Will California tax its billionaires?

A proposed one-time levy would shore up education and Medicaid

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

There are more than 200 billionaires in California. Now, Golden State labor leaders are pushing for tax on that wealth to help pay for education and Medicaid funding shortfalls.

California lawmakers have “never successfully passed a wealth tax,” said CalMatters. Instead, the state taxes its richest citizens on their income. That would change under a new union-led proposal to create a “one-time 5% tax” on “everything from investments to property value,” as well as “other assets, like jewelry and paintings.” This alarms critics.

The wealth tax could eventually “come all the way down to the middle class,” said Susan Shelley, a spokesperson for the Howard Jarvis Taxpayers Association, to CalMatters. But California is facing a “collapse of our health care system” thanks to federal budget cuts, said Dave Regan, the president of Service Employees International Union-United Healthcare Workers West, to CalMatters. A tax on billionaires is the “only solution anyone can see.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Opening the door?

The California proposal is the “first politically viable wealth tax,” Harold Meyerson said at The American Prospect. The purpose is to address a “crisis for many Medicaid recipients.” It has “greater significance” at a moment when the “fortunes of the very wealthy are reaching stratospheric levels,” while middle-class Americans see their incomes stagnate. The tax would be imposed just one time, but it “opens the door” to other efforts to rein in the runaway accumulation of power and wealth by the “very, sometimes obscenely, rich.”

A wealth tax is a “portent of what’s to come” if Democrats return to power in Washington, Allysia Finley said at The Wall Street Journal. The party sought such a tax to finance Joe Biden’s “Build Back Better” bill in 2021 and might have succeeded “if not for opposition from Democrats Kyrsten Sinema and Joe Manchin.” Those two are no longer in the Senate.

California Gov. Gavin Newsom is likely running for president, and he has opposed a wealth tax in his own state. “Would he oppose a national one if he wins” at a national level? Probably not. “Who doubts that Democrats will seek to sock Americans with higher tax bills to pay for their entitlements?”

The real problem is the “Trump administration’s massive planned reduction in Medicaid funding,” Mark Kreidler said at Capital & Main. Addressing that issue is more important than worrying whether California billionaires can handle a “one-time tax on a fraction of their collective wealth.” The proposal will get “plenty of pushback,” including from Newsom, but the bigger question is addressing an “existential threat to the collective well-being of the Golden State.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Gathering signatures

The tax would apply only to the 2025 net worth of California billionaires who have a “combined wealth of nearly $2 trillion,” said Axios. Because it would apply to their total wealth, “billionaires wouldn’t be able to avoid the tax by moving assets outside California.” Advocates must gather more than a half-million signatures to place the measure on the state’s 2026 ballot. If approved, billionaires will have five years to pay their bill.

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Anthropic: AI triggers the ‘SaaSpocalypse’

Anthropic: AI triggers the ‘SaaSpocalypse’Feature A grim reaper for software services?

-

NIH director Bhattacharya tapped as acting CDC head

NIH director Bhattacharya tapped as acting CDC headSpeed Read Jay Bhattacharya, a critic of the CDC’s Covid-19 response, will now lead the Centers for Disease Control and Prevention

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

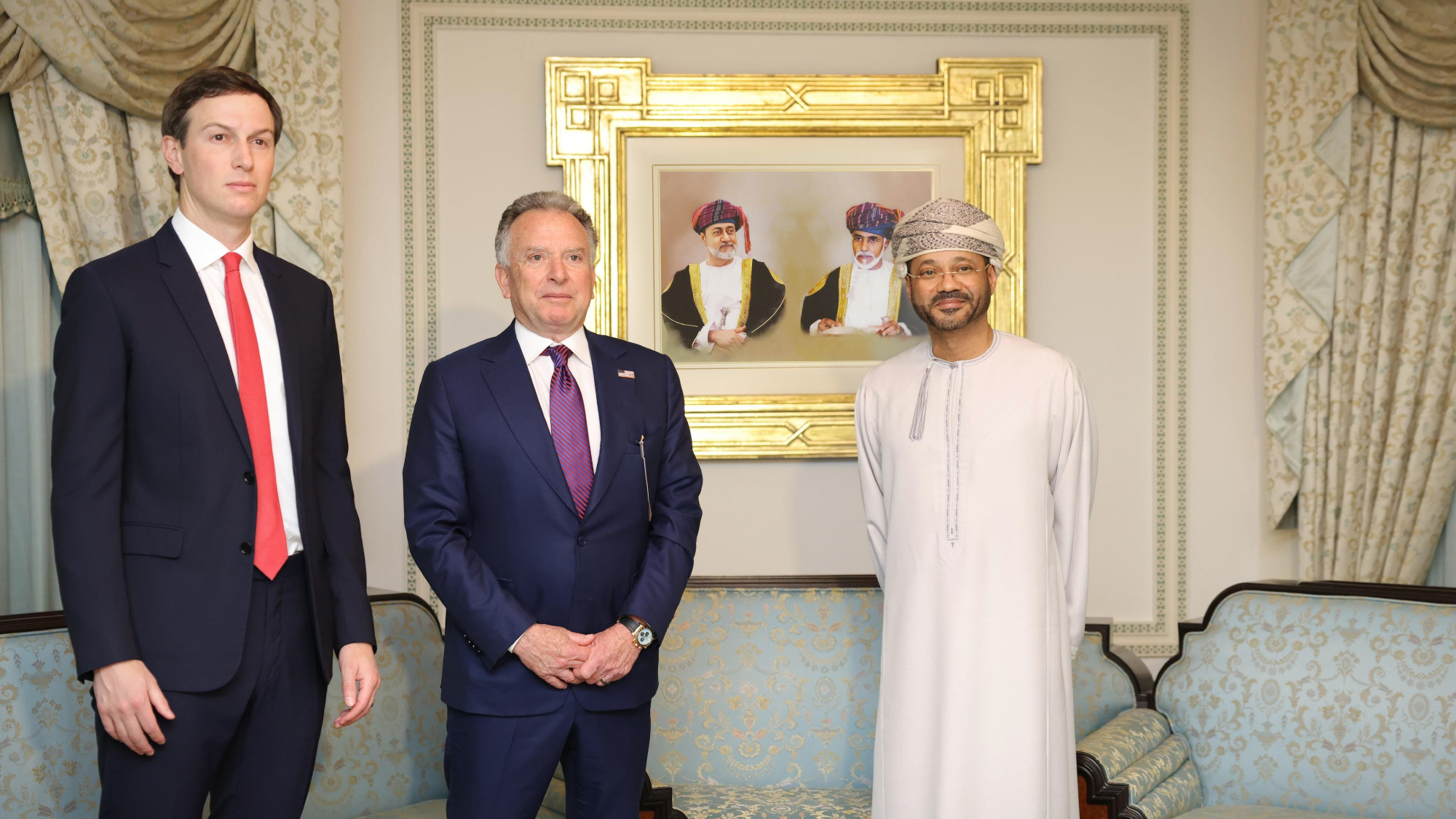

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

Kurt Olsen: Trump’s ‘Stop the Steal’ lawyer playing a major White House role

Kurt Olsen: Trump’s ‘Stop the Steal’ lawyer playing a major White House roleIn the Spotlight Olsen reportedly has access to significant US intelligence

-

Trump’s EPA kills legal basis for federal climate policy

Trump’s EPA kills legal basis for federal climate policySpeed Read The government’s authority to regulate several planet-warming pollutants has been repealed

-

House votes to end Trump’s Canada tariffs

House votes to end Trump’s Canada tariffsSpeed Read Six Republicans joined with Democrats to repeal the president’s tariffs

-

Bondi, Democrats clash over Epstein in hearing

Bondi, Democrats clash over Epstein in hearingSpeed Read Attorney General Pam Bondi ignored survivors of convicted sex offender Jeffrey Epstein and demanded that Democrats apologize to Trump

-

Judge blocks Trump suit for Michigan voter rolls

Judge blocks Trump suit for Michigan voter rollsSpeed Read A Trump-appointed federal judge rejected the administration’s demand for voters’ personal data

-

US to send 200 troops to Nigeria to train army

US to send 200 troops to Nigeria to train armySpeed Read Trump has accused the West African government of failing to protect Christians from terrorist attacks