SEC says 2016 hack could have enabled illegal stock trading

Late Wednesday, the Securities and Exchange Commission said that it discovered last month that a 2016 hack of its computer filing system for publicly traded companies "may have provided the basis for illicit gain through trading." The "software vulnerability in the test filing component of the commission's EDGAR system" has been patched, and while the "intrusion" was discovered last year, the SEC said, it only learned about the possible use of pilfered information to trade stocks for illegal profit after SEC Chairman Jay Clayton ordered a cybersecurity review in May 2017.

The SEC statement did not say why the agency didn't disclose the breach last year, when the system was hacked, or whether specific companies were targeted. The SEC is the federal government's main Wall Street regulator. "Cybersecurity is critical to the operations of our markets and the risks are significant and, in many cases, systemic," Clayton said. "We must be vigilant. We also must recognize — in both the public and private sectors, including the SEC — that there will be intrusions, and that a key component of cyber risk management is resilience and recovery."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Metal-based compounds may be the future of antibiotics

Metal-based compounds may be the future of antibioticsUnder the radar Robots can help develop them

-

Europe’s apples are peppered with toxic pesticides

Europe’s apples are peppered with toxic pesticidesUnder the Radar Campaign groups say existing EU regulations don’t account for risk of ‘cocktail effect’

-

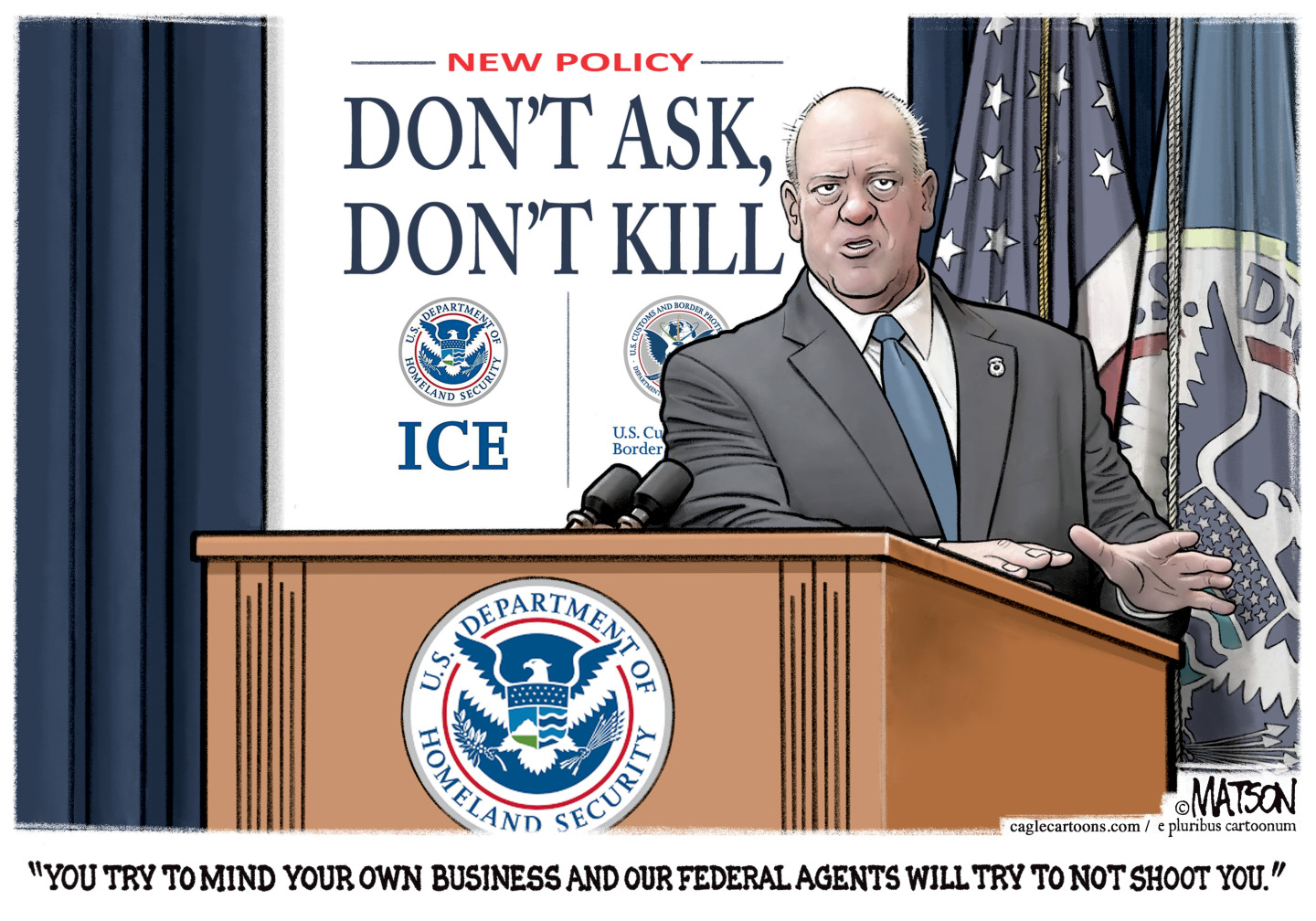

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting