Vietnamese EV maker VinFast wows with staggering Nasdaq debut

Can the company keep up the pace, or is it running out of gas?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

For a moment this week, the hegemony of established automakers over the car market cracked wide open, with a relatively new, relatively unheard-of Vietnamese brand capturing enough of a debut market share to dwarf manufacturing juggernauts like Ford and Volkswagen. It was a staggering American coming-out moment for VinFast, a Vietnamese automotive company founded in 2017, which ended its August 15 Nasdaq premiere valued at more than $85 billion — a stunning achievement for a company that last year sold just 7,400 vehicles, solely in Vietnam.

The company's U.S. debut, made possible by a merger with a Black Spade Capitol special purpose acquisition company (SPAC), was hailed as "nothing short of remarkable" by TechCrunch and "eye-popping" by The Wall Street Journal. But behind the sincerely staggering valuation is a more complicated picture that calls into question whether VinFast can keep up with its successful launch.

New player

Despite being owned by VinGroup, Vietnam's largest corporate conglomerate, VinFast is a virtual unknown in the United States, having only started delivering a single model of electric SUV, the VF8, this past March. The Wall Street Journal reported that it's currently taking orders for a second model to be delivered in the coming year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Hailing its initial Nasdaq accomplishment as having accelerated the global EV "revolution" in a press release, VinFast CEO Le Thị Thu Thuy, known as Madame Thuy, boasted of her company's "commitment to sustainable mobility at a global scale" and its newfound "access to the capital markets and important avenues for future development." She added, "It is our hope that VinFast's listing will inspire and unleash greater opportunities for Vietnamese brands to participate in the global market." VinFast is now the "largest U.S.-listed Vietnamese company by market cap," according to CNN.

In addition to its incredible Nasdaq debut, VinFast has worked hard to gain a toehold in the American market this year, breaking ground on a multibillion-dollar manufacturing plant outside of Raleigh, North Carolina, this summer. The facility marks "North Carolina's first car manufacturing plant and North Carolina's largest-ever, state-backed economic development project as far as job creation," The Associated Press reported. The company is also in the process of modifying its initial Tesla-based sales plan of marketing cars directly to buyers and will operate on a hybrid system of direct sales, as well as sales through dealerships, in the future.

"The overall feedback is positive for a Vietnamese brand going into the U.S.," Thuy explained in an interview early last year. "We are emphasizing our quality by giving a 10-year warranty on our vehicles globally."

'Thin trade'

For as much as VinFast's debut may have dazzled observers on the surface, the upstart car company's reality is much more complicated and decidedly less cheery. For one, the company's massive stock premiere was fueled in large part by the "thin trade" of a relatively small segment of shares available for public purchase. According to CNN, 99% of VinFast's stock remains owned by Pham Nhat Vuong, Vietnam's richest man, "through shares held by his other company VinGroup and other business entities." In the days following its Nasdaq launch, VinFast's stock has dropped significantly, erasing nearly half of its peak market cap and dropping Pham Nhat Vuong's net worth by an estimated $18 billion at the week's close.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

While some stock volatility and resettling is to be expected with a splashy debut like VinFast's, the company's problems may go deeper than ordinary stock fluctuations, in which "everything is made up and the product performance doesn't matter," The Drive's James Gilboy said. "Vinfast's public image isn't great, and neither are its balance sheets," he continued, allowing that some of its money losses this year are "due to capital expenditure" like the North Carolina plant. "But there's also the fact that sales aren't so hot," he added. "VinFast's balance sheet is in poor shape, with limited cash and significant debt," agreed Seeking Alpha market analyst Bill Maurer, who predicted the company will "likely need a major capital raise for its growth plans."

Perhaps more troubling for VinFast is the fact that its VF8 has largely been panned by industry reviewers. The 2023 model "proves building cars is hard," stated Car and Driver. "I'd be embarrassed to look a customer in the eye when handing over the keys to this vehicle," MotorTrend's Scott Evans concluded this past May, writing that although the company "has the right idea," its VF8 is "nowhere near ready for the customer deliveries that are already happening." A review from InsideEVs was particularly critical of the car's suspension issues, which "made being in this electric crossover — and I say this without hyperbole — unbearable." Adding to the drumbeat of negative reviews is the fact that after debuting the 2023 VF8, VinFast was forced to recall the model after reporting that nearly a thousand cars may have inoperative main display screens.

The company has said it hopes to sell 50,000 vehicles this year — a significant uptick from 2022. As The Wall Street Journal noted, however, it has shipped just over 11,000 so far, including "around 3,000 VF8 SUVs to the U.S. as of May," adding, "but most of them are awaiting buyers."

Rafi Schwartz has worked as a politics writer at The Week since 2022, where he covers elections, Congress and the White House. He was previously a contributing writer with Mic focusing largely on politics, a senior writer with Splinter News, a staff writer for Fusion's news lab, and the managing editor of Heeb Magazine, a Jewish life and culture publication. Rafi's work has appeared in Rolling Stone, GOOD and The Forward, among others.

-

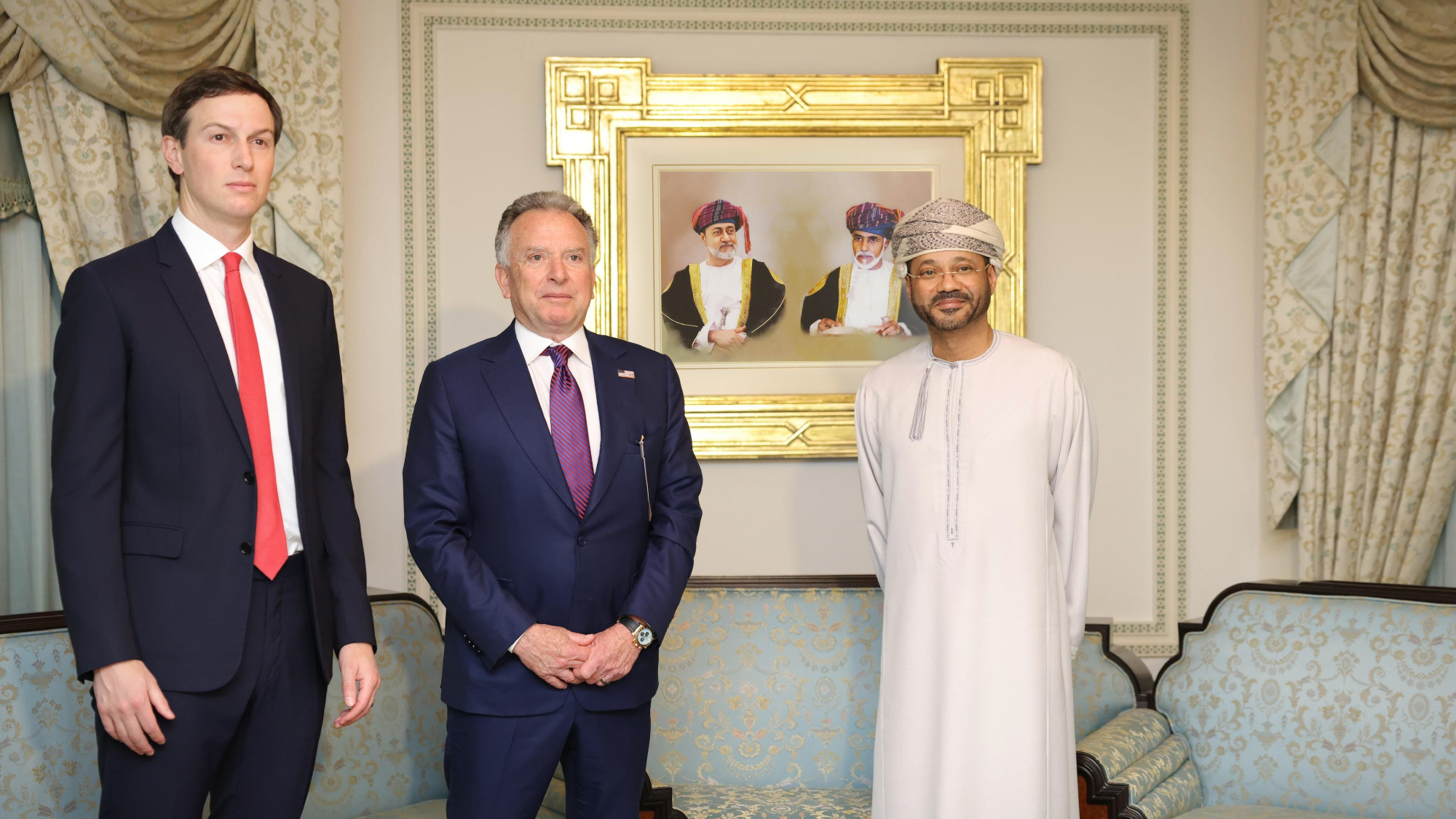

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

Pentagon spokesperson forced out as DHS’s resigns

Pentagon spokesperson forced out as DHS’s resignsSpeed Read Senior military adviser Col. David Butler was fired by Pete Hegseth and Homeland Security spokesperson Tricia McLaughlin is resigning

-

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?Today’s Big Question Investors navigate a suddenly uncertain global economy

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

What a rising gold price says about the global economy

What a rising gold price says about the global economyThe Explainer Institutions, central banks and speculators drive record surge amid ‘loss of trust’ in bond markets and US dollar

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

The AI bubble and a potential stock market crash

The AI bubble and a potential stock market crashToday's Big Question Valuations of some AI start-ups are 'insane', says OpenAI CEO Sam Altman

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Dollar faces historic slump as stocks hit new high

Dollar faces historic slump as stocks hit new highSpeed Read While stocks have recovered post-Trump tariffs, the dollar has weakened more than 10% this year

-

How the US bond market works – and why it matters

How the US bond market works – and why it mattersThe Explainer Donald Trump was forced to U-turn on tariffs after being 'spooked' by rise in Treasury yields