Tax-efficient investments: ISAs vs SIPPs

ISAs and SIPPS are tax-efficient ways to grow and keep more of your wealth. Here is what you need to know

From putting money aside for major milestones like a wedding or first home, to preparing for retirement, investing can be a great way to grow your wealth.

Of course, HMRC will be as interested in your profits as you are, but tax-efficient investments in an ISA or pension will let you keep all your returns, and avoid handing the taxman more than he's due.

Savvy investors, who are prepared to forego the services of a financial adviser, can keep costs down and take personal control by building their own tax-free portfolios using an investment platform that puts individual investors in charge of where they put their money.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Here is what your need to know about ISAs and self-invested personal pensions (SIPPs).

ISA investing

All UK adults get an annual ISA allowance that can be used to save or invest money tax-free without paying tax on interest or profit. It can’t be carried over from one tax year to the next – you have to use it or lose it.

While cash ISAs pay interest, like a standard savings account, a stocks and shares ISA puts your money to work in the stock market.

You can back the biggest and best known listed companies in the world or find unloved or underrated stocks to put into your ISA portfolio, depending on your appetite for risk. You may also be able to include investment trusts and exchange traded funds (ETFs).

Managing your own ISA, rather than relying on a financial adviser, lets you buy and sell stocks based on your own research and strategy instead of waiting for a fund manager to decide what is best for your money.

Keeping the money within an ISA tax wrapper also means you will never have to pay a penny on any of the capital gains or dividends you receive from that investment.

Share dealing for retirement with a SIPP

A pension helps you put money away for your retirement.

Since 2012, most companies have auto-enrolled staff into workplace pensions to ensure people can support themselves when they stop working. Many of these will put your money into default funds run by a pension scheme.

But you can take more control with a self-invested personal pension (SIPP) which you can run through an investment platform.

This gives you more freedom to choose how you invest your retirement fund, which could be important if you want to take an ethical or sustainable stance, prefer to favour certain regions, sectors or companies, or just want to have more active control.

With a SIPP you can choose from a wide range of stocks, ETFs and investment trusts, and refine the balance over time to reflect changes in your own risk outlook, and how soon you may need to access the funds. The sooner you start investing, the better chance you have of riding out volatile times and the larger your pension pot could be by the time you retire.

As with an ISA, any gains made within a SIPP are tax-free, and pensions investors also benefit from tax relief that boosts contributions.

For example, if a basic-rate taxpayer puts £80 into a pension, HMRC will top it up with the £20 of tax that would have been paid when that money was earned - so an £80 contribution becomes £100 in their pension pot. Someone paying the 40% higher rate tax will be able to claim the extra 20% back too, which means each £100 added to their pension would cost them just £60.

These tax benefits, which are paid on pension contributions of up to £60,000 per year, are intended to incentivise long-term financial planning, and they come with one important caveat. While you can sell the stocks and shares in an ISA at any time, contributions are locked into your pension until you reach the age of 55.

You must therefore consider how to use each tax wrapper according to when you will need the money.

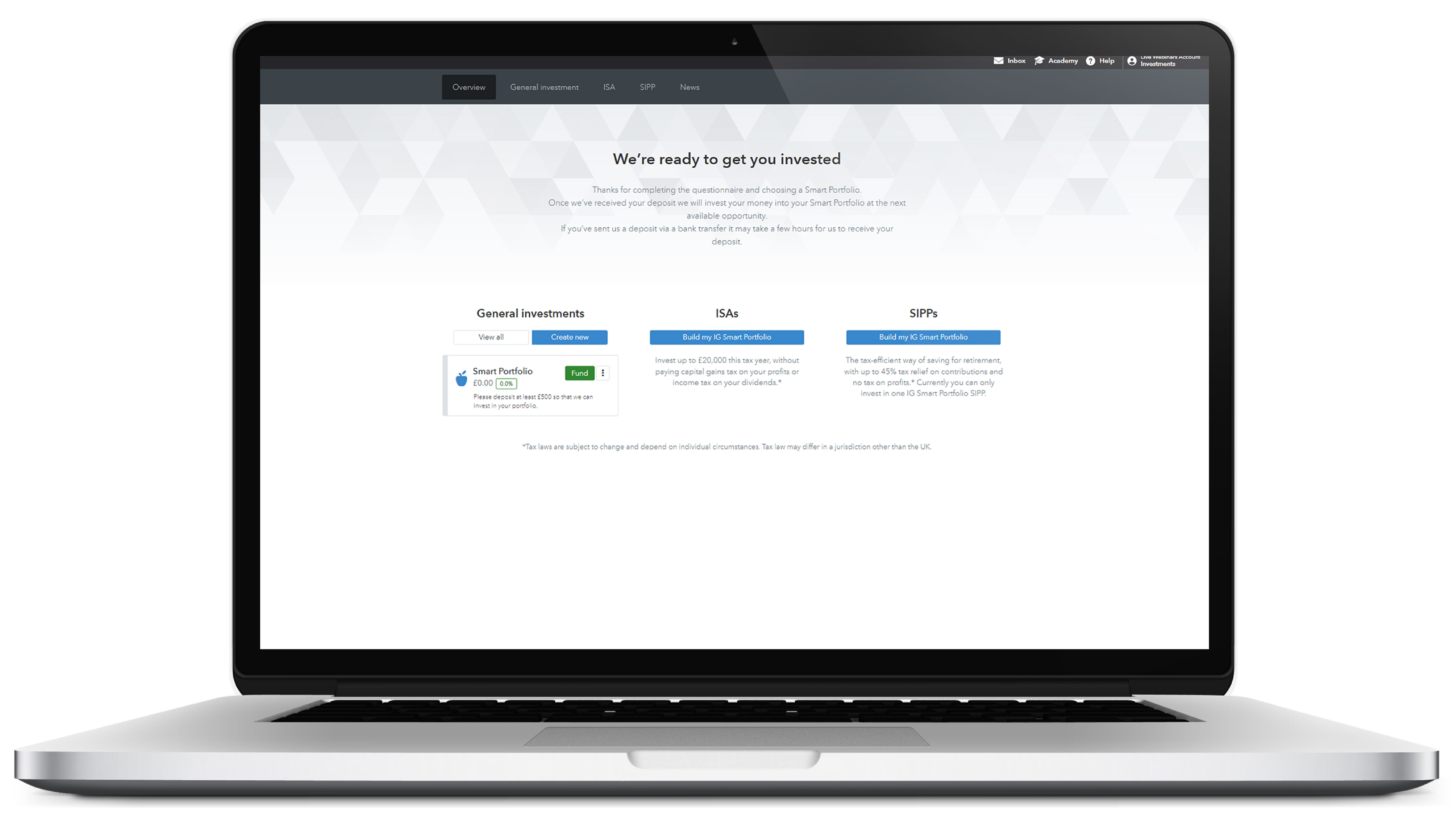

IG's online investment platform lets you research shares and place trades whenever it suits you

Keeping your costs down

Sheltering money from tax is just the start when it comes to ISA or SIPP investing.

It is also important to choose the right type of investment platform based on your own goals, strategy and experience to ensure you get the right level of support to make the best choices while keeping costs down.

Investors on IG benefit from a choice of more than 13,000 global shares, funds and investment trusts as well as research tools – all accessible through its website or mobile app.

That can be beneficial for active investors who want to take control of their own ISA or SIPP and keep trading costs down.

Many platforms impose trading charges, which – if you regularly buy and sell stocks – will soon mount up, having a big impact on your returns. IG users, by contrast, pay zero commission on US shares if they have placed three or more trades in the previous calendar month, and just £3 per trade on UK shares.

Additionally, investment platforms often charge a yearly fee based on a percentage of your portfolio, so you end up paying more and losing more of your profits as your wealth grows.

Once again, IG is different. It charges a flat fee of £24 per quarter for its share dealing ISA, and even this is waived if you make three or more trades during the period. There is a flat £210 annual administration fee for its share-dealing SIPP.

If you don't have time to carry out your own research or prefer to outsource some of your financial management, you can also choose an IG Smart Portfolio. These are multi-asset investment portfolios of ETFs based on your risk profile.

With its wide range of tax-free investment opportunities, IG can help get the best out of your trading strategies as you plan for your financial wellbeing, now and in the future.

Find out more at IG.com/investing

Investing puts your capital at risk. Tax treatment depends on the individual circumstances of each client and may be subject to change in future

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

How has Iran been preparing for war?

How has Iran been preparing for war?Today’s Big Question As the Iran war enters its second week, Tehran turns to — and adjusts — longstanding plans to defend itself

-

How to make friends as an adult

How to make friends as an adultThe Week Recommends Finding new friendships in adulthood is hard, but not impossible

-

AI fears are giving rise to ‘HALO trading’

AI fears are giving rise to ‘HALO trading’The explainer Lower tech, higher value

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

Six ways to boost your finances in 2026

Six ways to boost your finances in 2026The Explainer It’s not too late to make a new year’s resolution to finally get organised money-wise

-

3 required minimum distribution tax mistakes to avoid

3 required minimum distribution tax mistakes to avoidThe Explainer Missteps in making withdrawals from tax-advantaged retirement accounts can cost you big

-

Six actions to protect your finances before the Autumn Budget

Six actions to protect your finances before the Autumn BudgetIn Depth Reforms to property taxes, pensions and inheritance tax may be on the agenda for the 2025 Autumn Budget. Here is how you can prepare

-

Is duty-free shopping worth it?

Is duty-free shopping worth it?the explainer How to determine whether you are actually getting a good deal

-

What the 2025 Autumn Budget could mean for your wallet

What the 2025 Autumn Budget could mean for your walletThe Explainer Chancellor Rachel Reeves will reveal her latest plan to balance the nation’s finances in November

-

What taxes do you pay on a home sale?

What taxes do you pay on a home sale?The Explainer Some people — though not many — will need to pay capital gains taxes upon selling their home

-

Clean energy tax credits are going away. Here's how to get them before it's too late.

Clean energy tax credits are going away. Here's how to get them before it's too late.The Explainer Trump's recently passed megabill promises the early demise of clean energy tax credits