How the USD Coin aims to bring stability to the crypto market

Cryptocurrency prices can swing wildly – but stablecoins such as USDC are aiming to minimise volatility in the market

Cryptocurrency valuations have been hit this year amid regulatory crackdowns and collapses of high-profile exchanges.

That may make people nervous about getting involved in this area, but there is a less volatile way to use crypto-related assets: a type of financial product known as stablecoins.

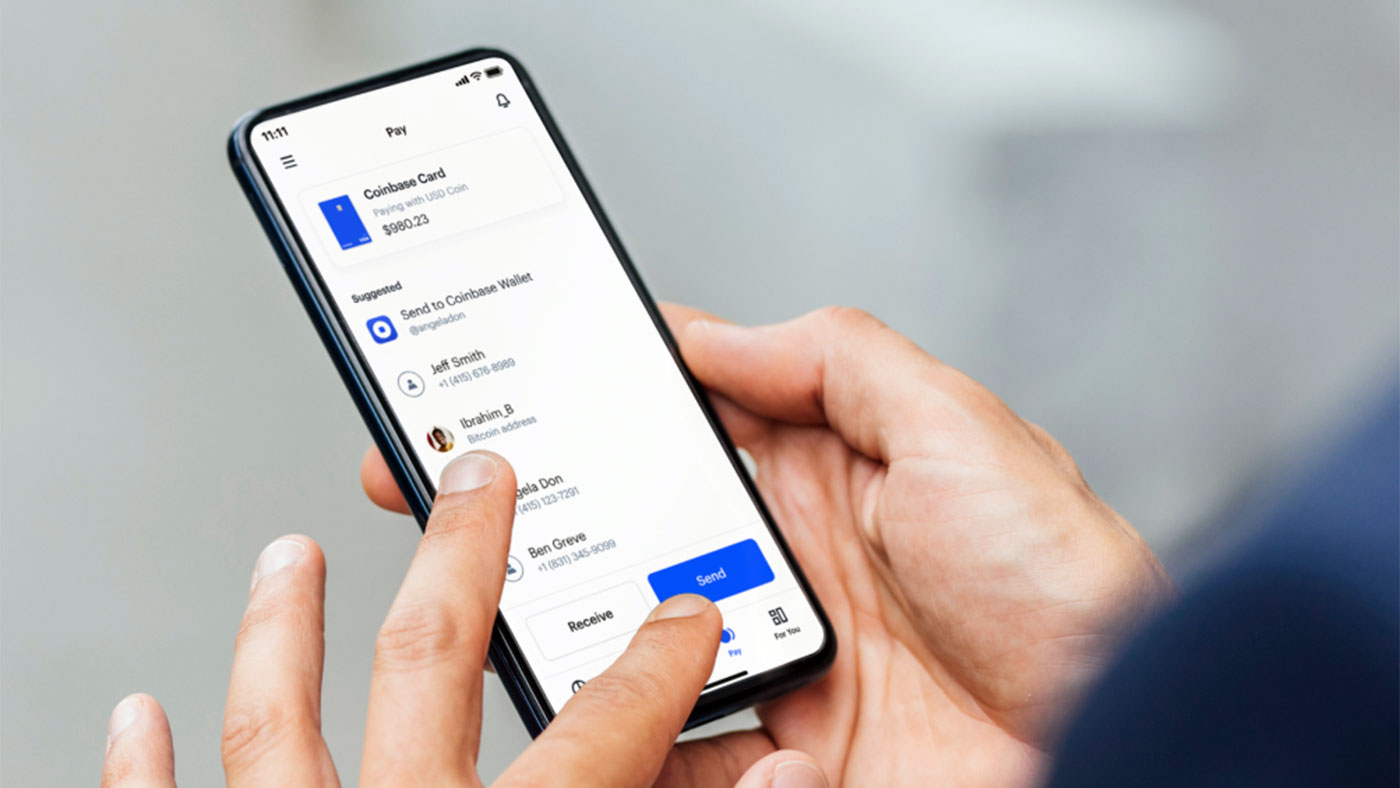

Crypto exchange Coinbase co-founded the Centre Consortium in 2018 to develop a stablecoin called the USD Coin or USDC, with the aim of boosting “economic freedom in the world” by developing a form of digital dollar that can be used by anyone.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What is a stablecoin?

Cryptocurrencies have emerged over the past decade with the aim of decentralising money supply, supporting people without bank accounts and providing a faster and cheaper form of payments.

Most people have heard of cryptocurrencies such as bitcoin and ethereum. They are the oldest and largest cryptocurrencies by market capitalisation and their value depends on a range of factors such as investor sentiment and levels of supply and demand.

Stablecoins fall into various categories of crypto-asset but can work differently. USDC is a fiat-backed stablecoin whose value is pegged to the US dollar, so it is always clear what one USDC will be worth.

For example, a user would always be able to redeem one stablecoin for one dollar, making it easier to monitor than the value of bitcoin, for example, which can change significantly on a daily basis.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Stablecoin purchases and valuations are managed using blockchain technology, which promises to make transactions more quickly and more securely than traditional banking software is able. The idea is that the stablecoin can therefore be used around the world as a convertible form of digital money for lending, payments or just for those who may not have access to a bank account.

How does USDC work?

Unlike most cryptocurrencies, the USDC is issued by regulated and licensed financial institutions, Coinbase and Circle, both of which are established crypto exchanges.

Transfers made using USDC can be completed in under an hour using blockchain technology. By contrast, international bank transfers often take several business days. There are also no added intermediary costs as you don’t have to pay a banker or broker for arranging the transfer – a typical saving of up to 7% of the sum transferred. Eligible Coinbase customers can earn rewards for every USD Coin they hold, worth up to 1% annual yield. They can also enjoy no commission fees upon purchase of USDC.*

USDC aims to be a transparent stablecoin and maintains full reserves of the equivalent fiat currency, which is reported and verified by the accountancy firm Grant Thornton each month.

What else is USDC used for?

While many cryptoassets have become speculative investments or hedges against inflation, stablecoins are intended to be used as currency.

According to Coinbase, that means USDC will have several applications. As well as international transfers, it can be used as a secure store of wealth for those living in parts of the world with limited access to banking or other financial services.

It could also generate opportunities in the new “web3” world. This is seen as the next stage of the internet, in which online tools are decentralised and run in a collection of virtual worlds known as the metaverse. Many of these applications rely on a blockchain-based currency such as USDC.

They are already used in areas such as gaming, insurance, saving, lending and borrowing – and even on job platforms that let freelancers get paid from anywhere in the world in ethereum or stablecoins.

While recent setbacks have dented the reputation of some digital currencies, USDC may signal a more stable, practical future for crypto assets.

* No commission fees attributed to Coinbase will be charged until further notice. However, spread, and processing fees charged by third party processors, will continue to apply. This feature may not be available to all regions. See terms for USDC APY

For more information on the USD Coin, visit the Coinbase website

Upon purchase of USDC, you will be automatically opted into rewards. If you’d like to opt out or learn more about rewards, click here. The rewards rate is subject to change and can vary by region. Customers will be able to see the latest applicable rates directly within their accounts.

Cryptocurrency is unregulated in the UK. The value of investments can go down as well as up. Profits may be subject to Capital Gains Tax.'

Marc Shoffman is an NCTJ-qualified award-winning freelance journalist, specialising in business, property and personal finance. He has a BA in multimedia journalism from Bournemouth University and a master’s in financial journalism from City University, London. His career began at FT Business trade publication Financial Adviser, during the 2008 banking crash. In 2013, he moved to MailOnline’s personal finance section This is Money, where he covered topics ranging from mortgages and pensions to investments and even a bit of Bitcoin. Since going freelance in 2016, his work has appeared in MoneyWeek, The Times, The Mail on Sunday and on the i news site.

-

How to Get to Heaven from Belfast: a ‘highly entertaining ride’

How to Get to Heaven from Belfast: a ‘highly entertaining ride’The Week Recommends Mystery-comedy from the creator of Derry Girls should be ‘your new binge-watch’

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

What are stablecoins, and why is the government so interested in them?

What are stablecoins, and why is the government so interested in them?The Explainer With the government backing calls for the regulation of certain cryptocurrencies, are stablecoins the future?

-

'Wrench attacks' are targeting wealthy crypto moguls

'Wrench attacks' are targeting wealthy crypto mogulsThe Explainer The attacks are named for physical coercion that can be used to gain crypto passwords

-

Crypto firm Coinbase hacked, faces SEC scrutiny

Crypto firm Coinbase hacked, faces SEC scrutinySpeed Read The Securities and Exchange Commission has also been investigating whether Coinbase misstated its user numbers in past disclosures

-

The collapse of El Salvador's bitcoin dream

The collapse of El Salvador's bitcoin dreamUnder the Radar Central American nation rolls back its controversial, world-first cryptocurrency laws

-

Javier Milei's memecoin scandal

Javier Milei's memecoin scandalUnder The Radar Argentinian president is facing impeachment calls and fraud accusations

-

Bitcoin surges above $100k in post-election rally

Bitcoin surges above $100k in post-election rallySpeed Read Investors are betting that the incoming Trump administration will embrace crypto

-

Donald Trump's bitcoin obsession

Donald Trump's bitcoin obsessionThe Explainer Former president's crypto conversion a 'classic Trumpian transactional relationship', partly driven by ego-boosting NFTs