Retirees’ biggest surprise expense

And more of the week's best financial insight

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Here are three of the week's top pieces of financial insight, gathered from around the web:

Retirees’ biggest surprise expense

Home expenses put a bigger dent in retirement savings than even health care costs, said Brenden Rearick in Money. The surprising finding comes courtesy of T. Rowe Price, which surveyed 1,300 American households. According to the results, home expenses, “which the company defined as things like home repairs, mortgages, rent, and taxes, contribute to about 25% of the average retiree’s increase in spending.” Health care–related costs made up only about 5%. “Homeownership gets more expensive with each year, even if your house is fully paid off.” T. Rowe Price notes that what seem like small expenses tend to add up as retirees age, with increasing spending on “housekeeping, laundry, household furnishing, and cleaning.”

A pandemic-era magnet for fraud

The IRS is pausing processing for a pandemic-era tax break that has been a major fraud target, said Richard Rubin and Ruth Simon in The Wall Street Journal. The employee retention credit was created in 2020 “to reward businesses and nonprofits for keeping employees on payrolls” amid pandemic shutdowns. Though the active credit expired in 2021, “the window to claim it retroactively by filing amended tax returns is open until 2025.” The agency says a “pop-up industry” of firms that promote the credit to small businesses — for a sizable commission — doesn’t do enough to scrutinize clients’ eligibility. One company, Bottom Line Concepts, has recruited “a vast sales army” of affiliates, including an anti-aging consultant in Florida and a telemarketer in Pakistan, who cold-call businesses offering to help them claim their credits.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Beware of excessive HOA penalties

The power of homeowners associations often goes unchecked, said Sarah Holder in Bloomberg. About 74 million people in the U.S. live in community associations, mostly HOAs, which “create their own regulations, meant to keep behavior polite, aesthetics consistent, and property values high.” But the rules can be “capricious” and penalties for violations steep. In about 20 states, HOAs are allowed to file so-called super liens, which “can get priority over other liens or loans on the property, including a first mortgage.” One Colorado couple, Jose and Lupita Mendoza, say that a series of minor violations, like failing to remove a dead tree, snowballed into the HOA’s foreclosing on their home — despite their never missing a mortgage payment.

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Colbert, CBS spar over FCC and Talarico interview

Colbert, CBS spar over FCC and Talarico interviewSpeed Read The late night host said CBS pulled his interview with Democratic Texas state representative James Talarico over new FCC rules about political interviews

-

The Week contest: AI bellyaching

The Week contest: AI bellyachingPuzzles and Quizzes

-

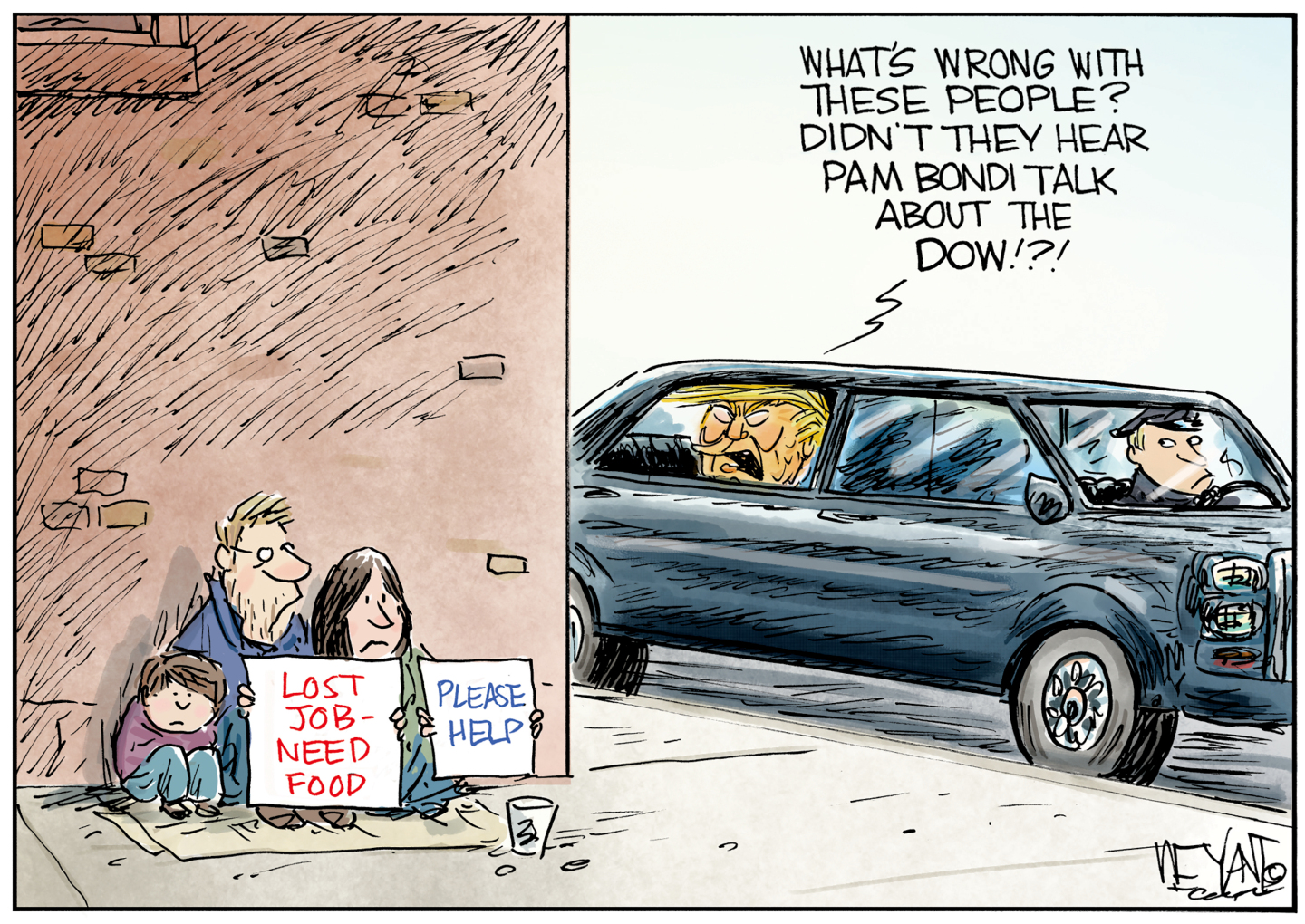

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Trump wants a weaker dollar, but economists aren’t so sure

Trump wants a weaker dollar, but economists aren’t so sureTalking Points A weaker dollar can make imports more expensive but also boost gold

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Powell: The Fed’s last hope?

Powell: The Fed’s last hope?Feature Federal Reserve Chairman Jerome Powell fights back against President Trump's claims