Trouble in China: ‘triple shock’ has taken its toll

The world’s second-largest economy is ailing, with worrying ramifications for the global outlook

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Many economists expected China’s growth to trend lower in the second half of 2021, said Jonathan Cheng in The Wall Street Journal. But the scale of the slowdown has proved much “sharper than expected”. The world’s second-largest economy grew by 4.9% in the third quarter – way down on the previous quarter’s 7.9% – reflecting a range of negative factors. Beijing’s crackdown on the technology, private education and property sectors was always going to push growth lower. But to that has been added a series of “energy snafus” caused by soaring coal prices and aggressive green targets, as well as major supply chain disruptions. None of these problems are going away.

Coal futures in China “notched up another record this week”, said Dan Murtaugh on Bloomberg – bad news for a nation reliant on the fossil fuel for more than half its energy needs. Indeed, with winter approaching, China may have little choice but “to set aside ambitious plans to cut carbon emissions” and ramp up coal production, said Yen Nee Lee on CNBC. Power cuts have been reported in 20 provinces across China since mid-August, causing “production halts at many factories”. Call it “a triple shock”, said The Economist: “power cuts, the pandemic and a property slowdown” have “taken their toll”. More than a year and a half after Covid-19 first struck, “China is reporting growth rates that were unheard of before the pandemic”, and most economists think growth will slow even further in the last quarter of the year–to 4% or below. Increased coal production could temporarily ease the country’s “acute power crisis”, but China’s property sector, hitherto a “perennial engine of growth” (contributing more than a quarter of China’s GDP) is more difficult to fix. Regulators “trying to curb speculative demand” and “limit the excessive borrowing of homebuilders” have brought “dangers to a head”.

China’s central bank describes the stricken property giant Evergrande, with its vast $300bn in liabilities, as a one-off case in a healthy industry. Not so, said the FT. Evergrande is merely the biggest of a bad bunch. This week, another developer, Sinic Holdings, added to “a growing list of defaults”, amid “a slew of downgrades from international rating agencies”. Meanwhile, sales of new homes are slowing sharply, and higher borrowing costs are making refinancing difficult. The threat to the global economy is clear, said Yawen Chen on Reuters Breakingviews. “At risk is $2trn of Chinese annual demand for foreign goods and services.” “Better a little loss than a long sorrow”, runs the Chinese proverb. We must hope for the first, but “buckle up” for the second.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

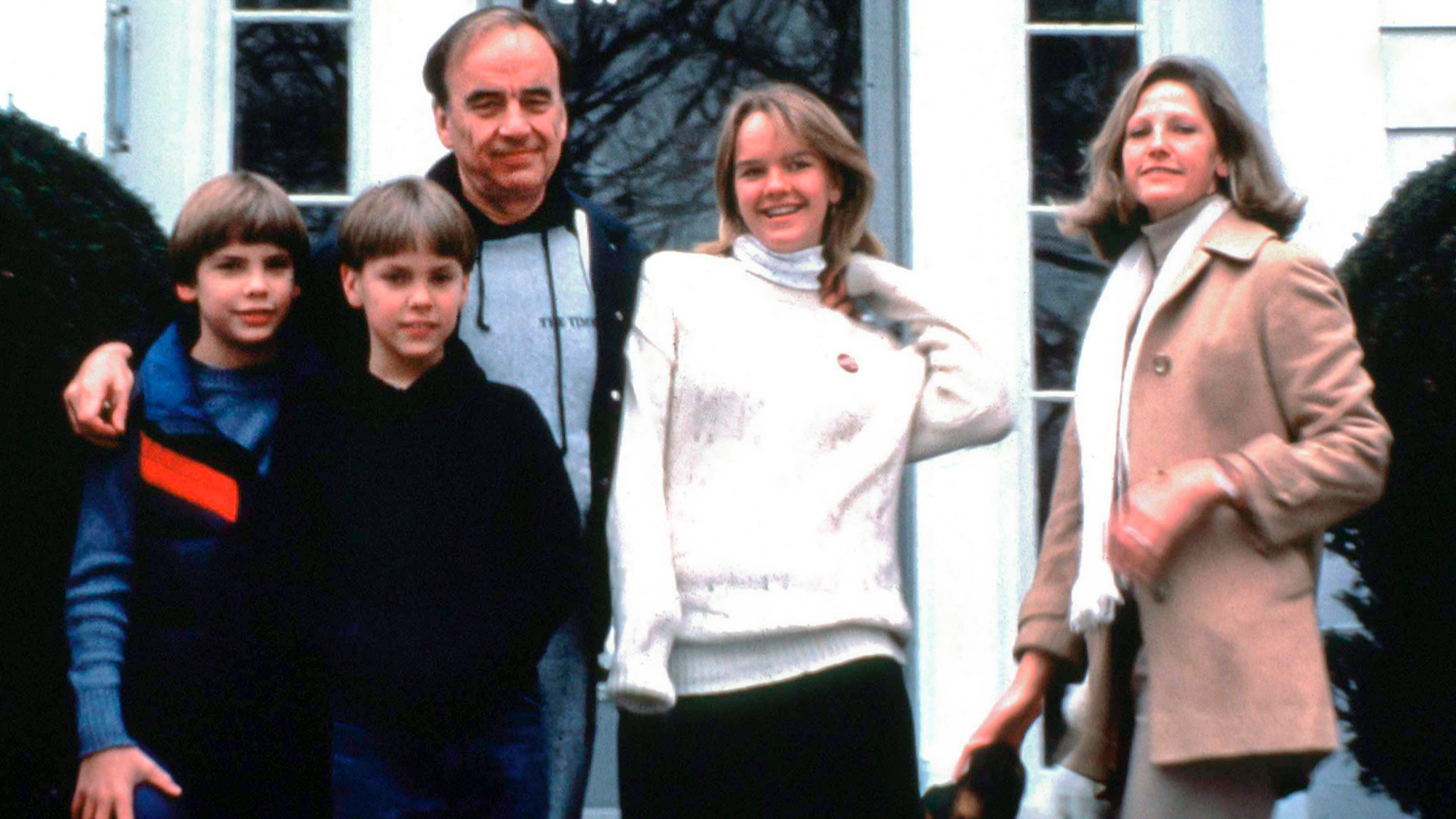

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

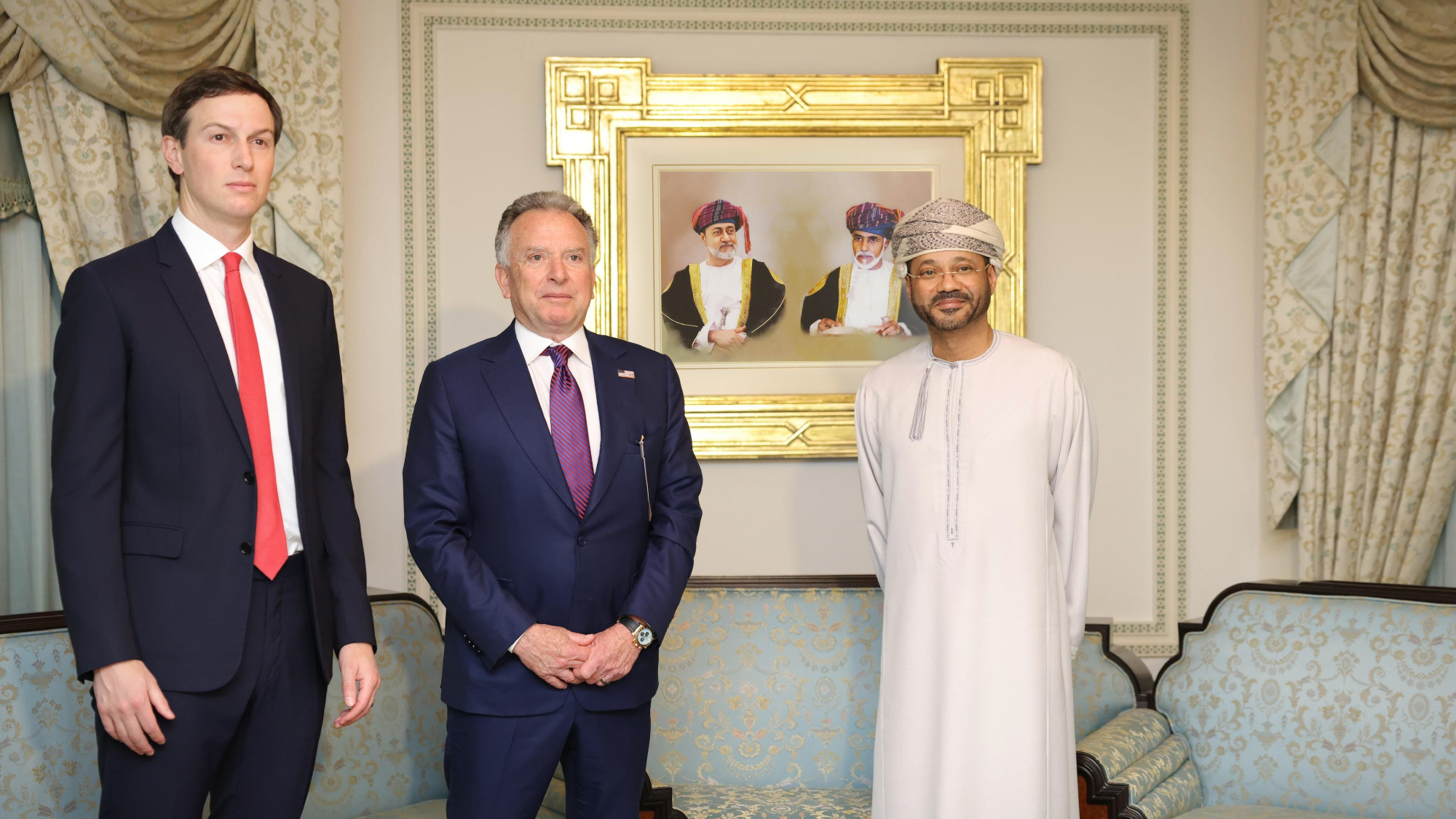

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Powell: The Fed’s last hope?

Powell: The Fed’s last hope?Feature Federal Reserve Chairman Jerome Powell fights back against President Trump's claims

-

Taxes: It’s California vs. the billionaires

Taxes: It’s California vs. the billionairesFeature Larry Page and Peter Thiel may take their wealth elsewhere