The great wealth transfer: who stands to gain?

Millennials are forecast to inherit a fortune but are they qualified to handle sudden riches?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

A $90 trillion "great wealth transfer" will make millennials the "richest generation in history", according to a new study.

The "blockbuster" findings predict that a "windfall" is set to "fall into the laps of millennials over the course of the coming decades", said Fortune, "shifting the power dynamic in the economy away from boomers".

But USA Today warned that millennials "may miss out" on the transfer of wealth, and there are concerns over whether younger generations are equipped to handle such sudden riches.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

'Sandwich generation'

Millennials are also "dealing with crippling student debt" and becoming the "sandwich generation", which pays for both adult children and ageing parents. They have also "long been told how lazy they are".

Knight Frank’s 2024 Wealth Report found that, over the next 20 years, $90 trillion in assets will be transferred between generations in the US alone. This means that millennials are expected to be five times richer in 2030 as the assets begin to change hands.

This will be quite a turnaround, said Fortune. It "hasn't been an easy road" for millennials "thus far" as they grapple with an "increasingly inaccessible" housing market as well as a jobs outlook "irreversibly altered by a global pandemic".

'Destroying capitalism'

But boomers "may not be handing down as much as their children think", said Yahoo Finance. A "slew" of studies have found a "notable disconnect" between how much millennials expect to inherit and how much "aging boomers plan on leaving them".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

A survey by Alliant Credit Union found that 53% of millennials expect to inherit at least $350,000 from their parents, yet 55% of boomers report that they're planning to gift an inheritance of less than $250,000.

Healthcare costs could eat up a significant chunk of what might be handed over, said USA Today. "Americans struggle to pay for expenses like premiums, copayments, coinsurance, and uncovered health services", so the great wealth transfer "may not be so great after all".

Health payments are "one of the biggest factors that drives wealth depletion during retirement", said a Nationwide Retirement Institute research report, so the "hoped-for transfer of accumulated wealth" may "ultimately end up in the medical system".

There are also concerns over how qualified millennials are to manage sudden windfalls. In his book "The 100 Trillion Dollar Wealth Transfer", veteran banker Ken Costa says there are risks to concentrating money in the hands of a new generation with an "agenda" to save the planet from the climate crisis and make the system more "fair".

Speaking to the Financial Times, the 73-year-old warned that the "polarisation between the generations" that has "gone on in the last few years" will "destroy capitalism and the market economy" once the inheritances begin to move down the family trees.

Millennials and Gen Zers feel the least confident to handle new wealth, at 21% and 18%, respectively, according to Fortune.

The two age groups have grown up "amidst global and financial turmoil,” Suzanne Schmitt, head of financial wellness at New York Life, told Fortune, and having "witnessed economic changes in their formative years", they "may be more risk-averse when it comes to financial habits than their predecessors".

Chas Newkey-Burden has been part of The Week Digital team for more than a decade and a journalist for 25 years, starting out on the irreverent football weekly 90 Minutes, before moving to lifestyle magazines Loaded and Attitude. He was a columnist for The Big Issue and landed a world exclusive with David Beckham that became the weekly magazine’s bestselling issue. He now writes regularly for The Guardian, The Telegraph, The Independent, Metro, FourFourTwo and the i new site. He is also the author of a number of non-fiction books.

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

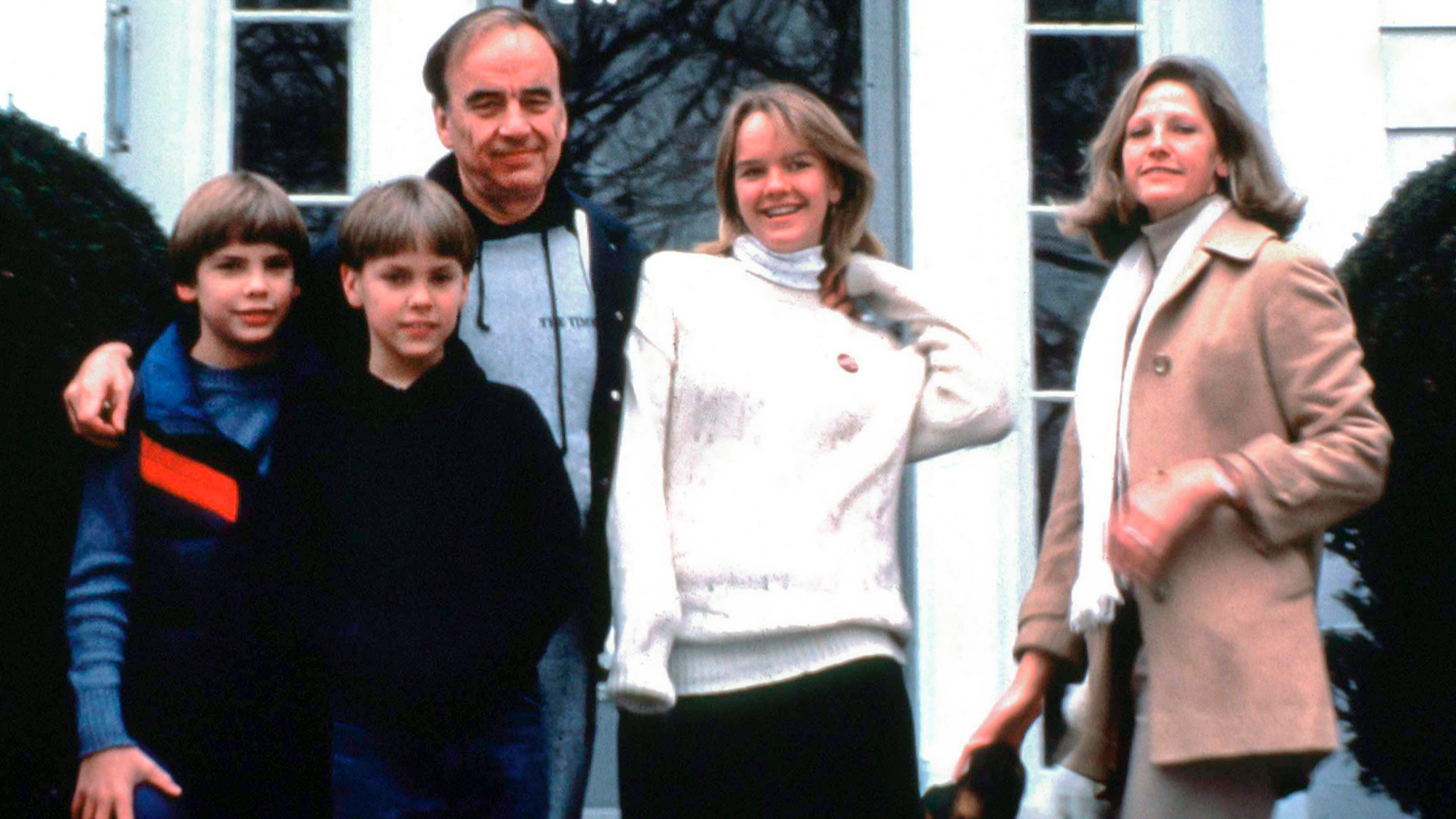

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

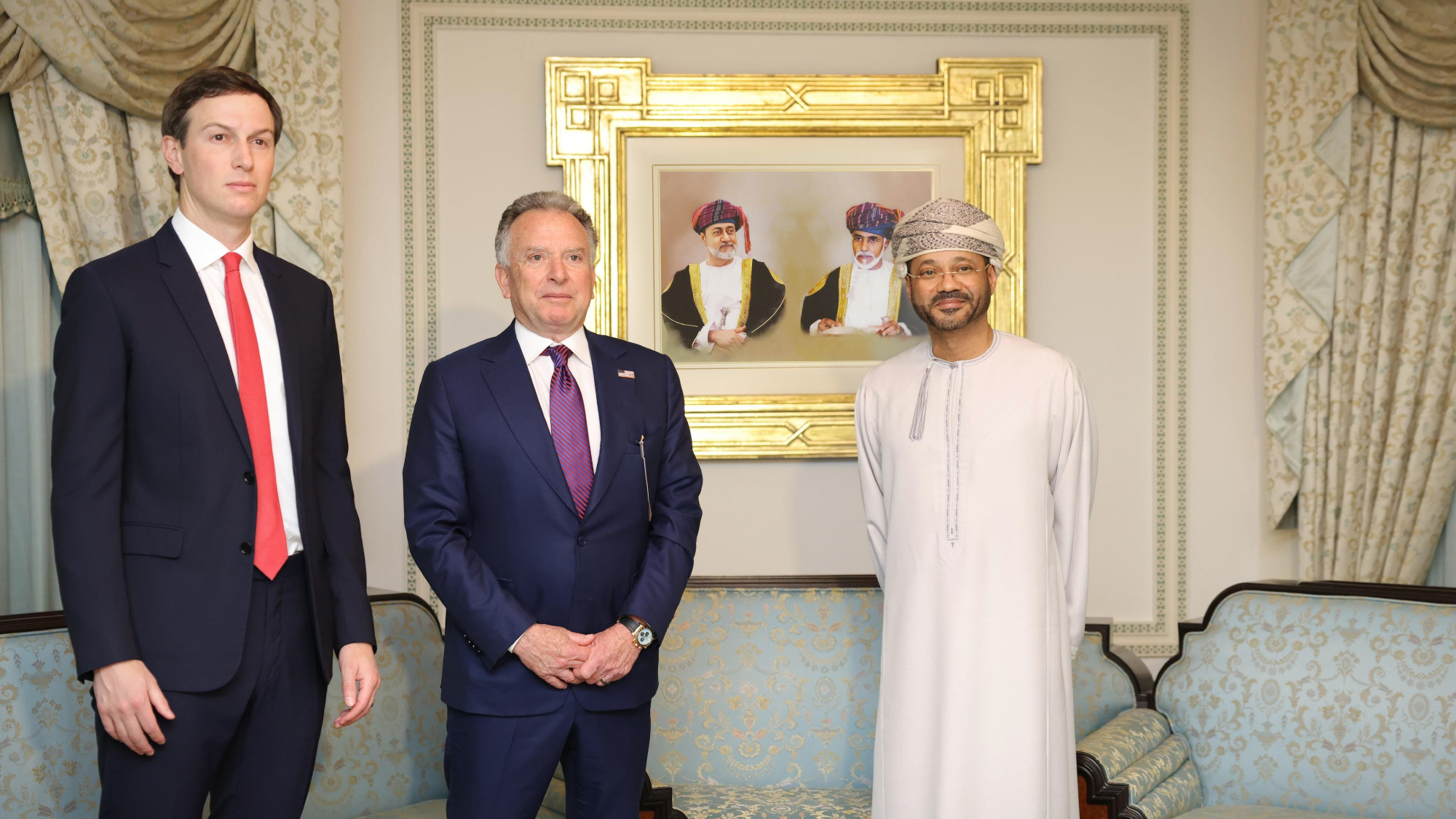

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

4 ways to streamline your financial life in 2026

4 ways to streamline your financial life in 2026the explainer Time- and money-saving steps

-

4 ways to save on rising health care costs

4 ways to save on rising health care costsThe Explainer Health care expenses are part of an overall increase in the cost of living for Americans

-

Who will the new limits on student loans affect?

Who will the new limits on student loans affect?The Explainer The Trump administration is imposing new limits for federal student loans starting on July 1, 2026

-

What’s the best way to use your year-end bonus?

What’s the best way to use your year-end bonus?the explainer Pay down debt, add it to an emergency fund or put it toward retirement

-

Can medical debt hurt your credit?

Can medical debt hurt your credit?The explainer The short answer is yes, though it depends on the credit scoring mode

-

4 signs you have too much credit card debt

4 signs you have too much credit card debtthe explainer Learn to recognize the red flags

-

The FIRE movement catches on as people want to retire early

The FIRE movement catches on as people want to retire earlyIn the spotlight Many are taking steps to leave the workforce sooner than usual