The end of 'cheap credit': What it means for you

With interest rates set to rise, inexpensive consumer credit lines could vanish. What does that mean for average Americans?

The economy is slowly improving, but consumers may soon bear a new burden: the rising cost of credit. Over the past 30 years, interest rates have dropped dramatically. But the ballooning national debt — now at nearly $1.3 trillion — and the looming threat of inflation have triggered what could be an extended climb for interest rates. What does this mean for the pocketbooks of average Americans? A concise guide:

Overall, what do higher interest rates mean?

Increased interest rates mean the cost of borrowing money goes up, for everyone, from the federal government to individuals. Credit card rates have risen from around 12 percent in late 2008 to more than 14 percent in February, a jump that translates into roughly $200 a year in added interest payments for the typical U.S. household.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Why are interest rates going up?

To offset the possibility of inflation. When prices go up, safe but low-yielding government bonds become less attractive for investors. With inflation prospects returning as the economy improves, major bond investors have been selling off government debt, pushing interest rates up. At the same time, Washington is ending supports that kept rates low through the financial crisis, increasing upward pressure on rates.

How much could interest rates rise?

Between 1 percent and 1.5 percent annually. Thirty-year mortgages, for example, were below 5 percent late last year. They hit 5.31 percent last week, and could go reach 6 percent by the end of the year.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

How does this translate into actual dollars?

It depends on the size and term length of the loan. On a 30-year fixed-rate loan, for instance, a 1 percent increase could add as much as 19 percent to the total cost of a home.

How high could interest rates go?

That remains unclear. Fortunately, however, "no one expects rates to return to anything resembling 1981 levels," says Nelson D. Schwartz in The New York Times, when "mortgage rates peaked" at a devastating 18.2 percent.

Is there any other good news?

Yes. Increased interest rates are signs of a strengthening economy, says Chris Farrell in BusinessWeek. And, despite what some believe, "the rise in rates could be good for corporate profits and the stock market." Also, because credit is now much more difficult to obtain, says Jerry Remmers in The Moderate Voice, consumers have already begun to learn "the value of saving, paying off debt and stop using their homes as ATM machines" — necessary practices for surviving an interest rate hike.

Sources: The New York Times, BusinessWeek, The Moderate Voice

-

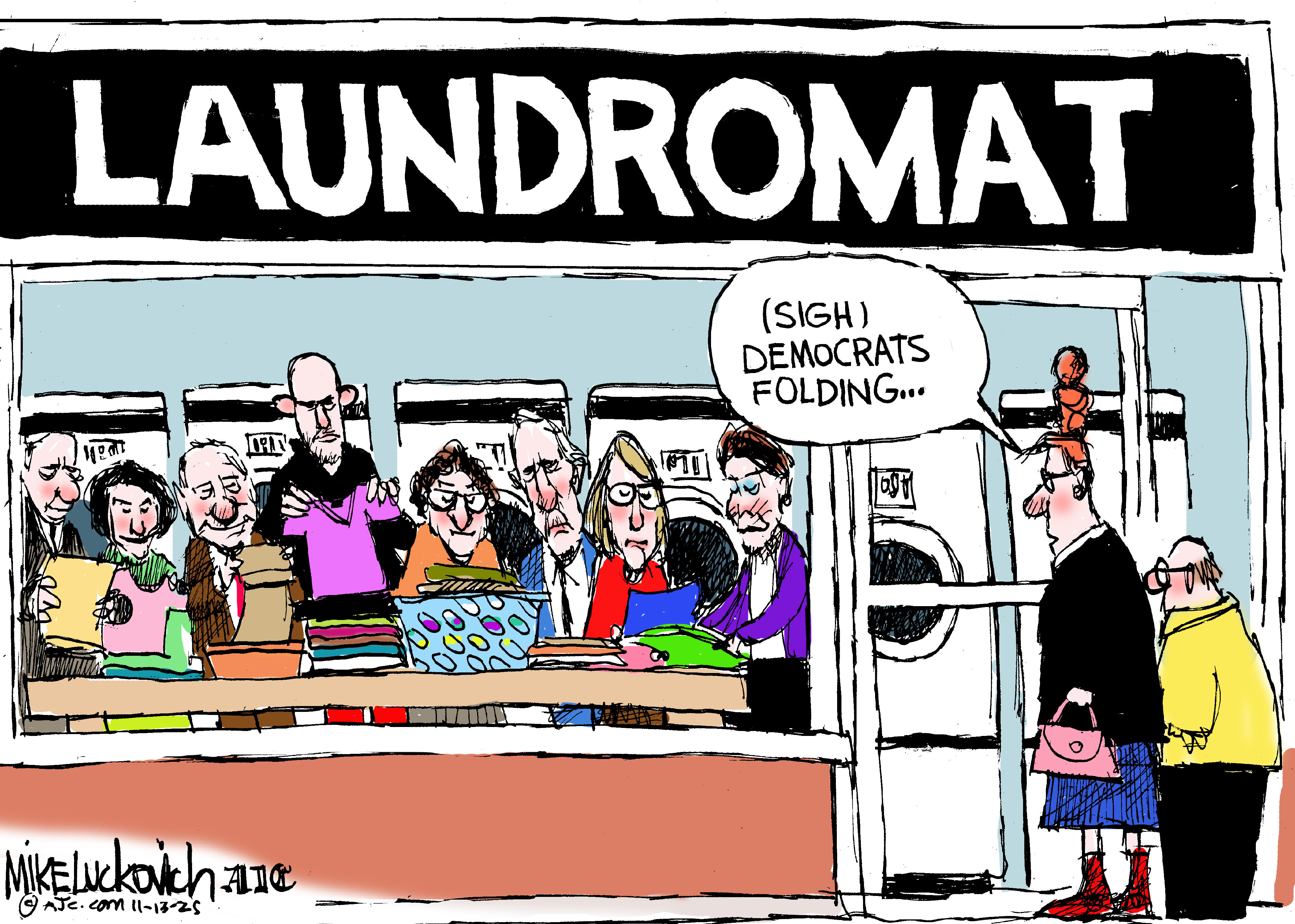

5 capitulating cartoons about the Democrat's shutdown surrender

5 capitulating cartoons about the Democrat's shutdown surrenderCartoons Artists take on Democrat's folding, flag-waving, and more

-

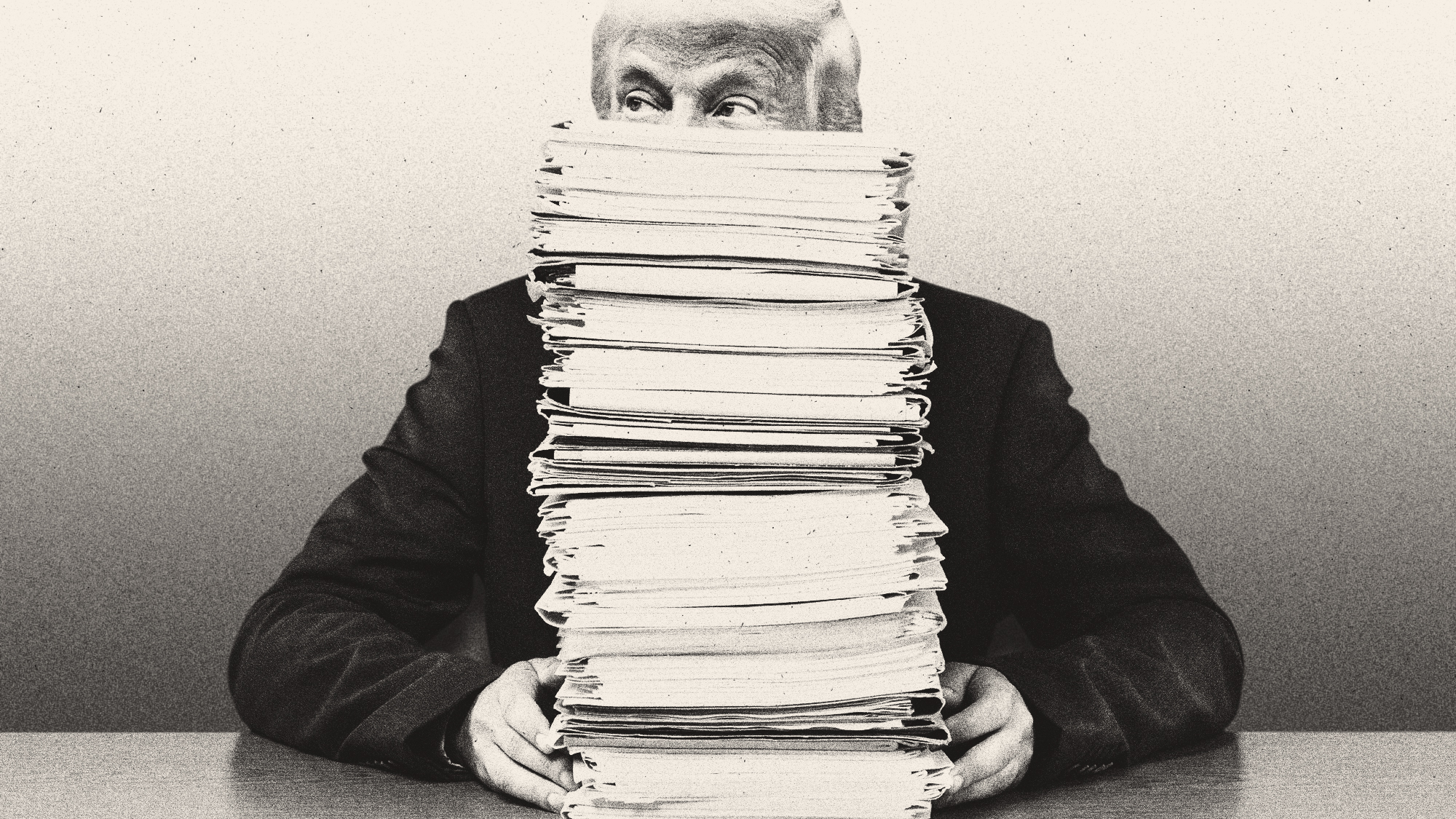

How are these Epstein files so damaging to Trump?

How are these Epstein files so damaging to Trump?TODAY'S BIG QUESTION As Republicans and Democrats release dueling tranches of Epstein-related documents, the White House finds itself caught in a mess partially of its own making

-

Margaret Atwood’s memoir, intergenerational trauma and the fight to make spousal rape a crime: Welcome to November books

Margaret Atwood’s memoir, intergenerational trauma and the fight to make spousal rape a crime: Welcome to November booksThe Week Recommends This month's new releases include ‘Book of Lives: A Memoir of Sorts’ by Margaret Atwood, ‘Cursed Daughters’ by Oyinkan Braithwaite and 'Without Consent' by Sarah Weinman

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: who are US billionaires backing?

Democrats vs. Republicans: who are US billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration