4 ways to save on your prescriptions

A little flexibility can go a long way toward saving you money at the pharmacy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

If you take a prescription medication, you likely know all too well that it can put a dent in your monthly budget. Already, according to Health, "Americans spend more on prescription drugs per capita than people in any other country — or about $1,200 more per person." And in the coming years, it's projected that prescription drug prices are "expected to rise faster over the next decade than other areas of healthcare spending," per Health.

Luckily, there are a number of ways you can save on your prescriptions, though which method is appropriate depends "on the type of medication you take, when you need it and whether you’re using insurance or not," according to Forbes.

1. Go generic

Depending on which type of medication you take, you might be able to score major savings by opting for the generic version of it over the name brand. Per Kiplinger, which cited 2022 data from the Association of Accessible Medicines (AAM), the average copay for a brand name drug is "more than nine times higher than the average copay for generic drugs." Further, according to Kiplinger's reporting on AAM findings, the copay for name-brand drugs was under $20 only 59% of the time, compared to 93% of the time for generic drugs.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

To ensure you have the option to choose generic, either ask your doctor directly when they fill out the prescription or "make sure they check the box that allows the pharmacy to substitute a generic equivalent for the medication," Forbes recommended. Another tip while you're at it: Ask if you can get a three-month prescription as opposed to a one-month. Even if you end up paying more upfront, "you'll shell out less money overall in the long run," per Kiplinger.

2. Consider switching pharmacies

You might also be able to save if you switch to a different pharmacy. For one, your health insurance provider may have a preferred network of pharmacies and if you fill your prescription there you could save on copays, according to Kiplinger. Mail-order is another avenue to explore for potential savings, whether that's through a big chain like CVS or Walgreens, a vendor like Amazon, or an online pharmacy such as GeniusRx, Honeybee Health, Cost Plus Drug, Ro Pharmacy, and ScriptCo Pharmacy.

Another possibility is to switch from a chain pharmacy to a local pharmacy. According to Consumer Reports, a community pharmacy can "sometimes meet or even beat low prices at a chain or online pharmacy, but you have to ask.

3. Look into prescription discount offers

You might also score savings by joining a prescription savings program. For instance, if you pay a membership fee to join the Walgreens Prescription Savings Club Program, you can "fill prescriptions for hundreds of generic drugs for $7.50, $10, or $15 for a 30-day supply, or $15, $20, or $30 for a 90-day supply — no insurance needed," per Consumer Reports, which noted that supermarkets may offer similar deals. Or, if you already have an Amazon Prime membership, you can enjoy access to prescription savings.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There are also no-cost prescription savings programs that allow you to determine which local pharmacy offers the lowest price on the drug you need. Per Forbes, however, "if you use a prescription savings card from these programs, you won’t also be able to use your insurance" — though in some cases, "the savings card price is lower than the price you’d pay with insurance."

4. See if you qualify for a patient assistance program

If you meet income requirements and are uninsured or underinsured, you may qualify for and save through a patient assistance program. These are programs "managed by pharmaceutical companies to provide free or discounted medications to people who can't afford them," explained Kiplinger.

According to USA Today, "people typically need to seek out these programs by searching on the drug manufacturer's website, searching for nonprofits that offer assistance to those with their condition, or going to a site like NeedyMeds." From there, it's necessary to apply for the program, which can involve showing proof of income and demonstrating that you either don't have insurance or your insurance doesn't cover the drug you need.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

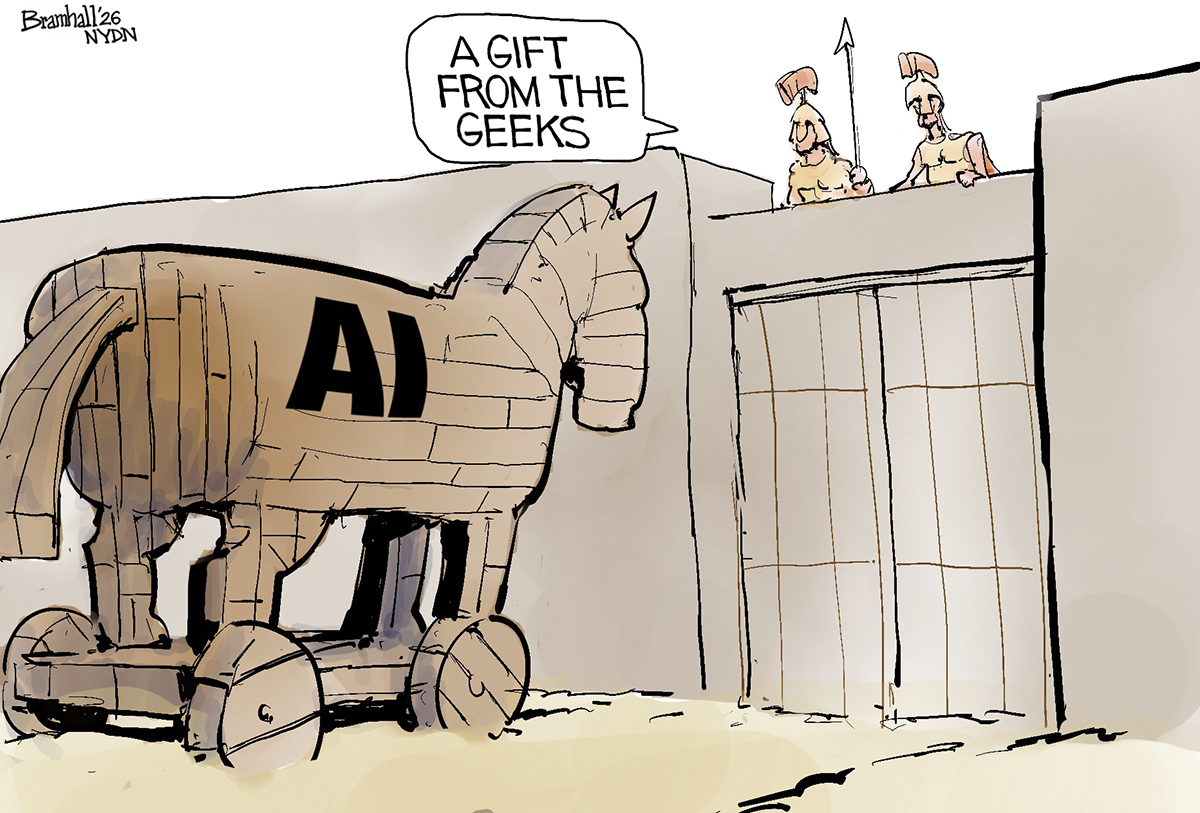

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money