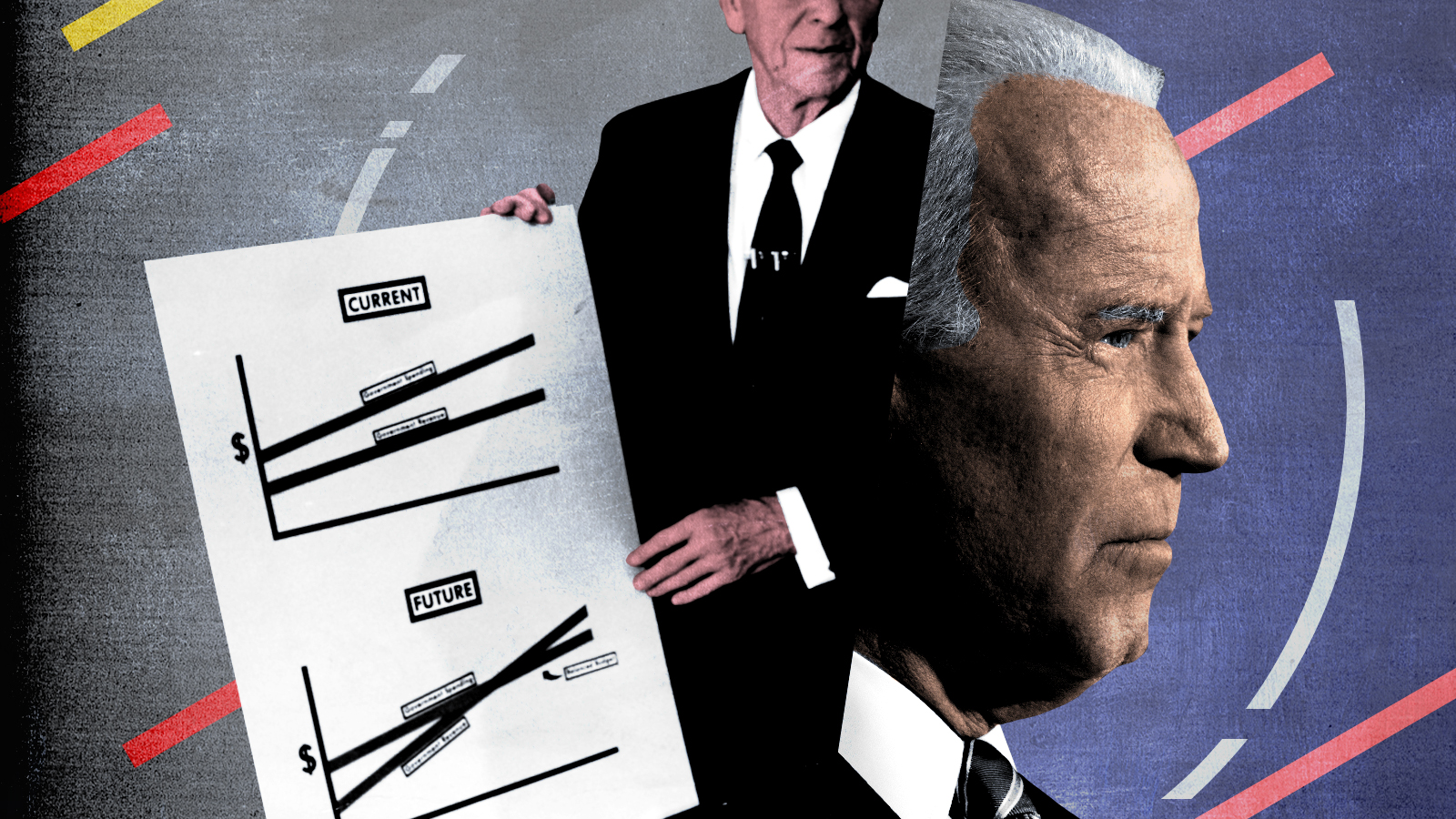

Reagan's supply-side economics get a Biden update

Treasury Secretary Janet Yellen took pains to distinguish Bidenomics from Reaganomics. Maybe don't draw that line too bright.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The last time U.S. inflation was raging, presidential candidate Ronald Reagan promised that cutting income taxes and business regulation would stabilize the volatile American economy, then get it growing like gangbusters. Voters believed the GOP nominee enough that they gave him a landslide victory over President Jimmy Carter in 1980. Now, with prices soaring again, it seems President Biden is promising much the same thing — though he claims his version of "supply-side economics" is different from Reagan's.

In a speech last Friday to the World Economic Forum, Treasury Secretary Janet Yellen said the Biden administration is aiming to create a more productive economy by focusing on issues like the supply of workers and the quality of our infrastructure, an approach she called "modern supply-side economics." As Yellen went on to explain, "Our new approach is far more promising than the old supply-side economics, which I see as having been a failed strategy for increasing growth."

It's an interesting bit of rhetorical and policy framing by Yellen, whose previous job was Federal Reserve chair. First, the descriptive phrase "supply-side" economics may remind some older voters — especially those who twice pulled the lever for the Gipper — of a previous time when an elderly president used smart policy to steady a flailing economy.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

More important, I think, is the message that Yellen is trying to send to the broader electorate, as well as to influential economic thinkers and policymakers: that Bidenomics, both the infrastructure bill that passed and the Build Back Better social spending and climate bill that's moribund, is about fixing the economy's deep fundamentals, not simply flooding it with government spending.

That's an important political message with inflation at a four-decade high. The last thing Democrats want voters to think is that Bidenomics, rather than a pandemic-induced breakdown in global supply chains, is the thing mostly responsible for the inflation surge. (As it is, about 60 percent of voters say Biden's policies are "very" or "somewhat" responsible for rising inflation, according to a recent Morning Consult poll.)

A super-short economics lesson: One way to stimulate economic growth is by boosting demand for goods and services by getting money into the hands of consumers. This was the thinking behind those three rounds of checks that Washington sent to many Americans over the past two years. But there's also the "supply side" of the economy, which determines the overall economy's ability to meet demand. Basically, it's the economy's productive capacity, taking into account such things as the supply of workers, the stock of business equipment, and entrepreneurship.

So all economists, really, are demand-side and supply-side economists. But during the Reagan years, the phrase "supply-side economics" took on a narrow, politicized definition. Reaganite supply-siders argued that lower tax rates on individuals and companies, as well as lighter business regulation, were the keys to boosting productivity. Not only would that combo raise worker wages, but it would also help lower inflation. Especially the tax cuts. As one conservative columnist famously quipped, "God put the Republican Party on earth to cut taxes. If they don't do that, they have no useful function."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Although Yellen is making it seem as if the Biden administration is trotting out some novel economic approach, it's really not new. Rather, she's merely going back to the Econ 101 definition of "supply side" and offering some standard ways of strengthening it.

For example: Better national infrastructure makes it easier to move goods around the country and for workers to commute. Paid family and medical leave increase labor-force participation, especially among women. And universal pre-K today might improve workforce quality in decades to come. Again, all these things could potentially boost the nation's productive capacity. (I say "potentially" because not all the evidence about all these ideas is without controversy. An important new study, for instance, finds significantly negative effects for students in Tennessee's state-funded pre-K program.)

In short, Yellen is arguing that national policy dealing with the supply side of the economy has become imbalanced to the detriment of infrastructure, education, labor supply, and workforce training. And the Biden administration is now trying to correct that imbalance. What's more, improving the economy's long-term productivity by strengthening its supply side also helps create a more inflation-resistant economy.

My concern here is that all this nuanced economic explanation, filtered through partisan punditry and social media, becomes "tax cuts and deregulation don't work and don't matter. More government intervention does." That isn't true, and Yellen, an excellent and highly respected economist, would never make such a strong claim. Few economists would — and that reality is an important legacy of the 1980s shift in American economic policy.

It's more a matter of balance and emphasis. While Yellen and many left-leaning economists support raising the top corporate tax rate, it's tough to find ones who want to go back to the sky-high rate before the 2017 Trump tax cuts. Nor would Yellen and her colleague ever claim the innovation impacts from regulation don't exist or should be ignored. Yellen knows the importance of private investment to economic growth and that tax rates and regulation can affect the flow of that investment.

And that's why it would behoove Secretary Yellen to sometimes be Professor Yellen and explain how supply-side economics, properly understood, isn't only a Reagan holdover or a new big-government program from Biden. It's really about stuff both Democrats and Republicans favor, and it could once again be the inflation fix we need.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.