Hillary Clinton Wall Street speech attendee says Clinton sounded 'like a Goldman Sachs managing director'

Before Hillary Clinton was railing on big banks in a race for the Democratic presidential nomination against notoriously anti-Wall Street candidate Sen. Bernie Sanders (I-Vt.), she was getting paid by the big banks to give talks. Now, those private talks are threatening to make a second — and very public — appearance as the push grows for Clinton to release transcripts.

While some argue that the remarks are nothing but the "boilerplate, happy talk that highly paid speakers generally offer to their hosts," others worry that Clinton's speech, if released, could easily be taken out of context by Sanders, who has already been slamming her for her Wall Street connections.

According to one attendee at Clinton's October 2013 speech to Goldman Sachs executives and tech industry leaders, Clinton's remarks then were a far cry from what she's saying on campaign trail now. "It was pretty glowing about us," the attendee told Politico of the speech. "It's so far from what she sounds like as a candidate now. It was like a rah-rah speech. She sounded more like a Goldman Sachs managing director." Clinton, Politico reports, got $225,000 for the talk, during which she not once criticized Goldman or Wall Street over the financial crisis.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

While the question of whether the release will happen remains up in the air, the attendee at Clinton's 2013 speech is pretty confident it won't. "It would bury her against Sanders," the attendee told Politico. "It really makes her look like an ally of the firm."

Read the full story over at Politico.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

How to rekindle a reading habit

How to rekindle a reading habitThe Week Recommends Fall in love with reading again, or start a brand new relationship with it

-

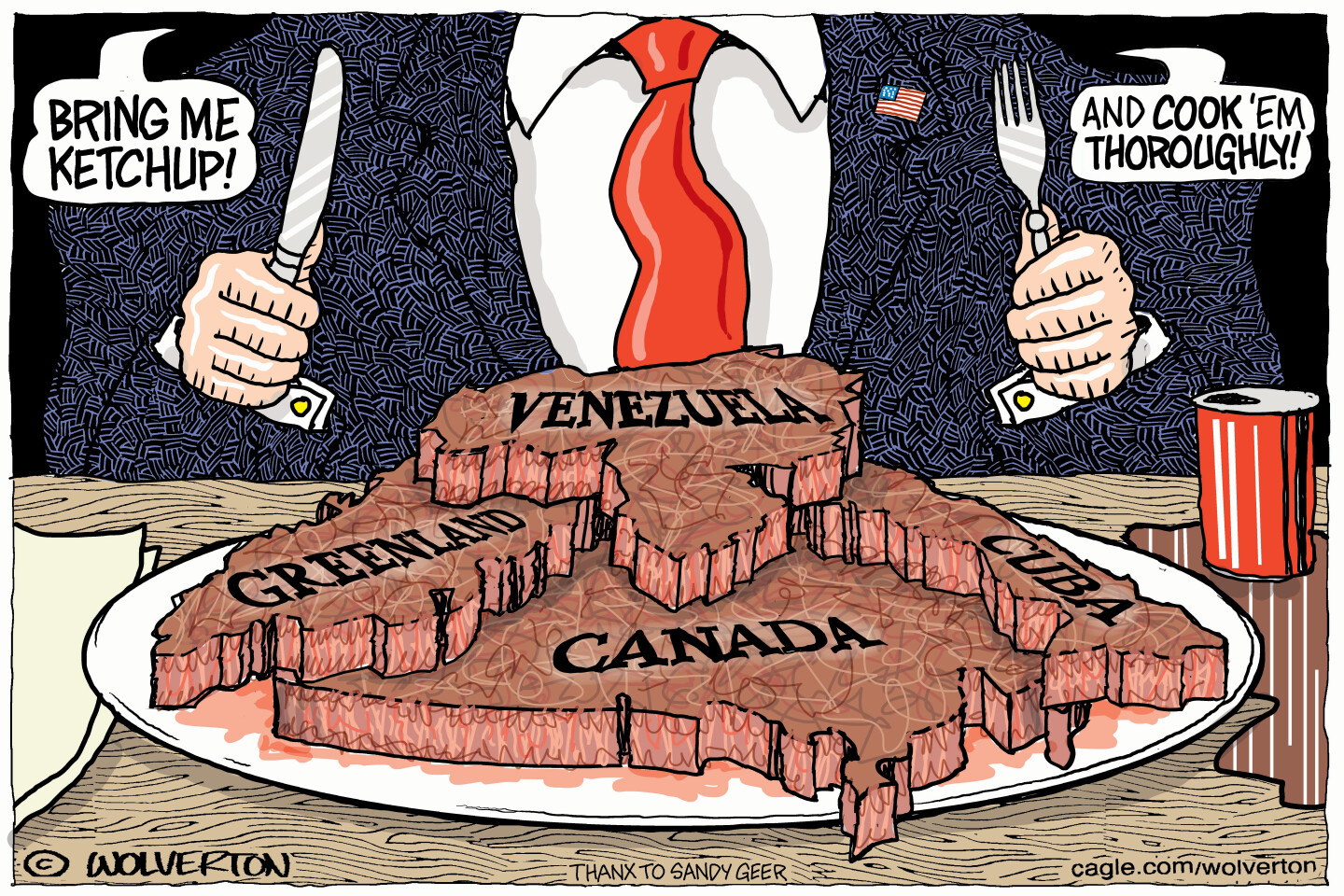

Political cartoons for January 8

Political cartoons for January 8Cartoons Thursday’s political cartoons include a well-done steak, a silenced protester, and more

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting