Taxes: Should cuts for the wealthy be extended?

The Obama administration would like tax rates for families earning more than $250,000 a year to return to their Clinton-era levels, where the top marginal rate was 39.6 percent.

When times get tough, liberals always go to their default response, said Robert J. Samuelson in The Washington Post. “Get the rich!” With midterm elections just weeks away, the White House has taken up that cry, as it battles Republicans over whether to extend the Bush-era tax cuts that are set to expire at the end of this year. Virtually no one is advocating letting all the cuts expire, since the economy remains hamstrung by weak consumer spending. So the Obama administration says we should extend the cuts for “the middle class,” while allowing tax rates for families earning more than $250,000 a year to return to their Clinton-era levels, with a top marginal rate of 39.6 percent. Quite sensibly, Republicans counter that these tax increases would affect consumer spending at the top, and hurt about 725,000 business owners—lawyers, accountants, contractors, plumbers, and restaurant owners. All of them would employ fewer people as a result. “Raising taxes in a weak economy doesn’t make sense.”

That’s ridiculous, said Paul Krugman in The New York Times. Extending tax cuts for the top 2 percent of wage earners would provide minimal economic stimulus. As a recent Moody’s study showed, the wealthy saved and invested, rather than spent, most of their windfall from the Bush tax cuts. Extending tax cuts for top earners would provide “little bang for the buck” while adding $700 billion to the deficit over the next decade. Claims that “restoring the Clinton tax rates for the rich would hurt the economy” are “ludicrous,” said Robert Reich in HuffingtonPost.com. Under the Clinton era’s top tax rate of 39.6 percent, “the economy roared,” creating 22 million jobs. Under Bush’s tax policies, the rich got dramatically richer, but “nothing trickled down,” and the middle class actually lost ground. And then “we were plunged into the Great Recession.”

Your facts are wrong, said Terry Savage in the Chicago Sun-Times. The top earners targeted by the White House account for one-quarter of all consumer spending. If their taxes rise, their spending will decline, and we’ll all suffer. That’s why even Obama’s recently departed budget chief, Peter Orszag, says tax cuts for top earners “should be extended for at least two years.” Obama, unfortunately, believes that all taxpayer income “is the government’s by default,” said Matthew Continetti in The Weekly Standard. In this backward liberal logic, the government decides, through tax rates, “how much to give back to people.” Obama would rather spend wealthy taxpayers’ money through his social-engineering policies, even though long experience proves that it’s the free market, not government, that creates real economic growth.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Has everyone forgotten about the deficit? said Ezra Klein in The Washington Post. Just months ago, Republicans and Tea Partiers were apoplectic about the federal government’s $1.3 trillion shortfall in 2010. But now that we have a chance to do something about it by increasing revenues, so-called fiscal conservatives “are running in the opposite direction.” Extending the Bush tax cuts for everyone would add $4 trillion to the deficit over the next decade. The Democratic proposal is only marginally less expensive. Now, $4 trillion is “vastly more deficit spending than the stimulus, bank bailouts, health-care bill (which actually reduces the deficit), and everything else we’ve done in the past few years combined.” So indulge yourself with more tax cuts, if you must, but please, no more empty rhetoric about balancing the budget.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

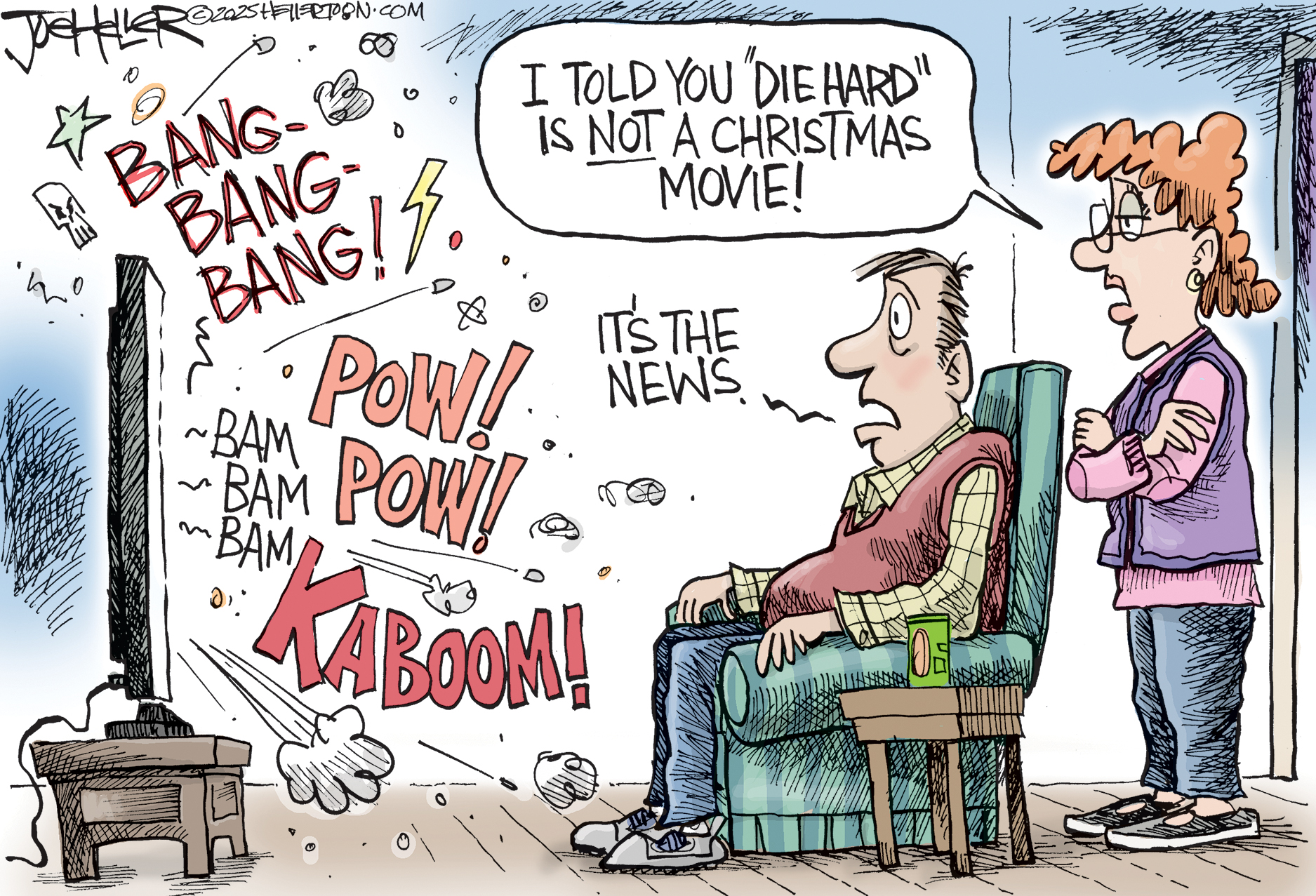

Political cartoons for December 21

Political cartoons for December 21Cartoons Sunday’s political cartoons include Christmas movies, AI sermons, and more

-

A luxury walking tour in Western Australia

A luxury walking tour in Western AustraliaThe Week Recommends Walk through an ‘ancient forest’ and listen to the ‘gentle hushing’ of the upper canopy

-

What Nick Fuentes and the Groypers want

What Nick Fuentes and the Groypers wantThe Explainer White supremacism has a new face in the US: a clean-cut 27-year-old with a vast social media following

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: who are US billionaires backing?

Democrats vs. Republicans: who are US billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration