FTX: Silicon Valley's favorite whiz kid unravels

How did Sam Bankman-Fried lead FTX to bankruptcy?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Sam Bankman-Fried, the founder of $32 billion crypto exchange FTX, was the industry's golden boy, captivating "crypto bros and the Davos set," who poured billions into his firm, said Alexander Osipovich in The Wall Street Journal. Behind the scenes, though, the company that went bankrupt last week was a "chaotic mess." The people who ran FTX and its related companies lived and worked together in a $30 million penthouse in the Bahamas. "Romantic relationships among Bankman-Fried's upper echelon were common." So was "the use of stimulants" — something Caroline Ellison, the 28-year-old CEO of Bankman-Fried's trading firm, Alameda Research, and his sometime romantic partner, publicly bragged about. Meanwhile, SBF, as he was known, was taking huge, and possibly illegal, risks — namely, using customer deposits so that Alameda could "buy stakes in speculative startups," the hallmark of a Ponzi scheme. The executive appointed to clean up the mess, John Ray, "has helped oversee some of the biggest bankruptcies ever," including Enron's. He said he had never seen a "complete failure of corporate controls" as extreme as that of FTX.

Bankman-Fried blames "confusing internal labeling" for why billions in customer funds were transferred to Alameda, said Matt Egan at CNN. But former top U.S. financial regulator Sheila Bair said she detects "eerie similarities between his rise and fall and that of infamous Ponzi scheme mastermind Bernie Madoff." Both "proved adept at using their pedigree and connections to seduce investors" — and investigators missed "red flags" hidden in plain sight. This may turn out to be a story of fraud and theft, said Matt Levine in Bloomberg, but it "also reads like what would happen if you and a few of your college friends set up a gigantic international financial exchange after a year or two of working in finance." Still, Bankman-Fried implies in an interview that he forgot about $8 billion in customer deposits. I think even my college buddies and I wouldn't mess that up.

SBF's earnestness was part of his appeal, said Will Gottsegen in The Atlantic — and possibly his deception. "He was always accessible — a friend to journalists and crypto podcasters everywhere, reachable both by private message and public exhortation." Crypto is considered "an industry that hinges on anonymity," but Bankman-Fried behaved like "someone without much to hide." Amazingly, he is still speaking. In a remarkable interview with Vox conducted via Twitter direct message, SBF appeared to "let the mask drop completely," disparaging regulators and "emphatically agreeing with the suggestion that his ethics-first persona was 'mostly a front.'"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"Disheveled, young, and exceedingly brainy, Bankman-Fried fit the mold of a Silicon Valley mogul in the making," said Margaret O'Mara in The New York Times. Then, of course, so did Elizabeth Holmes, the disgraced founder of blood-testing startup Theranos. It's a reminder that we place "too much faith in those who look the part." Some "golden geeks" have transformed the world, like Steve Jobs, Bill Gates, and Larry Page and Sergey Brin. But our collective infatuation with the "whiz-kid archetype" reflects an unhealthy tendency "to overstate the importance of individual 'genius' and gloss over things critical to their success — especially connections, timing, and luck."

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Putin’s shadow war

Putin’s shadow warFeature The Kremlin is waging a campaign of sabotage and subversion against Ukraine’s allies in the West

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

What are stablecoins, and why is the government so interested in them?

What are stablecoins, and why is the government so interested in them?The Explainer With the government backing calls for the regulation of certain cryptocurrencies, are stablecoins the future?

-

'Wrench attacks' are targeting wealthy crypto moguls

'Wrench attacks' are targeting wealthy crypto mogulsThe Explainer The attacks are named for physical coercion that can be used to gain crypto passwords

-

Crypto firm Coinbase hacked, faces SEC scrutiny

Crypto firm Coinbase hacked, faces SEC scrutinySpeed Read The Securities and Exchange Commission has also been investigating whether Coinbase misstated its user numbers in past disclosures

-

The collapse of El Salvador's bitcoin dream

The collapse of El Salvador's bitcoin dreamUnder the Radar Central American nation rolls back its controversial, world-first cryptocurrency laws

-

Javier Milei's memecoin scandal

Javier Milei's memecoin scandalUnder The Radar Argentinian president is facing impeachment calls and fraud accusations

