What the latest Fed rate hike means for the economy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Federal Reserve has announced that it will raise interest rates another 0.5 percent to 4.5 percent, marking the seventh increase of 2022. This will, however, be the smallest of the last four rate hikes showing promise that the increases will slow soon.

The increase comes following the latest consumer price index report showing that inflation cooled in November. Along with the rate increase, the Fed also announced economic predictions indicating that rates will likely need to go higher to slow the economy even more, writes The New York Times. It currently predicts rates will rise to 5.1 percent by the end of next year. Unemployment is likely to increase as well.

However, despite the consistent rate hikes, the economy has stayed strong, especially the job market, which some experts predict will reach a dead end at some point. "The cumulative impact of higher rates are just beginning. Hence, the Fed has to step down its pace a bit," said Kathy Jones, chief fixed income strategist at the Schwab Center for Financial Research.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There is concern that the hikes will cause a recession in the coming year with the rates already heavily damaging the housing markets, a key cause of inflation. "Rate cuts may be too late. Recession risks are still relatively high," commented Keith Lerner, co-chief investment officer at Truist Advisory Services, adding that "A pivot or pause is not a cure-all for this market."

Even though it's smaller, a rate increase is still an increase and people may see higher rates on mortgages, credit cards, auto loans, and student loans. In a statement, the Fed wrote that it is, "strongly committed to returning inflation to its 2 percent objective."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Devika Rao has worked as a staff writer at The Week since 2022, covering science, the environment, climate and business. She previously worked as a policy associate for a nonprofit organization advocating for environmental action from a business perspective.

-

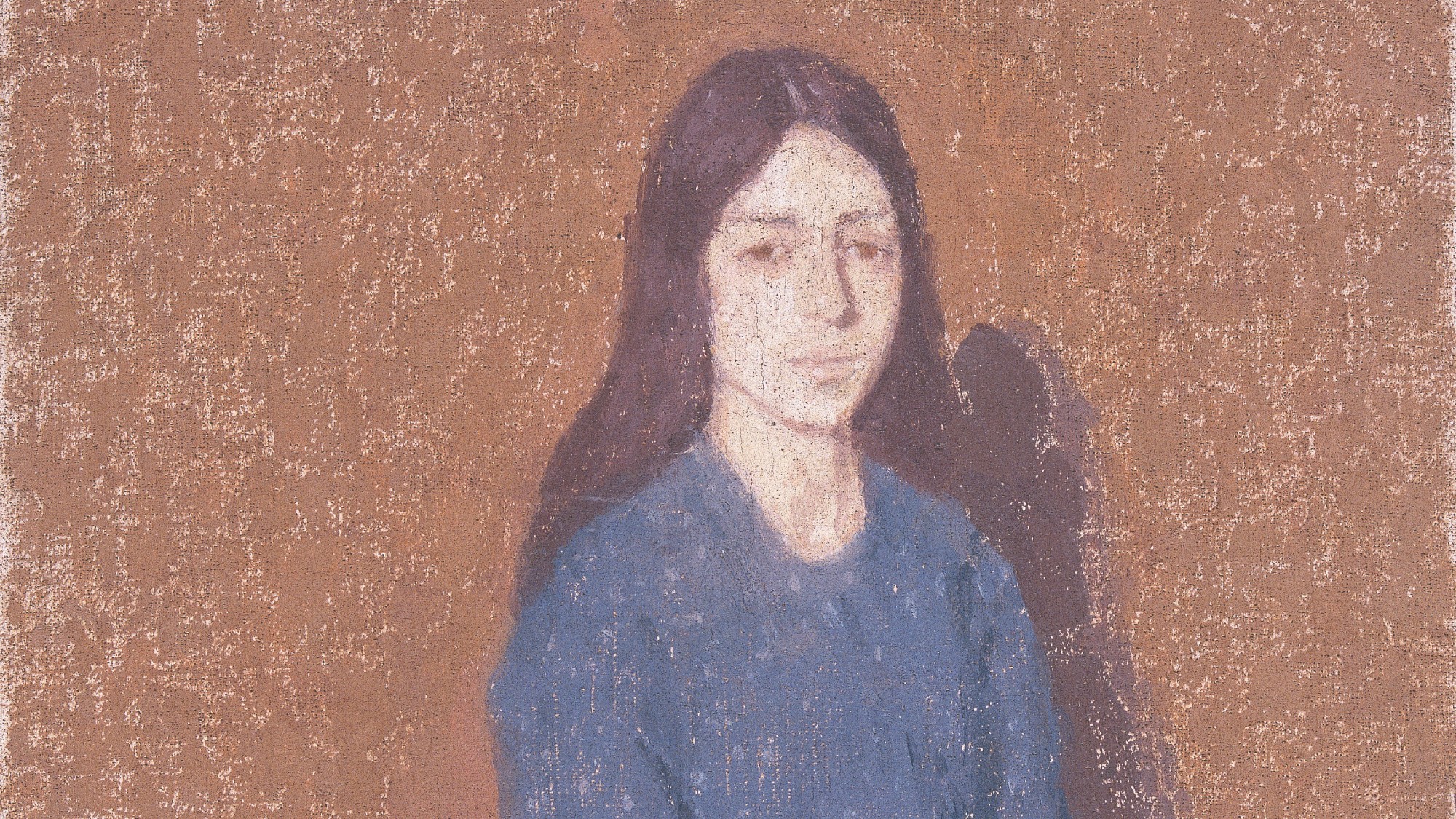

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

How your household budget could look in 2026

How your household budget could look in 2026The Explainer The government is trying to balance the nation’s books but energy bills and the cost of food could impact your finances

-

How will Fed rate cuts affect the housing market?

How will Fed rate cuts affect the housing market?the explainer An anticipated series of Federal Reserve cuts could impact mortgage rates

-

What is the Federal Reserve and what does it do?

What is the Federal Reserve and what does it do?The explainer The decisions made by the United States' central banking system have very real economic effects

-

With economic uncertainty, 2025 looks to be a 'No Buy' year

With economic uncertainty, 2025 looks to be a 'No Buy' yearIn the spotlight Consumers are cutting back on splurges to combat overconsumption

-

What is the CFPB and how does it protect consumers?

What is the CFPB and how does it protect consumers?the explainer The Consumer Financial Protection Bureau has had its work stymied by the Trump administration

-

3 tips to lower your household bills

3 tips to lower your household billsThe Explainer Prices on everything from eggs to auto insurance to rent have increased — but there are ways to make your bills more manageable

-

Should you lease your next car?

Should you lease your next car?The explainer To buy or to lease, that is the question

-

Where should you stash your savings after the Fed rate cut?

Where should you stash your savings after the Fed rate cut?The Explainer You will not be earning as much on savings rates, so you may want to make some changes