Goldman Sachs to pay $5 billion settlement over selling risky mortgages

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

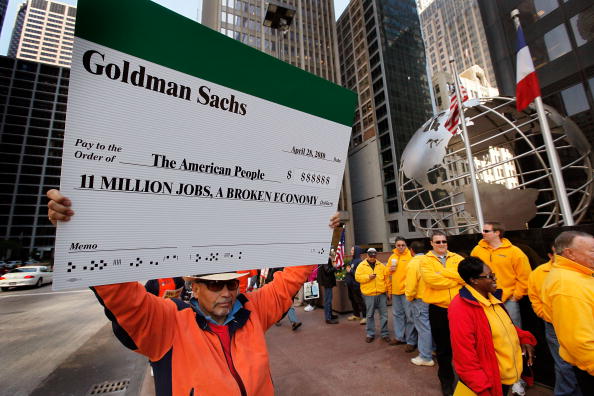

Goldman Sachs agreed Monday to pay $5 billion to settle state and federal investigations into the investment bank's sale of residential mortgage-backed securities ahead of the 2008 financial crisis, the Justice Department said. The deal requires the bank to pay a $2.4 billion civil penalty and $1.8 billion to homeowners and other borrowers affected by the housing crisis. The other $875 million will go towards resolving claims by the New York and Illinois attorneys general, the National Credit Union Administration, and the Federal Home Loan Banks of Chicago and Seattle.

"This resolution holds Goldman Sachs accountable for its serious misconduct in falsely assuring investors that securities it sold were backed by sound mortgages, when it knew that they were full of mortgages that were likely to fail," Acting Associate Atty. Gen. Stuart Delery said in a statement. However, the deal does not include any criminal sanctions or penalties, nor does it hold any individual bank employees responsible.

This marks the fifth settlement reached by a panel created by President Obama in 2012. The Residential Mortgage-Backed Securities Working Group has already reached settlements with JPMorgan Chase, Bank of America, Citigroup, and Morgan Stanley.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com