The U.S. credit downgrade: 4 predictions

What does Standard and Poor's controversial decision mean for Wall Street investors, Main Street Americans, and beltway politicians?

Stocks dropped sharply in the U.S. and around the world on Monday, as investors reacted to the news that Standard and Poor's had stripped the federal government of its top-notch AAA credit rating for the first time in history. In a "remarkably blunt" statement explaining the unprecedented downgrade to AA+, the ratings agency said it no longer considers U.S. Treasury bonds to be an essentially risk-free investment because Washington is running up mounting deficits with no real plan to reduce them. What ramifications can we expect from the downgrade? Here, four predictions:

1.The economy will plunge into another recession

The Dow Jones Industrial Average plummeted more than 500 points by mid-afternoon on Monday. With the threat of a double-dip recession looming, says UBS markets strategist David Cassidy, as quoted by Australia's Herald Sun, the downgrade, which threatens to send interest rates higher, has torpedoed everyone's sense of well-being and sent stocks into a nosedive. That only worsens the "negative feedback loop," making another recession more likely than ever.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. Our lawmakers will shape up — or be shipped out

Members of both political parties should view this downgrade "as a last-chance wake-up call," says The Baltimore Sun in an editorial. We have no choice now but "to reject both far-right and far-left doctrine on the deficit. Neither a hard line on taxes nor entitlements is what the nation needs right now." If our leaders can't grow up and achieve "genuine compromise," maybe in 2012 voters will "put centrist pragmatism back in the nation's capital."

3. Despite the downgrade, treasury bonds will remain the "gold standard"

In this topsy-turvy economy, every investment has become riskier, say Min Zeng and Cynthia Lin at The Wall Street Journal. As one big-time trader put it, "Double-A-plus is the new triple-A," and U.S. Treasury bonds remain "the world's gold standard." Japan and China, which both own massive amounts of U.S. debt, won't be dumping their holdings. If anything, nervous investors might snap up U.S. debt because it's less risky than everything else, which will send interest rates down, not up.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. S&P's credibility will be shot

This is "amateur hour" at S&P, says Paul Krugman at The New York Times. The Treasury Department put out a fact sheet showing that S&P analysts overshot deficit projections to the tune of $2 trillion, something "real budget experts" would never have done. These guys clearly don't even understand "basic analysis of budget estimates." Really, Krugman says, S&P is "the last place anyone should turn for judgements about our nation's prospects."

-

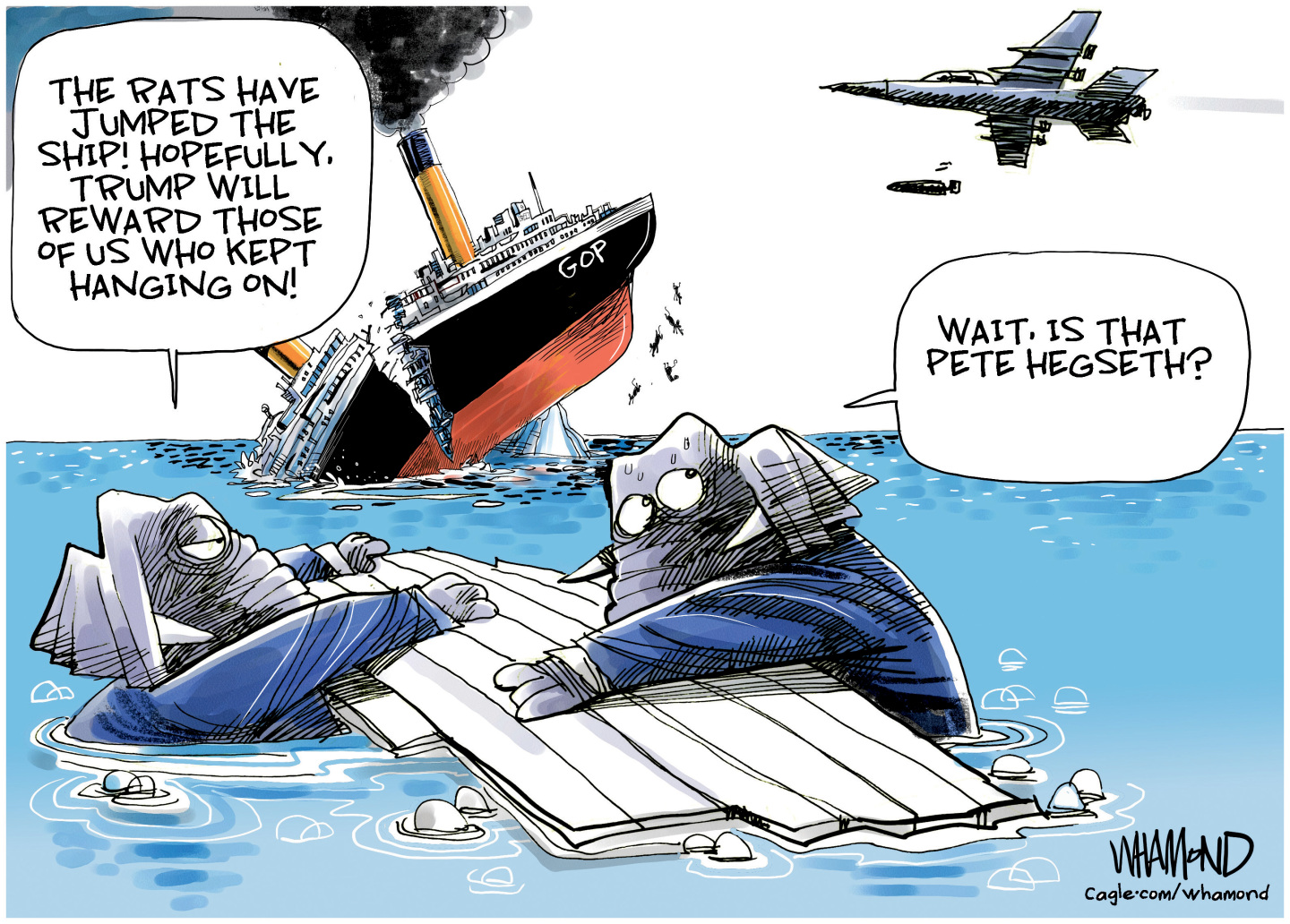

Political cartoons for December 20

Political cartoons for December 20Cartoons Saturday’s political cartoons include drowning rats, the ACA, and more

-

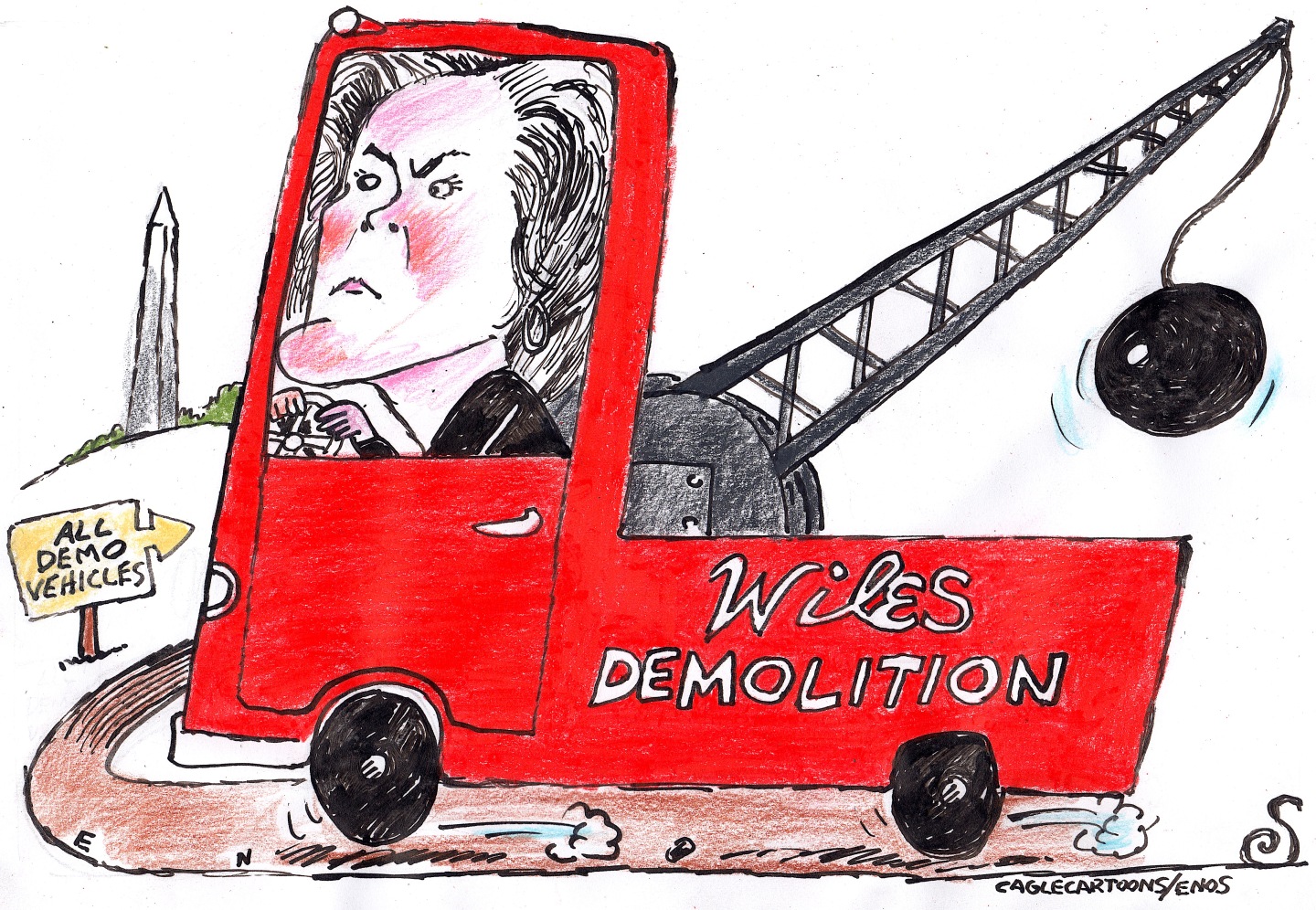

5 fairly vain cartoons about Vanity Fair’s interviews with Susie Wiles

5 fairly vain cartoons about Vanity Fair’s interviews with Susie WilesCartoon Artists take on demolition derby, alcoholic personality, and more

-

Joanna Trollope: novelist who had a No. 1 bestseller with The Rector’s Wife

Joanna Trollope: novelist who had a No. 1 bestseller with The Rector’s WifeIn the Spotlight Trollope found fame with intelligent novels about the dramas and dilemmas of modern women

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: who are US billionaires backing?

Democrats vs. Republicans: who are US billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration