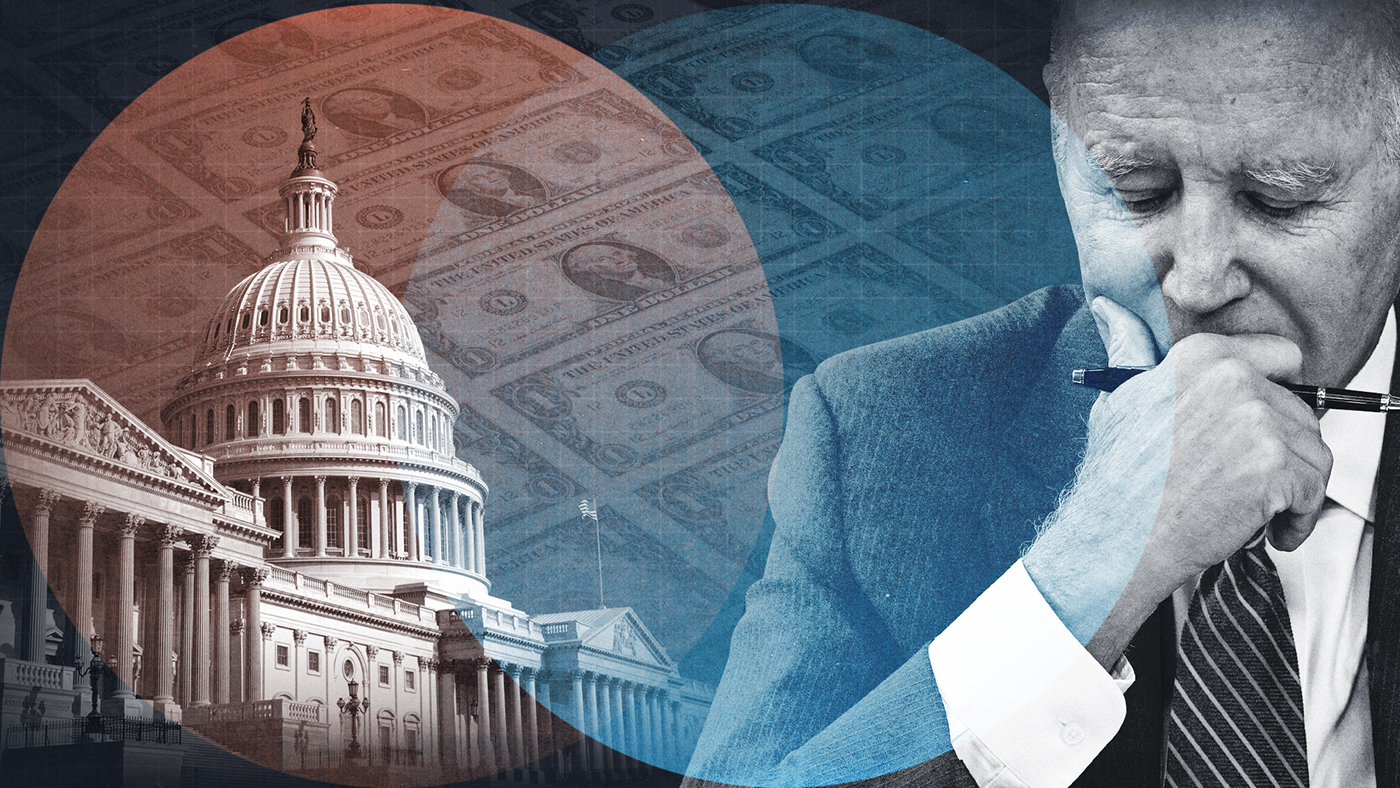

4 plausible ways to avert a catastrophic U.S. default without raising the debt limit

Biden has no great options, but he does have options

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The U.S. government has hit the borrowing limit set by Congress two years ago, and House Republicans are demanding a pound of flesh to raise the debt ceiling again. President Biden, who has seen this play before and didn't like it, insists he won't negotiate with the full faith and credit of the U.S. government held hostage. The U.S. Treasury has been paying America's bills using a series of accounting maneuvers, but the day is now rapidly approaching when the U.S. defaults on its financial obligations.

The stakes are high: Even a temporary default would be really bad for the U.S. and global economies, raising borrowing costs for the government, businesses, and American consumers, and sending unemployment soaring, according to government and private analysts. The government also couldn't pay for normal operations or services.

Biden has no great options, but he does have options. The first (and most likely) is finding some deal with House Speaker Kevin McCarthy (R-Calif.) that all parties find acceptable, if not pleasant. But wrangling with recalcitrant House Republicans as vice president in 2011, during the last near-miss with willful default, Biden became convinced that you "do not negotiate with a speaker who cannot reach a deal," The New York Times reports. And it is far from clear McCarthy can negotiate a compromise on behalf of his fractious caucus.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Luckily, over the past 12 years economists, lawyers, historians, government officials, and sundry observers have come up with ideas to neuter the debt ceiling as a bargaining chip — to, in effect, shoot the hostage. Here are four workarounds Biden could plausibly try out to avert the "financial Armageddon" of a default — and perhaps return budget fights to a place where government shutdowns are once more the worst outcome.

1. Mint the big platinum coin

A 1997 law allows the Treasury secretary to mint commemorative platinum coins of any value, and in a widely discussed (and frequently mocked) scenario first suggested in 2010 in the comment section of a popular finance blog, Janet Yellen would order up a $1 trillion platinum coin that would be deposited in the government's general account at the Federal Reserve. The government could then draw down that account, without issuing new debt, until Congress raises the debt ceiling. Or, if the point is to neuter the debt ceiling, Yellen could mint a $20 trillion coin.

Philip Diehl, director of the U.S. Mint from 1994 to 2000 and one of the forces behind the 1997 law, told the Times that the $1 trillion coin is a viable idea that Yellen should keep at least in her "back pocket" to avoid default. But Yellen is vocally unenthusiastic about the idea. For one thing, "it truly is not by any means to be taken as a given that the Fed would do it, and I think especially with something that's a gimmick," she told The Wall Street Journal in 2021. "The Fed is not required to accept it. There's no requirement on the part of the Fed."

"There's only one way forward here, and that is for Congress to raise the debt ceiling so that the United States government can pay all of its obligations when due," Federal Reserve Chairman Jerome Powell said in February. "Any deviations from that path would be highly risky."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

It is a gimmicky move with some potential pitfalls, but "under the surface strangeness, minting the coin is just a way to permit de facto borrowing despite the debt limit," economist Paul Krugman argues at the Times. Besides, it's irresponsible not to "consider possible end runs around the debt ceiling" at this point, and "it would be especially irresponsible to reject them because they sound undignified: Crashing the world economy for fear of looking silly would be unforgivable."

2. Treat the debt ceiling as unconstitutional

Section 4 of the 14th Amendment to the U.S. Constitution states: "The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned." Some prominent legal scholars "have argued that this provision would enable the president to ignore the debt limit," The Washington Post reports.

"The Constitution's text bars the federal government from defaulting on the debt — even a little, even for a short while," Garrett Epps, a constitutional scholar at the University of Oregon's law school, wrote in Washington Monthly in November.

The Congressional Research Service concluded in 2021 that the Supreme Court has never weighed in on that part of the Constitution, and it's "unclear how the provision might apply to the statuary debt limit." But Harvard Law professor Laurence Tribe, who previously opposed using the 14th Amendment this way, told the Post that Section 4 clearly "says the threat to default is itself unconstitutional. The country has to stand behind its word in terms of all of its debt obligations, and that is not something that is a matter of opinion. It's very explicitly in the Constitution."

Yellen, again, is cold to the idea. She did not explicitly rule it out in an interview with ABC News in early May, calling it "one of the not good options," but she said "there is no way to protect our financial system and our economy other than Congress doing its job and raising the debt ceiling and enabling us to pay our bills," and getting to the point where "we need to consider whether the president can go on issuing debt" would "be a constitutional crisis."

Biden, after meeting with McCarthy and other congressional leaders on the debt ceiling, said that option is on the table. "I have been considering the 14th Amendment," he said, noting that Harvard's Tribe "thinks that it would be legitimate." The problem with testing out that theory now is that "it would have to be litigated, and in the meantime," the markets may still treat the situation as a default, Biden added. "The one thing I'm ruling out is default, and I'm not going to pass a budget that has massive cuts."

Financial markets would be jolted by the constitutional challenge, but the short-term damage would lead to long-term gains if the Supreme Court upholds the 14th Amendment no-default clause and takes future debt-limit brinksmanship off the table, Moody's Analytics economist Mark Zandi wrote in March, based off his modeling of such a challenge. "The extraordinary uncertainty created by the constitutional crisis leads to a sell-off in financial markets until the Supreme Court rules," he wrote, "but the economy avoids a recession and quickly rebounds."

3. Treat the debt ceiling as illegal

The 14th Amendment is a narrow path to challenge the debt limit, but there's a broader legal theory that the modern debt limit, dating back to 1917, puts a president in an untenable situation of having to break one of the conflicting laws Congress has thrust upon the executive branch. Basically, Congress orders the president to spend specific amounts of money on specific things, but the debt limit forces the president to decide unilaterally which of those obligations not to pay.

"There is very clearly a conflict between the debt ceiling on the one hand and the law that is the federal budget itself on the other hand," says Bob Hockett, a former Federal Reserve official and congressional economic policy adviser. "People seem to forget that the federal budget is itself a legally effective enactment."

The debt ceiling puts the president in a "trilemma" where he either defaults on the debt, ignores the debt limit, or does nothing, and whatever choice he makes forces him to violate some law, Cornell constitutional law professor Michael Dorf tells the Post. "If the president faces one of these crises, he should minimize the violation," he said. "And our view is that the way to do so is to exercise the least amount of legislative direction by violating the debt ceiling rather than picking and choosing which bills to pay."

In this case, the courts will weigh in on that challenge regardless of what Biden chooses, The Associated Press reports. The National Association of Government Employees, a union representing 75,000 government workers, sued Biden and Yellen in early May to stop them from complying with the debt ceiling.

"Nothing in the Constitution or any judicial decision interpreting the Constitution," the lawsuit argues, "allows Congress to leave unchecked discretion to the president to exercise the spending power vested in the legislative branch by canceling, suspending, or refusing to carry out spending already approved by Congress."

Other people "argue that control over debt is a critical third leg of the congressional power of the purse," the Congressional Research Service counters. "While the other two legs — the power to authorize spending and the power to collect taxes — allow Congress to fine tune policies and priorities, the debt limit is a blunt instrument" that may induce "policymakers to focus on fundamental fiscal issues from time to time."

"If Congress is going to demonstrate this propensity for hostage taking," Norm Eisen at the Brookings Institution tells AP, then "a reallocation of authority in this dimension away from Congress" may be called for. "It is possible that the Treasury Department would welcome the suit," Tribe adds, because it contends that "the ceiling is not a permissible bargaining tool for Congress to employ because it simply threatens to destroy the economy and hold the president hostage."

4. Issue high-interest bonds

There's a fourth debt limit workaround, "and this one sounds more sophisticated, which some of its proponents have suggested could make it more likely to work," the Times reports. The government largely funds itself by selling bonds and notes or Treasury bills, which have a face value — say $100 — that the feds promise to back after a specified period of time, say 10 years, and "coupons," or interest, that gets paid to bondholder twice a year.

The interest rate is generally determined through an auction at which the lowest bid interest rate wins — but it doesn't have to be. One idea is for the Treasury to sell bonds with high yields — say 10 percent versus the market rate of 3.74 percent — and investors would pay more for the bonds, with the government keeping the extra money. "Would those higher interest rates, which would cost the government more money, pose a problem? Not technically," the Times explains. "The debt limit applies to the face value of outstanding federal government debt," not the interest.

Another idea would be for the government to issue perpetual bonds, or consols, that pay regular interest coupons but never mature and therefore have no face value. "With this kind of bond, there is no principal the government is guaranteed to repay," Carlos Mucha, the Atlanta attorney credited with coming up with the $1 trillion coin, tells the Post. "So it would not count under the debt limit."

"But, but, you splutter, that's cheating!" Krugman writes at the Times. "You might ask how we're supposed to enforce a debt ceiling if the government can play games with the definition of debt. But the answer, of course, is that we shouldn't have a debt ceiling. The government should make decisions about taxing and spending, and consider the fiscal consequences, without creating an additional choke point that extremists can weaponize."

"High-yield bonds are a little bit silly," though "less goofy than a platinum coin," and "the alternative of default or payment prioritization would destroy the constitutional order," Matt Yglesias writes at his Slow Boring Substack. "In the event of a debt ceiling breach, the executive branch has to do something, and issuing high-yield bonds is a way to avoid doing something flagrantly illegal." If done right, this could make the debt ceiling "entirely irrelevant over time," he adds.

The national debt is problematically large, and "Biden should do a big speech calling for a bipartisan commission on deficit reduction!" Yglesias writes. "But then he should have the Treasury start working on some high-yield bonds, because there is no sense in negotiating with hostage takers."

Finding workable ways around the debt limit "aren't technical problems, but problems with politics and perception: The people in the administration are uncomfortable violating norms of how things are done," J.W. Mason, an economist at City University of New York, tells the Post. "The problem is that everything in this space is a gimmick. That's the nature of the problem. It's just a question of which gimmick you prefer."

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

The ‘mad king’: has Trump finally lost it?

The ‘mad king’: has Trump finally lost it?Talking Point Rambling speeches, wind turbine obsession, and an ‘unhinged’ letter to Norway’s prime minister have caused concern whether the rest of his term is ‘sustainable’

-

A running list of everything Donald Trump’s administration, including the president, has said about his health

A running list of everything Donald Trump’s administration, including the president, has said about his healthIn Depth Some in the White House have claimed Trump has near-superhuman abilities

-

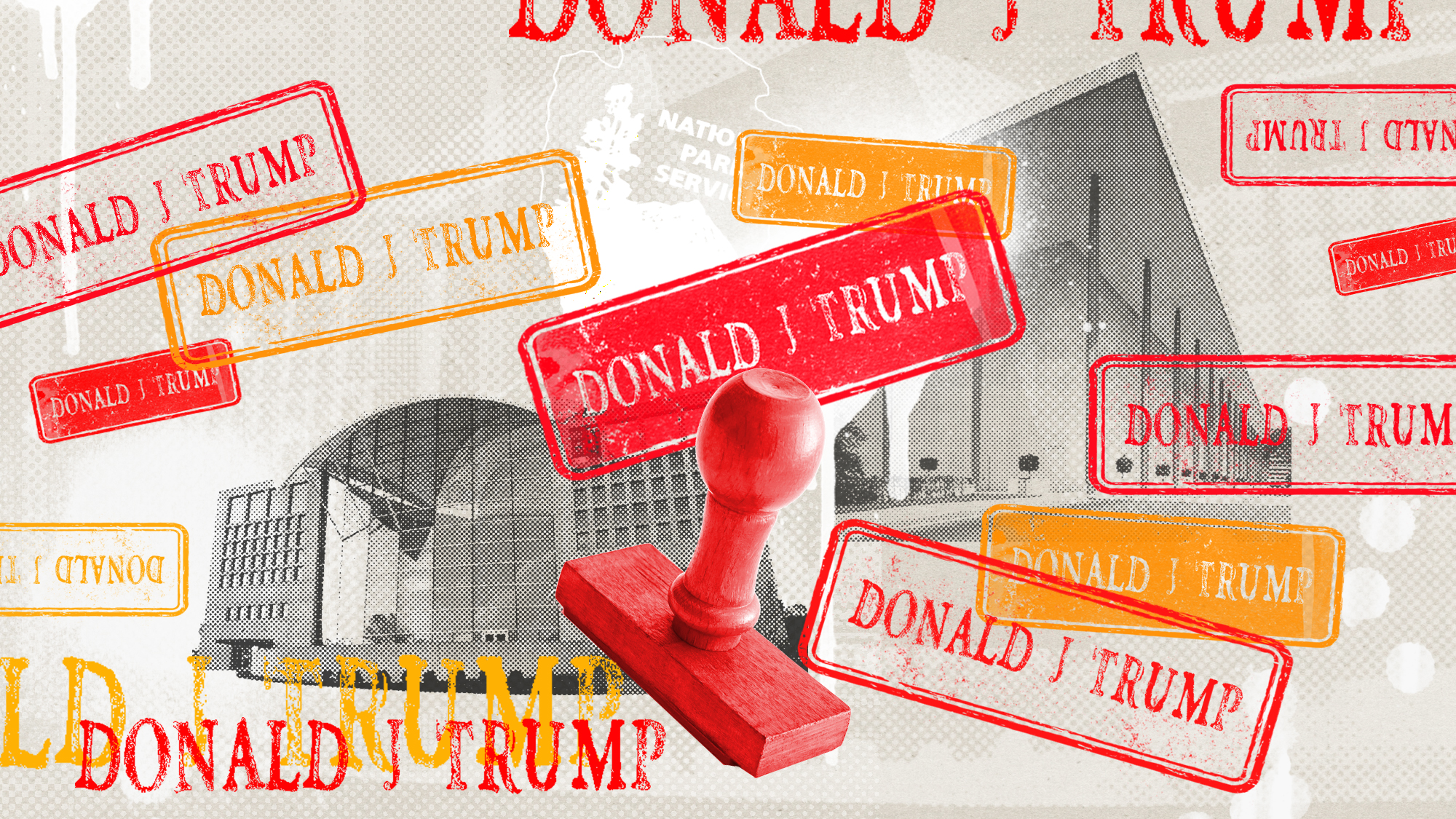

A running list of everything Trump has named or renamed after himself

A running list of everything Trump has named or renamed after himselfIn Depth The Kennedy Center is the latest thing to be slapped with Trump’s name

-

A running list of the international figures Donald Trump has pardoned

A running list of the international figures Donald Trump has pardonedin depth The president has grown bolder in flexing executive clemency powers beyond national borders

-

A running list of US interventions in Latin America and the Caribbean after World War II

A running list of US interventions in Latin America and the Caribbean after World War IIin depth Nicolás Maduro isn’t the first regional leader to be toppled directly or indirectly by the US

-

A running list of the US government figures Donald Trump has pardoned

A running list of the US government figures Donald Trump has pardonedin depth Clearing the slate for his favorite elected officials

-

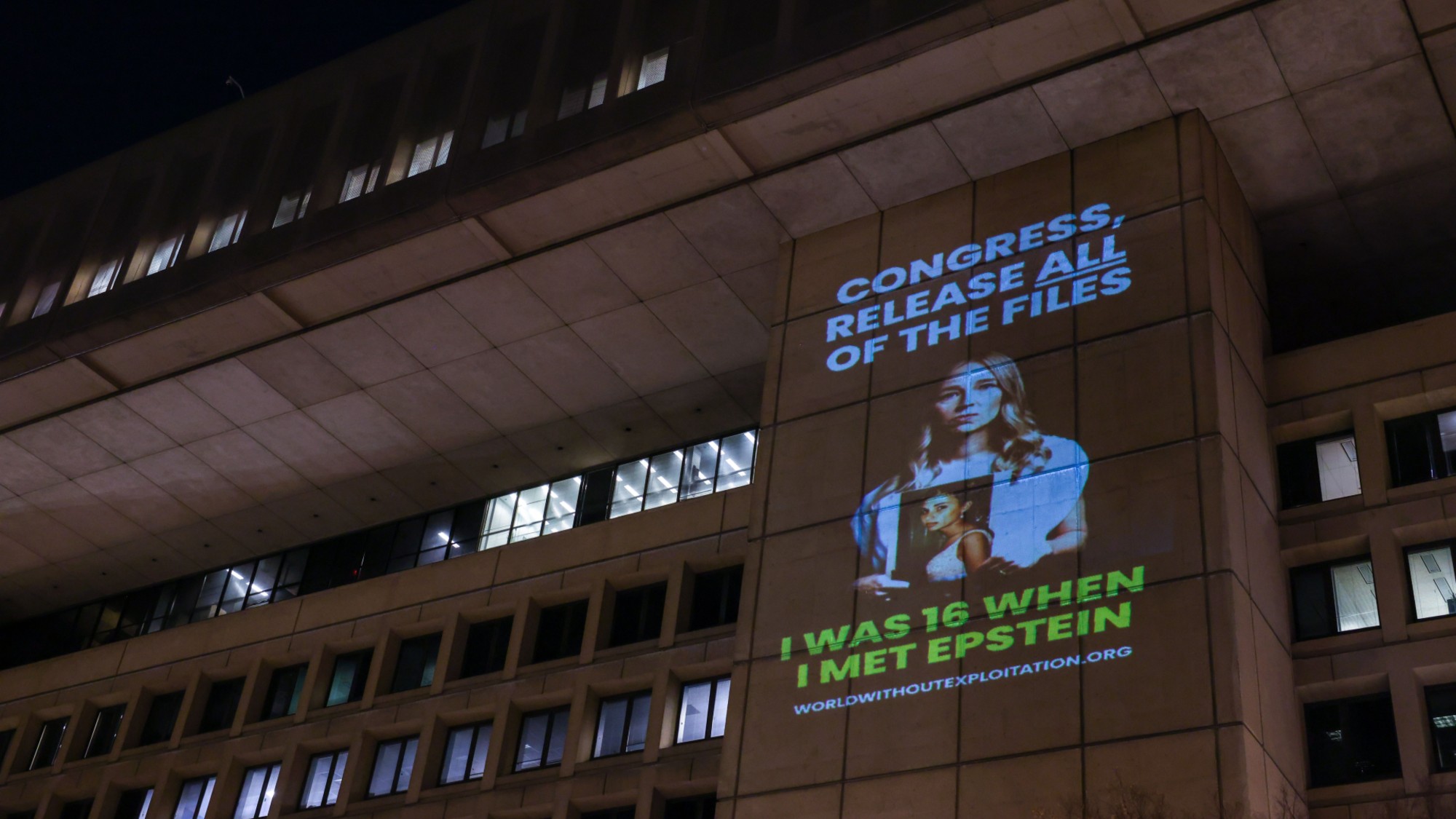

The powerful names in the Epstein emails

The powerful names in the Epstein emailsIn Depth People from a former Harvard president to a noted linguist were mentioned

-

Memo signals Trump review of 233k refugees

Memo signals Trump review of 233k refugeesSpeed Read The memo also ordered all green card applications for the refugees to be halted