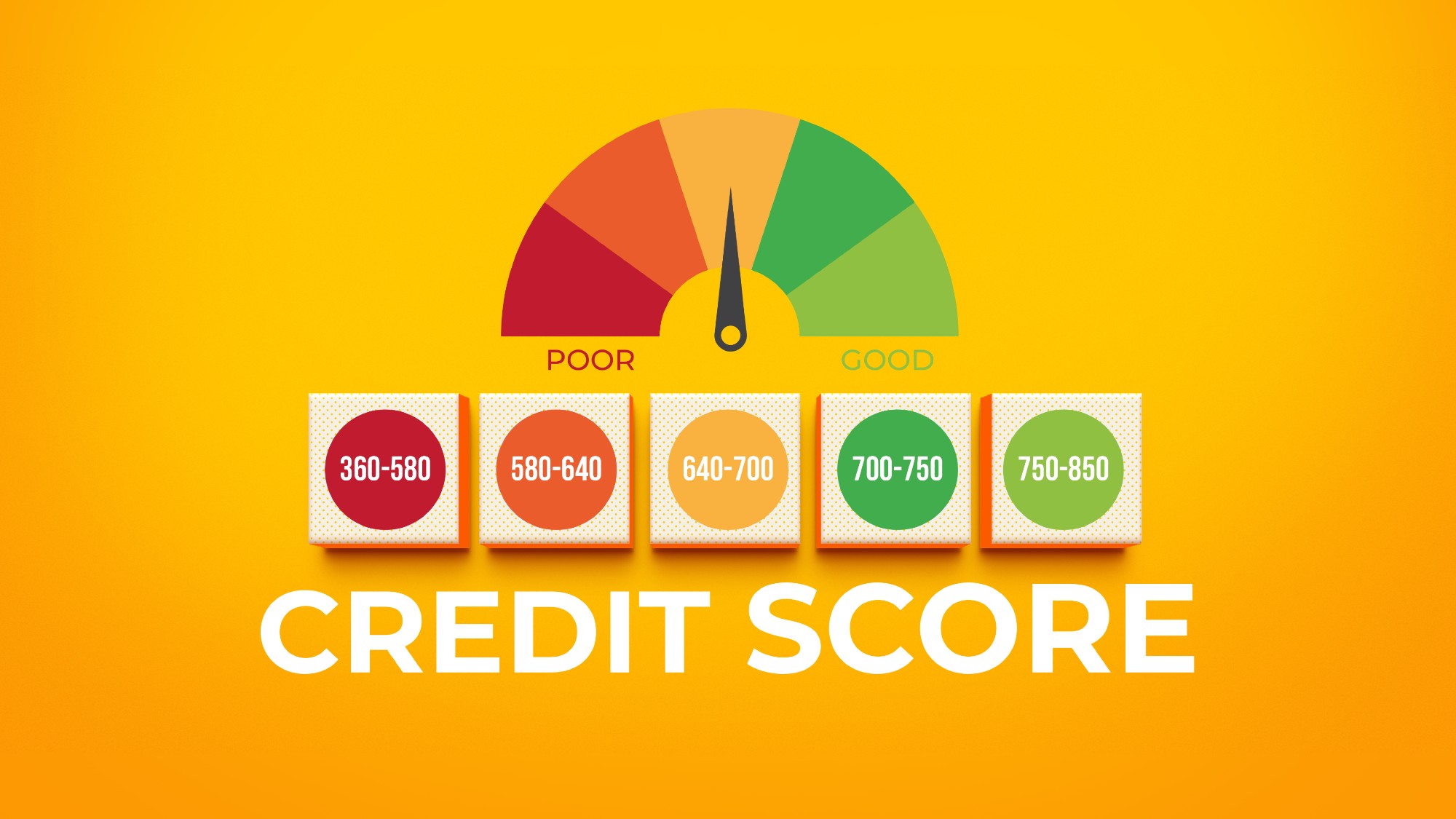

The rule of thumb for credit scores is the higher, the better. Does that mean hitting the highest possible credit score — 850 — is a goal worth striving for?

Admittedly, a good to excellent credit score can make a major difference in a person's financial life, helping them to get approved for loans, secure lower interest rates on money borrowed and even influencing whether they land a job or are approved to rent a house or apartment. But the returns start to diminish once your credit score reaches certain heights, a point that arrives well before the 850 mark. "A score in the ballpark of perfect will get you the same glory," said the credit bureau Experian, meaning the "best rates for loans and credit."

Should you try to get a perfect credit score?

Put simply: probably not. While it might "be exciting to aim for 850, the highest possible FICO score," achieving that milestone "really comes with no additional benefits," said CNBC Select.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"For most people, a perfect credit score probably won't be worth it," said Bankrate, as "having very good or excellent credit will be enough for most lenders to give you good rates and other perks." (Under the FICO scoring model, very good is considered a score of 740 to 799 while excellent is any score above 800.) Indeed, said CNBC Select, "according to credit expert John Ulzheimer, a 760 will get you the best mortgage rate and a 720 score is all you need for the best interest rate for an auto loan."

There is no harm in aiming high if the challenge interests you, of course, or if there is a compelling reason in your near future to boost your score. "If you're the kind of person who likes a credit score challenge, trying to boost your credit score as close to 850 as possible could be fun — and if you're about to apply for a mortgage or another major loan, getting your credit score as high as possible is always a good move," said Bankrate.

Having a top-tier score might also "provide peace of mind," as it "reflects disciplined financial habits and responsible money management," plus offers a buffer in case of any credit score drops, said Investopedia.

How common is a 'perfect' credit score?

An estimated "1.54% of consumers have a 'perfect FICO Score of 850,'" said Experian, citing its own recent data. What this figure indicates is that "for most people, a perfect score is simply too hard to reach — but it also suggests that it’s not really necessary," said Bankrate.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Just over 20% of U.S. consumers have a score in the range of 800 to 849, per Experian data, which is still considered 'excellent.' Around 28% have a 'very good credit score,' which falls from 740 to 799. Over 21% have a score of 670 to 739, which is still considered 'good' on FICO's scoring model.

Then there is a large percentage whose credit is not so stellar — roughly 28% of consumers in the U.S. have a score of less than 670, said Experian. Anything under 580 is considered a poor credit score, suggesting an elevated risk to lenders.

How do people achieve a perfect 850 credit score?

"The algorithms that assign people scores between 300 and 850 are proprietary," said The Wall Street Journal, which means it is not plain what exactly tips someone over the edge to a perfect score. "Credit bureaus constantly recalculate FICO scores," said Investopedia, which can make it hard to hang onto an 850 score once you do get it.

There are some shared traits of "perfect-credit consumers" you could seek to imitate, said Experian. Specifically, these include "an average number of delinquencies sitting at zero," a "credit utilization that's near zero" and "lower debt balances across the board."

In other words: Consumers with outstanding credit do not carry much debt, are unerring in making on-time payments and do not tend to use up much of their total available credit — all of which are solid general practices to follow if you want to boost your credit.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.