Shell companies are gobbling up Trump properties

An investigation by USA Today has documented more than 400 previously undisclosed properties across the U.S. owned by President Trump's business trust and companies. The properties are worth an estimated $250 million and include "at least 422 luxury condos and penthouses from New York City to Las Vegas, 12 mansion lots on bluffs overlooking his golf course on the Pacific Ocean, and dozens more smaller pieces of real estate," USA Today reported.

The properties present "an extraordinary and unprecedented potential for people, corporations, or foreign interests to try to influence the president," USA Today wrote. Because the properties in question are owned directly by Trump's companies and not licensed through a separate development company, any sales would directly augment Trump's wealth. Already, there are some murky deals: USA Today found that of the 14 luxury condos and home-building lots Trump companies have sold since Election Day, "half were sold to limited liability companies" and "no names were listed in deeds, obscuring buyers' identities."

Now that Trump has assumed office, a lot more people are apparently inquiring about buying real estate owned by the president. While Trump isn't legally obligated to offer a complete inventory of every property he owns, nor is he required to disclose when he makes a sale, he is constitutionally prohibited from accepting gifts from foreign officials. But because real estate laws allow shell companies to be set up so that a person can make a purchase without revealing his or her identity, USA Today noted it could be "impossible for the public to know" who purchases a Trump property in this manner.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"Anyone seeking to influence the president could set up an anonymous company and purchase his property," said Heather Lowe, director of government affairs at Global Financial Integrity, a group focused on stopping illegal financial transactions. "It's a big black box, and the system is failing as a check for conflicts of interest."

Read the full product of USA Today's four-month-long investigation here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Could Trump run for a third term?

Could Trump run for a third term?The Explainer Constitutional amendment limits US presidents to two terms, but Trump diehards claim there is a loophole

-

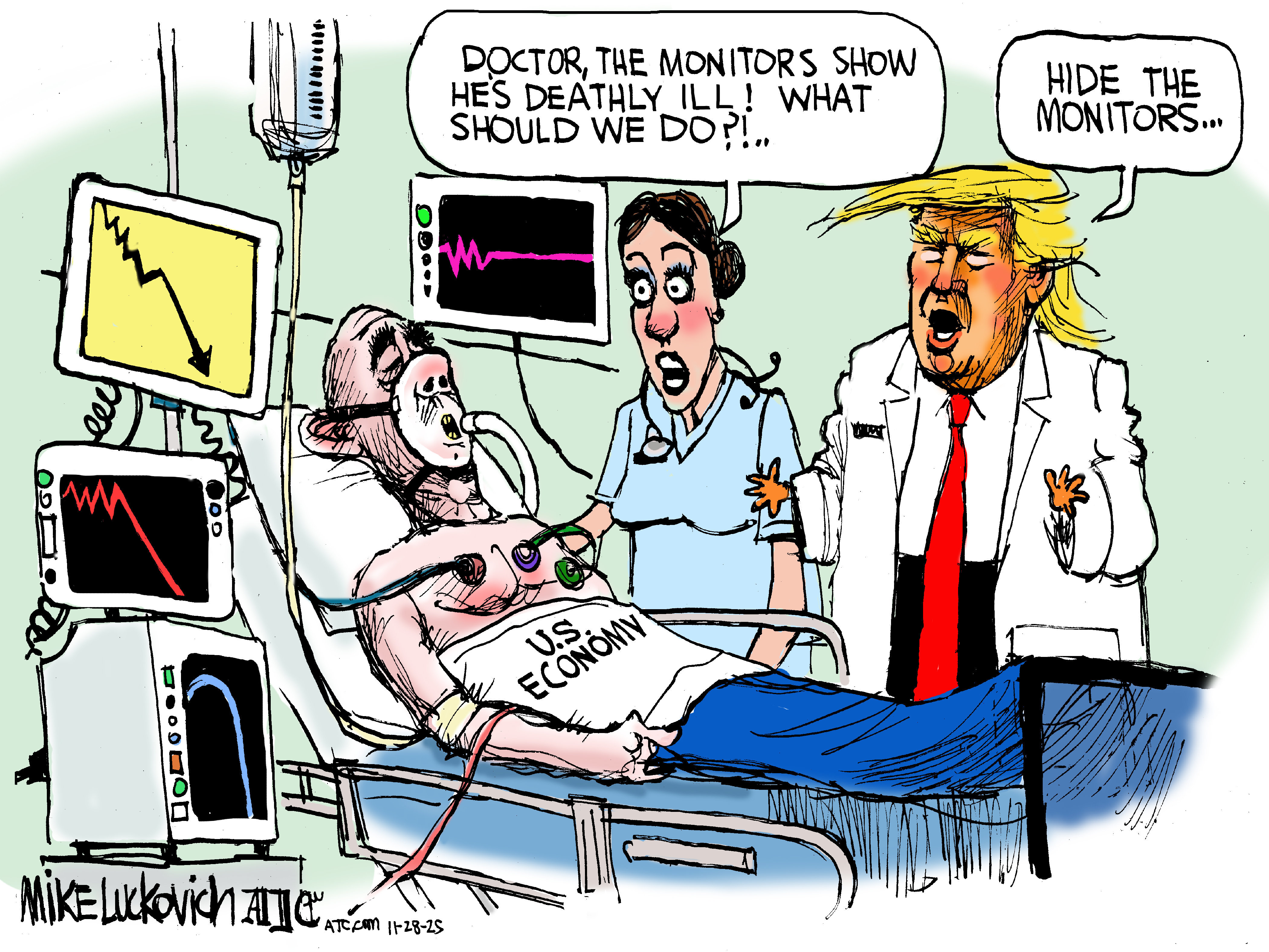

Political cartoons for November 28

Political cartoons for November 28Cartoons Friday's political cartoons include economic diagnosis, climate distractions, and more

-

What does the fall in net migration mean for the UK?

What does the fall in net migration mean for the UK?Today’s Big Question With Labour and the Tories trying to ‘claim credit’ for lower figures, the ‘underlying picture is far less clear-cut’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting

-

US to take 15% cut of AI chip sales to China

US to take 15% cut of AI chip sales to ChinaSpeed Read Nvidia and AMD will pay the Trump administration 15% of their revenue from selling artificial intelligence chips to China

-

NFL gets ESPN stake in deal with Disney

NFL gets ESPN stake in deal with DisneySpeed Read The deal gives the NFL a 10% stake in Disney's ESPN sports empire and gives ESPN ownership of NFL Network