Last-minute changes to the Senate GOP tax bill will mostly help the wealthy, and probably Trump

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

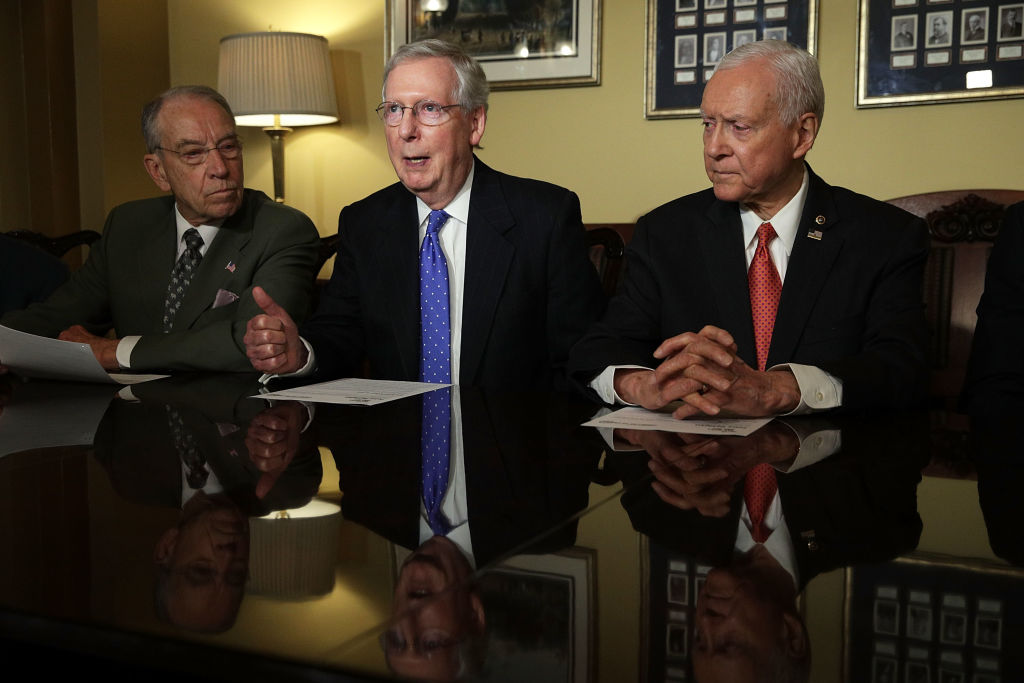

Republican leaders are hustling to win over a handful of GOP senators who have said or suggested they would vote no this week on the GOP's top-priority tax overhaul if their various concerns aren't met, and the most likely changes will benefit wealthy Americans, already the biggest winners in the legislation, according to official congressional analyses. Republicans can't lose more than two votes.

The only two Republicans who have said they will vote no if the bill doesn't change, Sens. Ron Johnson (Wis.) and Steve Daines (Mont.), want more generous cuts for pass-through entities, a broad category of businesses where income is taxed at individual rates not the corporate rate. Johnson sits on the Senate Budget Committee, and if he votes no in committee on Tuesday, the bill won't advance without procedural machinations.

Pass-throughs "can range from single-employee small businesses to the Trump Organization," Politico says, and The Washington Post notes that President Trump has financial stakes in hundreds of pass-throughs, not just the Trump Organization. Johnson also has a personal stake in several pass-through businesses. Trump and Johnson say they will not personally benefit from the tax bill, without explaining why not. While many small businesses are pass-throughs, 70 percent of pass-through income goes to the top 1 percent of earners, according to Owen Zidar at the University of Chicago.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Other senators expressing concerns about the bill include a handful of deficit hawks, and some of them, like Sens. Bob Corker (Tenn.) and James Langford (Okla.), say they want the bill to include a provision to raise taxes if the tax cuts aren't offset by economic growth. A new analysis by the Committee for a Responsible Federal Budget found that any growth from the tax cuts would be modest, and even if the GOP's unrealistically optimistic growth targets were met, that would make up for little more than half of the $1.4 trillion in deficit spending.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.