GlaxoSmithKline and Novartis sign $25 billion worth of drug deals

Thinkstock

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Two of the world's biggest drugmakers, Britain's GlaxoSmithKline and Switzerland's Novartis, announced a complex hodgepodge of deals worth at least $25 billion on Tuesday. The main components:

* Novartis agreed to buy Glaxo's oncology business for between $14.5 billion and $16 billion* Glaxo is buying Novartis' vaccine business for between $5.3 billion and $7.1 billion* The two companies are combining their consumer health (over-the-counter) divisions, with Glaxo taking 63.5 percent of the joint venture* Eli Lilly will purchase Novartis' animal health unit for about $5.4 billion

The transactions will let Novartis focus on high-margin businesses like cancer drugs while Glaxo boosts its position in consumer goods and the low-margin, high-volume vaccine market. But the pharmaceutical giants aren't the only drugmakers making high-stakes deals. The Wall Street Journal says the $25 billion worth of transactions cap a 24-hour period where "deals worth, conservatively, $65 billion" were announced, not counting Pfizer's unsolicited $101 billion offer to buy Britain's AstraZeneca.

"The Novartis-Glaxo deal and rumors about a potential AstraZeneca acquisition by Pfizer are giving the pharma sector a decent run this morning," Danish strategist Witold Bahrke tells Bloomberg News. "It's also fueling further M&A expectations."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

How to Get to Heaven from Belfast: a ‘highly entertaining ride’

How to Get to Heaven from Belfast: a ‘highly entertaining ride’The Week Recommends Mystery-comedy from the creator of Derry Girls should be ‘your new binge-watch’

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie

-

‘One Battle After Another’ wins Critics Choice honors

‘One Battle After Another’ wins Critics Choice honorsSpeed Read Paul Thomas Anderson’s latest film, which stars Leonardo DiCaprio, won best picture at the 31st Critics Choice Awards

-

Son arrested over killing of Rob and Michele Reiner

Son arrested over killing of Rob and Michele ReinerSpeed Read Nick, the 32-year-old son of Hollywood director Rob Reiner, has been booked for the murder of his parents

-

Rob Reiner, wife dead in ‘apparent homicide’

Rob Reiner, wife dead in ‘apparent homicide’speed read The Reiners, found in their Los Angeles home, ‘had injuries consistent with being stabbed’

-

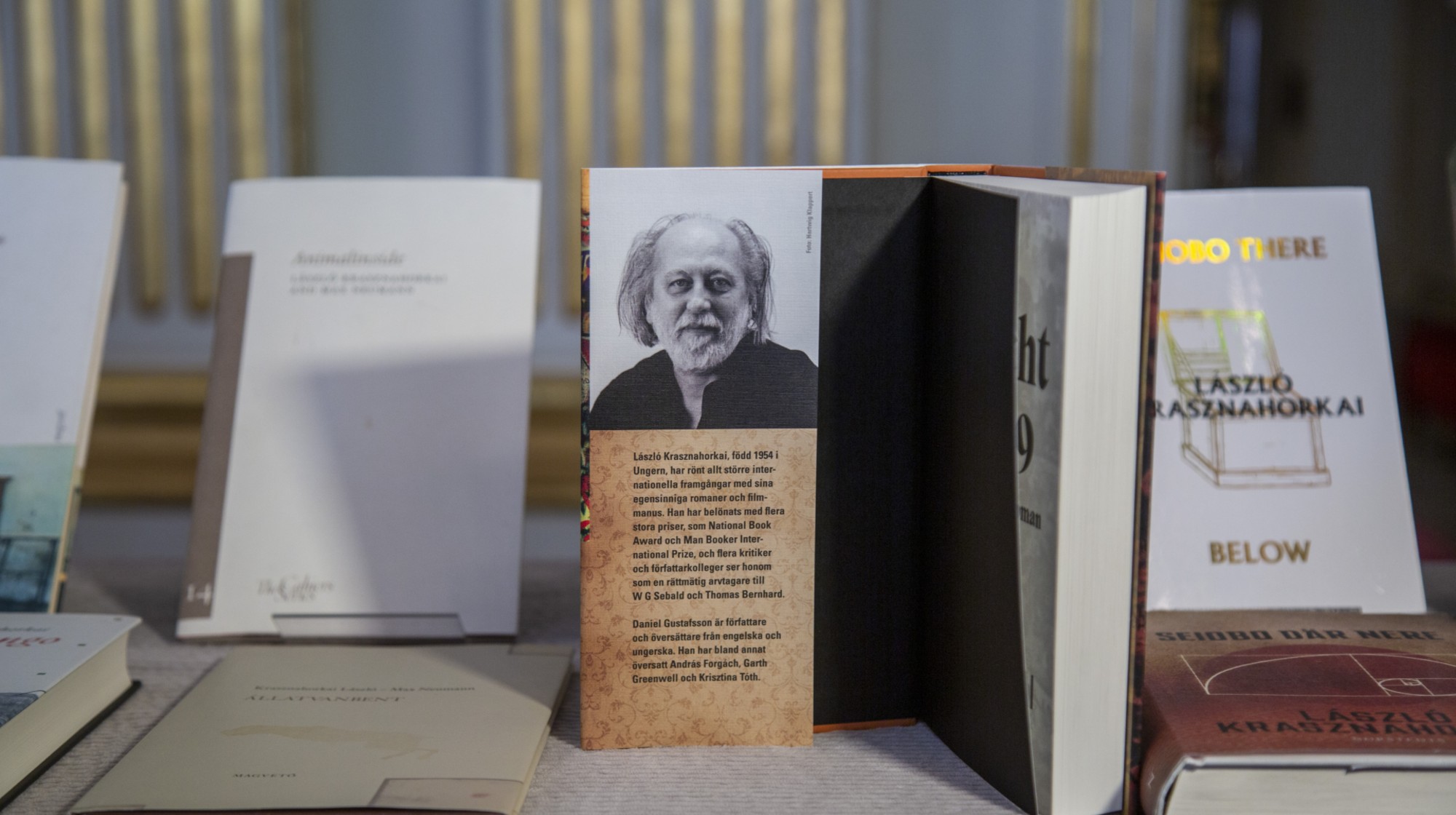

Hungary’s Krasznahorkai wins Nobel for literature

Hungary’s Krasznahorkai wins Nobel for literatureSpeed Read László Krasznahorkai is the author of acclaimed novels like ‘The Melancholy of Resistance’ and ‘Satantango’

-

Primatologist Jane Goodall dies at 91

Primatologist Jane Goodall dies at 91Speed Read She rose to fame following her groundbreaking field research with chimpanzees

-

Florida erases rainbow crosswalk at Pulse nightclub

Florida erases rainbow crosswalk at Pulse nightclubSpeed Read The colorful crosswalk was outside the former LGBTQ nightclub where 49 people were killed in a 2016 shooting

-

Trump says Smithsonian too focused on slavery's ills

Trump says Smithsonian too focused on slavery's illsSpeed Read The president would prefer the museum to highlight 'success,' 'brightness' and 'the future'

-

Trump to host Kennedy Honors for Kiss, Stallone

Trump to host Kennedy Honors for Kiss, StalloneSpeed Read Actor Sylvester Stallone and the glam-rock band Kiss were among those named as this year's inductees