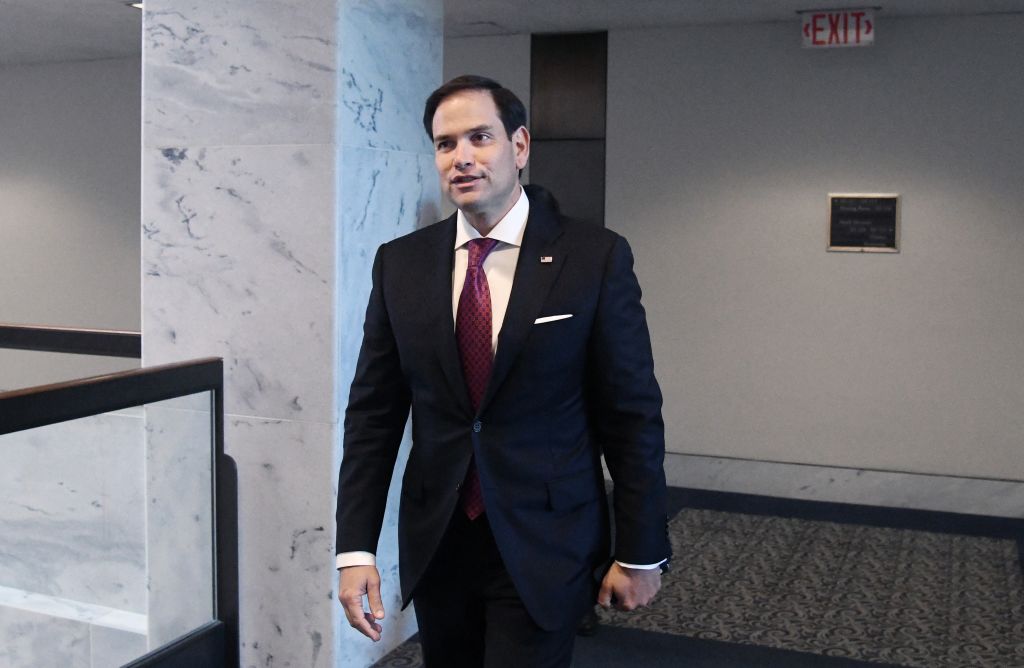

Rubio won't support GOP tax bill unless it expands child tax credit

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Sen. Marco Rubio (R-Fla.) could complicate things for the Republicans as they try to pass their tax overhaul, having told reporters on Thursday he won't support the legislation unless it increases the refundable portion of the child tax credit.

Senate and House Republicans say they have reached an agreement on a tax bill, which lowers the corporate tax rate to 21 percent and top individual tax rate from 39.6 to 37 percent, and are just ironing out the final details. As it stands now, the bill sets the child tax credit at $2,000 per child, and Rubio wants it to be refundable against both payroll and income taxes. He "can't in good conscience support" the legislation unless this happens, Rubio said, adding, "There's a way to do it, and we'll be very reasonable." Sen. Mike Lee (R-Utah) has said he agrees with Rubio on the child tax credit issue.

The GOP can only afford to lose two votes in the Senate, but several GOP aides and lawmakers told Politico they believe Rubio will come around before a final vote, which they hope happens next week. "The goal is to get a $2,000 per child tax credit with a significant portion of that to be refundable," Sen. John Cornyn (R-Texas) said. "I think Sen. Rubio would like to see us do a little more and we're trying to work with him."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Catherine Garcia has worked as a senior writer at The Week since 2014. Her writing and reporting have appeared in Entertainment Weekly, The New York Times, Wirecutter, NBC News and "The Book of Jezebel," among others. She's a graduate of the University of Redlands and the Columbia University Graduate School of Journalism.

-

The environmental cost of GLP-1s

The environmental cost of GLP-1sThe explainer Producing the drugs is a dirty process

-

Greenland’s capital becomes ground zero for the country’s diplomatic straits

Greenland’s capital becomes ground zero for the country’s diplomatic straitsIN THE SPOTLIGHT A flurry of new consular activity in Nuuk shows how important Greenland has become to Europeans’ anxiety about American imperialism

-

‘This is something that happens all too often’

‘This is something that happens all too often’Instant Opinion Opinion, comment and editorials of the day

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting