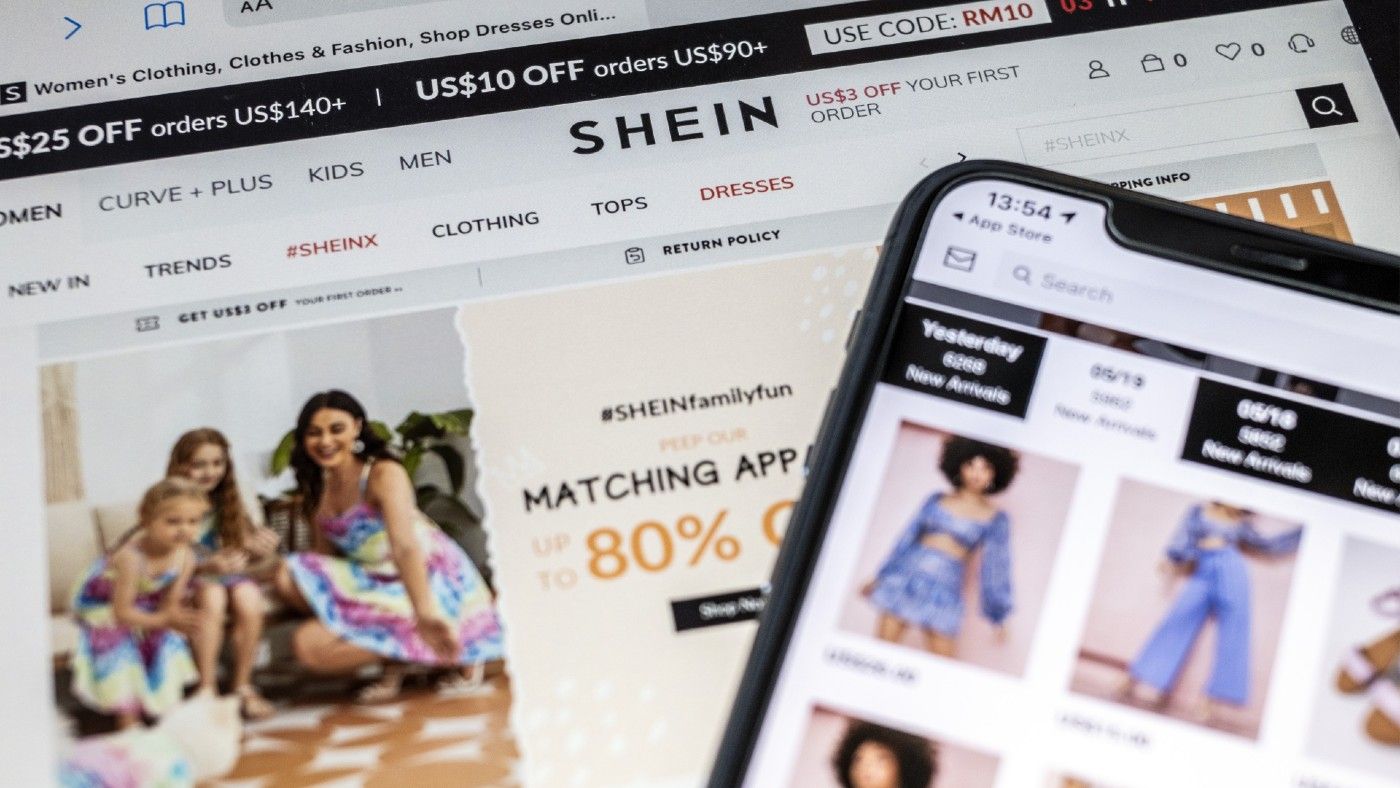

Shein: the biggest Wall Street float of 2024?

Clothing industry disruptor is about to test its acceptability on the US stock market

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Considered by some to be the unacceptable face of fast fashion, the Chinese behemoth Shein is about to test its acceptability on Wall Street, said The Economist.

Its forthcoming float could be "one of the biggest New York listings in years". There's a lot at stake. The company, founded by Chris Xu (aka Sky Xu), was valued at $66bn in May (down by a third on a year ago), but it "will probably aim for a higher valuation" of $80-90bn – testing an IPO market "dampened by soaring inflation and high interest rates". Although Shein shifted its HQ to Singapore in 2021, the move is also a marker of broader Sino-US relations.

In little more than a decade, Shein has "disrupted the clothing industry with its on-trend $5 skirts and $9 jeans" to become "one of the largest fashion brands in the world", said Corrie Driebusch and Shen Lu in The Wall Street Journal.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Having notched up "hundreds of millions of shoppers" – particularly in its largest market, the US – the online juggernaut pulled in record revenues of $23bn in 2022. Shein doesn't sell in China, but it has come "under intensifying scrutiny from Washington" over its supply chain there, with US lawmakers pressing the company over whether it sources cotton using forced Uyghur labour in the Xinjiang region, which it denies.

Those aren't the only complaints, said Helen Davidson in The Guardian. Shein has also been attacked for "alleged copyright infringement on independent artists' designs", its environmental impact, and for "building empires" by using loopholes to dodge taxes. "The No. 1 question for us is: are we adversaries or partners?" observed President Xi Jinping at an investment conference during his US visit in mid-November. Despite its attempts to internationalise, Shein may be a litmus test.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

Kia EV4: a ‘terrifically comfy’ electric car

Kia EV4: a ‘terrifically comfy’ electric carThe Week Recommends The family-friendly vehicle has ‘plush seats’ and generous space

-

Bonfire of the Murdochs: an ‘utterly gripping’ book

Bonfire of the Murdochs: an ‘utterly gripping’ bookThe Week Recommends Gabriel Sherman examines Rupert Murdoch’s ‘war of succession’ over his media empire

-

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

6 exquisite homes with vast acreage

6 exquisite homes with vast acreageFeature Featuring an off-the-grid contemporary home in New Mexico and lakefront farmhouse in Massachusetts