The giant corporate money hose to nowhere

Instead of investing profits back into businesses, huge amounts of money are being funneled to shareholders

At first glance, Friday's jobs report looks like a solid win: 271,000 new jobs created in October, 12,000 more jobs over August and September than we originally thought, and a 5 percent unemployment rate. But when you start to look more closely, it's not a pretty picture.

We're still a very long way from closing the hole in the jobs supply left by the Great Recession; labor force participation remains way too low; and the uptick in wage growth — the surest sign of a recovering labor market — was so small it could easily be a statistical blip.

There's still a very real rot in the American economy.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The collapse of aggregate demand explains a lot of this. But another story here is investment in new capital and productive capacity. If demand sets the floor for how much economic output can grow, investment sets the ceiling against which that floor can push. Beyond that, investment itself also creates demand: If you build a new tractor, a new office building, or a new batch of computers, workers have to be paid to do the building.

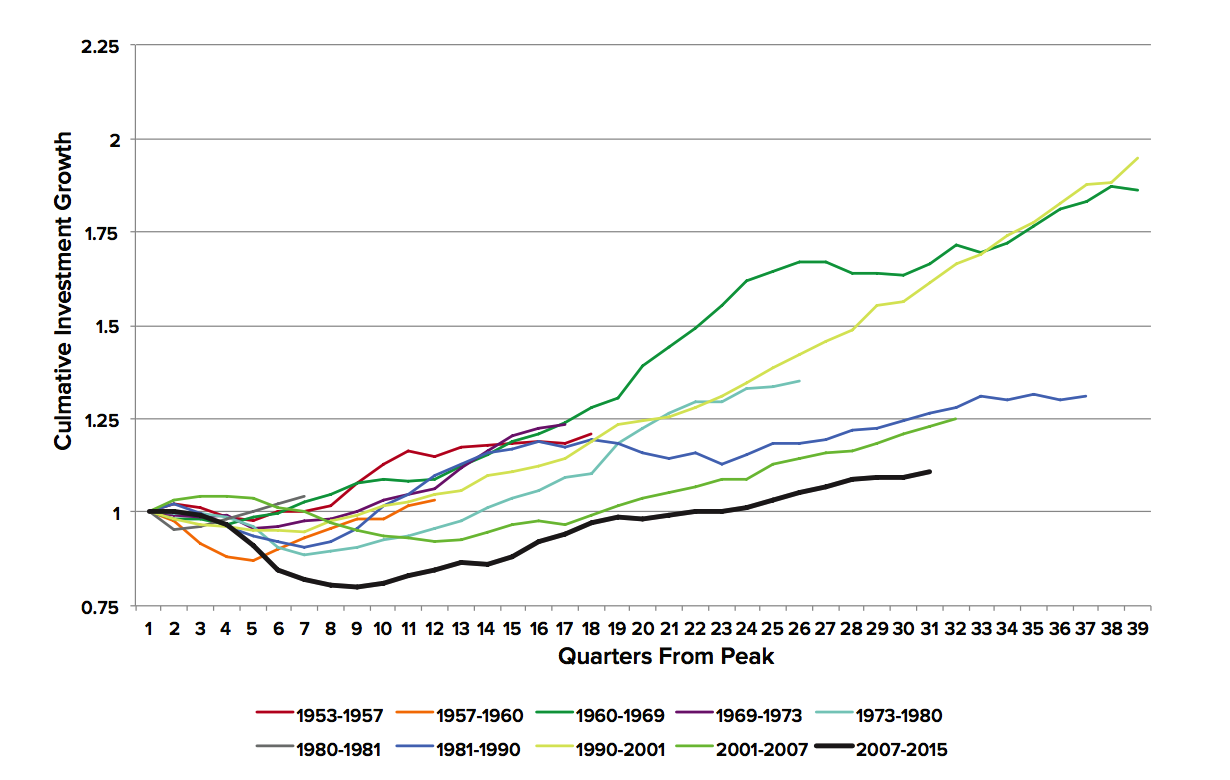

So how much revenue American companies plow back into new investments is a key part of the recovery. And a study the Roosevelt Institute released on Friday says investment is shockingly low — well below where it's been at an equivalent point in any other recovery since World War II.

Now, according to official government statistics, investment as a share of gross domestic product (GDP), while below its peak of the early 1980s, is doing fine. But John Jay College economics professor J.W. Mason, the Roosevelt study's author, pointed out that this is a deceptive metric. If the current recovery is unnaturally weak, then GDP as a whole will be unnaturally low, and a lower absolute level of investment could nonetheless read as a normal share of GDP. A better approach is to just compare the cumulative change in business investment during this recovery versus previous recoveries.

(Graph courtesy of Understanding Short-Termism by J.W. Mason, the Roosevelt Institute, November 6, 2015.)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"Real investment is about 8 percent above where it was at the end of the last expansion," Mason explained in an interview with The Week. "In the weakest expansion before this one — which also happens to be the last expansion — we were at 20 percent above the previous level at this point."

Making matters worse, government statistics for investment recently changed to include things like intellectual property development, which arguably don't capture the kind of increase in the economy's productive capacity we're concerned with here. That means the depth of the post-2008 collapse in business investment is even worse than the graph above suggests.

And remember, this is all occurring when "we have exceptionally high corporate profits, and exceptionally cheap and available credit. Under those circumstances you'd think investment would be booming," Mason said.

How did this happen?

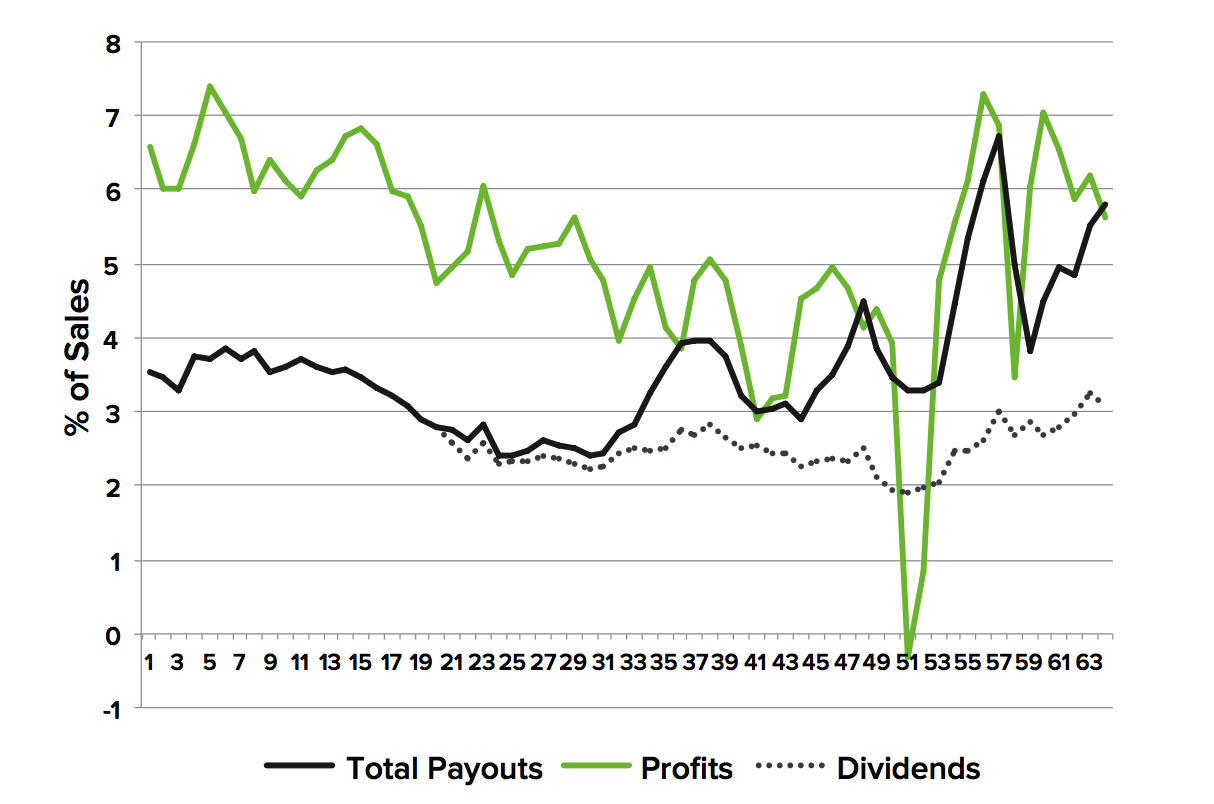

Revenue comes into a business, and then some of it goes out as income to workers, some of it goes into new investment, and some gets spit back out as payments to shareholders. Starting in the 1980s, the payouts-to-shareholders portion started to rise, and now completely swamps the other portions:

(Graph courtesy of Understanding Short-Termism by J.W. Mason, the Roosevelt Institute, November 6, 2015.)

It used to be that there was a tight statistical link between a corporation's cash flow and its investment. But Mason's work shows that relationship has completely broken down. Indeed, even corporate borrowing now appears to be financing what amounts to giant ATM payments for rich shareholders rather than real investment in the companies themselves.

So what does this mean for the economy? Imagine the financial system is a giant tank in which money churns. A lot of this churn doesn't create real economic activity on its own. When companies issue new shares into the financial tank, that represents real economic growth. But buying and selling existing shares does not. "There's more turnover of existing shares in one day on the major American markets than there are new shares issued over the entire year," Mason explained.

