There aren't enough rich people for Democrats' 'tax the rich' plan

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Facing unfavorable economic trends, congressional inertia, and collapsing approval for the Biden administration, Democrats are getting desperate. Tensions within the party have stalled the reconciliation bill on which they've placed longstanding aspirations for new social programs and environmental regulation. Now, reality seems to be setting in: The party needs to pass something if it hopes to avoid a wipeout in the midterm elections next year.

Senate Democrats took a step toward that outcome early this week when they agreed to fund some of the proposed spending with a new tax on billionaires. As with the rest of the bill, the details remain vague, but the idea is to tax "unrealized gains" — in essence, the appreciated value of property that hasn't been sold — of people who own more than $1 billion in assets or report income above $100 million for three consecutive years.

The short-term politics seem favorable. The very rich aren't especially popular with the public (although a majority regard them with indifference), and the plan is apparently acceptable to Sen. Krysten Sinema (D-Ariz.), who ruled out increases in standard marginal income tax rates. While raising any taxes probably isn't an optimal strategy before an election, squeezing about 700 billionaires is a fairly safe bet.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

For just that reason, though, the billionaire tax is more legislative gimmick than serious proposal. For one thing, it's not clear that it's legal because of a constitutional requirement of proportionality among the states for taxes, like this one, collected directly from citizens. The 16th Amendment makes an exception for income taxes. But are unrealized gains income? No money can be collected until the courts answer.

Second, the structure of the proposal makes it unlikely to go into effect as planned. In the current version, billionaires would have up to five years to pay the first installment. Since Republicans are likely to take control of Congress or even the White House during that time, there's a high probability this assessment would be reduced or eliminated before it ever came due. Billionaires can easily wait out the clock.

Last and most important, though: Taxing the rich is fiscally irrelevant. As my George Washington University colleague Kimberly Morgan has pointed out, "No large welfare state is funded solely through taxes on the rich and corporations. The middle class is where the money is."

According to reports, Democrats hope the tax could eventually be extended downward from billionaires to mere millionaires. But even that won't cover the bills for the spending they want. There simply aren't enough rich people, and you can't have European-style benefits without European-style taxes on people who aren't rich by any reasonable definition. That's a dilemma Democrats don't want to face.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Samuel Goldman is a national correspondent at TheWeek.com. He is also an associate professor of political science at George Washington University, where he is executive director of the John L. Loeb, Jr. Institute for Religious Freedom and director of the Politics & Values Program. He received his Ph.D. from Harvard and was a postdoctoral fellow in Religion, Ethics, & Politics at Princeton University. His books include God's Country: Christian Zionism in America (University of Pennsylvania Press, 2018) and After Nationalism (University of Pennsylvania Press, 2021). In addition to academic research, Goldman's writing has appeared in The New York Times, The Wall Street Journal, and many other publications.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘The forces he united still shape the Democratic Party’

‘The forces he united still shape the Democratic Party’Instant Opinion Opinion, comment and editorials of the day

-

How are Democrats turning DOJ lemons into partisan lemonade?

How are Democrats turning DOJ lemons into partisan lemonade?TODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

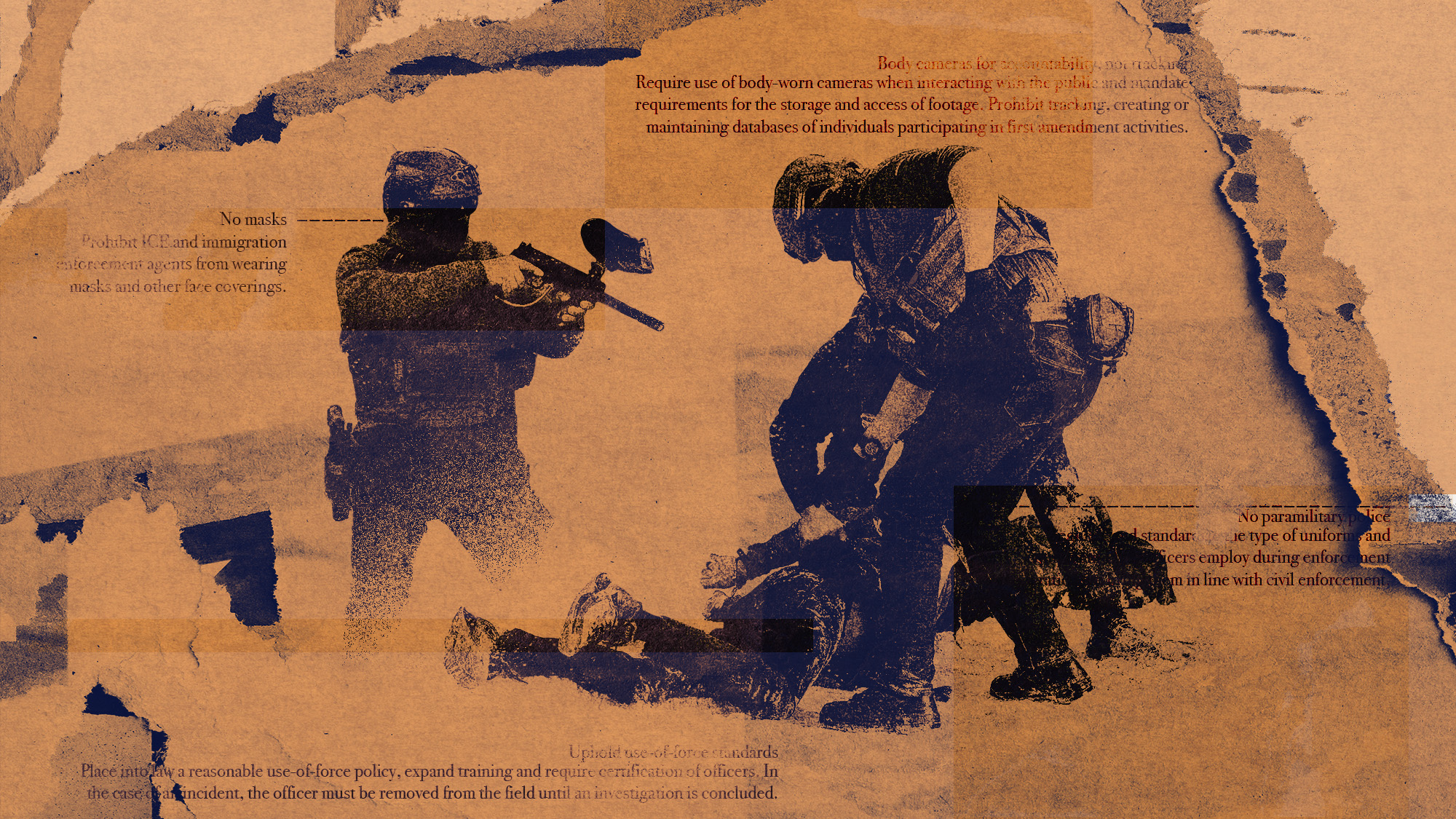

How are Democrats trying to reform ICE?

How are Democrats trying to reform ICE?Today’s Big Question Democratic leadership has put forth several demands for the agency

-

Democrats push for ICE accountability

Democrats push for ICE accountabilityFeature U.S. citizens shot and violently detained by immigration agents testify at Capitol Hill hearing

-

Big-time money squabbles: the conflict over California’s proposed billionaire tax

Big-time money squabbles: the conflict over California’s proposed billionaire taxTalking Points Californians worth more than $1.1 billion would pay a one-time 5% tax

-

Democrats win House race, flip Texas Senate seat

Democrats win House race, flip Texas Senate seatSpeed Read Christian Menefee won the special election for an open House seat in the Houston area

-

Did Alex Pretti’s killing open a GOP rift on guns?

Did Alex Pretti’s killing open a GOP rift on guns?Talking Points Second Amendment groups push back on the White House narrative