-

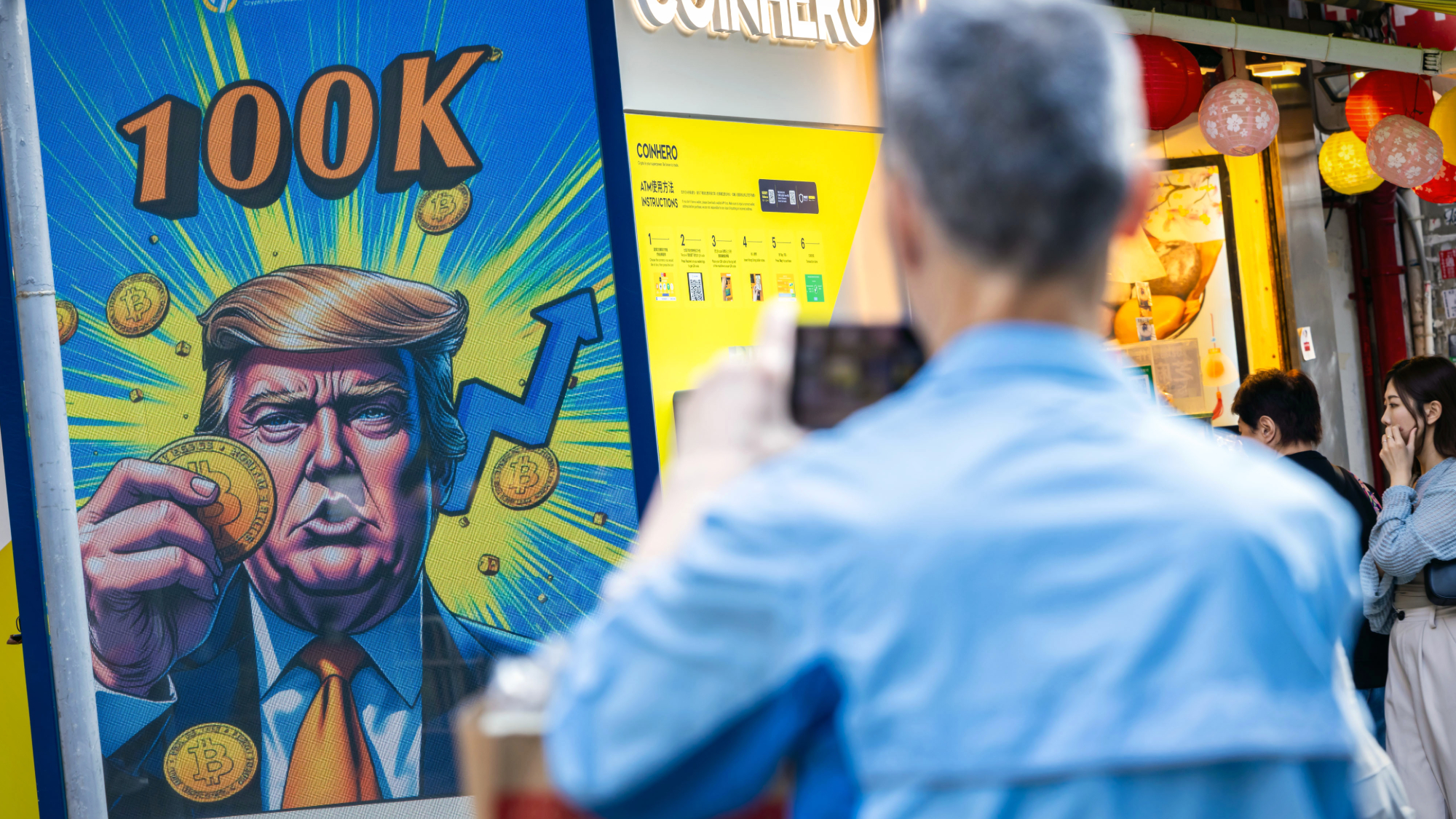

Bitcoin surges above $100k in post-election rally

Bitcoin surges above $100k in post-election rallySpeed Read Investors are betting that the incoming Trump administration will embrace crypto

-

Donald Trump's bitcoin obsession

Donald Trump's bitcoin obsessionThe Explainer Former president's crypto conversion a 'classic Trumpian transactional relationship', partly driven by ego-boosting NFTs