The rise of shareholder payouts means the pipes carrying money into the financial tank are now way bigger than the pipes carrying it back out: Shareholder payouts in 2014 alone totaled over $1.2 trillion, while money moving to new shares and venture capital was less than $200 billion. So year after year, the tank gets bigger, sucking ever more money out of the real economy, to uselessly churn in the tank rather than cycle back into real investment that creates genuinely new economic growth.

Now, some of the money also leaves the tank in the form of higher incomes for people in the financial industry, or for shareholders, which they can then use to buy more stuff or pay down debt. But, Mason said, "the numbers aren't even close to the right magnitude" to balance the flows in and out of the tank. "It's going to rich people, but it's being canceled out by other forms of income that aren't being generated." So total GDP "is lower than it otherwise would have been."

So what should we do about it? On this point, Mason and his colleagues released a companion report with a host of options. Some of it is more proactive regulation to combat stock buybacks. Some of it involves reforming corporate governance to force CEOs to take the long view on investment, and to empower other stakeholders in companies: shareholders with longer-term outlooks, like pension funds, but also workers who would like to claim more of the flow of revenue through companies as wages. Some of the agenda involves using tax reform to force money out of the hose going to shareholders, and back into real investments and wage growth. And lastly, some of it is just having government handle more investment directly rather than the private sector.

So a piece of this is a response to the short-termism in corporate thinking that worries people like Hillary Clinton. But another piece is just shrinking the flow of money to shareholders period, to ensure it goes elsewhere.

Mason thinks there's an underlying philosophic or even moral point here. What it is the purpose of the economy, and whom is it meant to serve? The answer is usually "the welfare of all people," and price signals ostensibly direct activity in a market economy to that end. But today, that relationship appears to have completely broken down.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Nasa’s new dark matter map

Nasa’s new dark matter mapUnder the Radar High-resolution images may help scientists understand the ‘gravitational scaffolding into which everything else falls and is built into galaxies’

-

Is the US about to lose its measles elimination status?

Is the US about to lose its measles elimination status?Today's Big Question Cases are skyrocketing

-

‘No one is exempt from responsibility, and especially not elite sport circuits’

‘No one is exempt from responsibility, and especially not elite sport circuits’Instant Opinion Opinion, comment and editorials of the day

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy