Ted Cruz, the Fed, and the folly of blaming the government for everything

Cruz is trying to reverse-engineer his way to the ideologically predetermined position that everything bad that happens in the economy is the result of government interference — no matter how tendentiously "interference" is defined

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

For a second there, Ted Cruz almost sounded like a lefty.

The Texas senator and GOP presidential hopeful has made no secret of his disdain for officials at the Federal Reserve, or for the entire design of modern monetary policy. Indeed, those criticisms emerge pretty naturally from the hard-right quarters of American politics.

However, something different happened this past Thursday, when Fed Chair Janet Yellen gave one of her regular reports before the Joint Economic Committee. During the questioning, Cruz rather pointedly suggested that the Fed exacerbated — or was even the primary driver behind — the Great Recession:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In the summer of 2008, responding to rising consumer prices, the Federal Reserve told markets that it was shifting to a tighter monetary policy. This, in turn, set off a scramble for cash, which caused the dollar to soar, asset prices to collapse, and CPI to fall below zero, which set the stage for the financial crisis. [Ted Cruz]

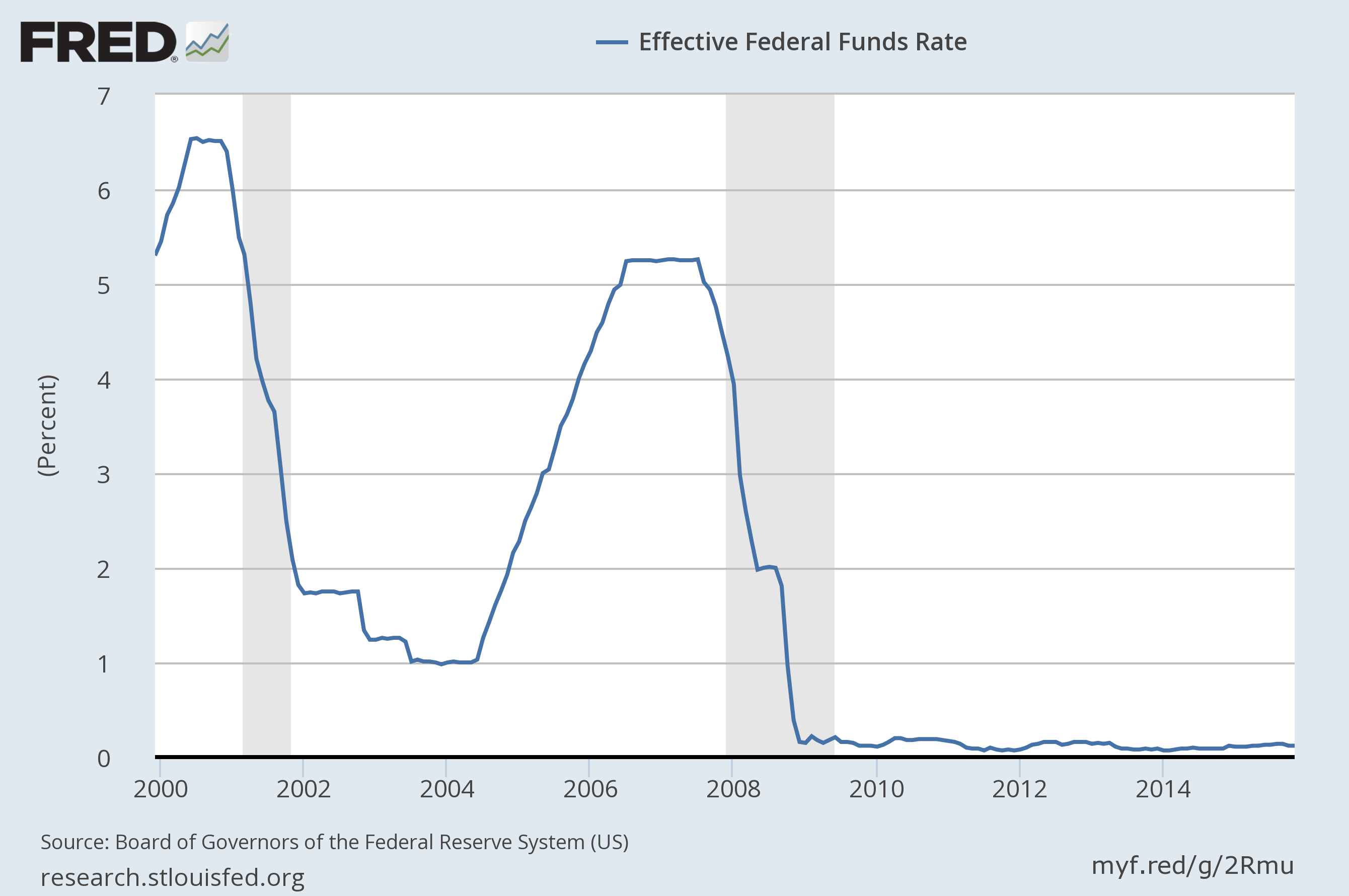

A bit of backstory: The Federal Reserve's main tool for controlling interest rates is called the federal funds rate. The Fed raised it in the 2000s in anticipation of the economy returning to normal after the 2001 recession. But signs of a coming crisis were already percolating by 2006, so in April of that year, the Fed stopped raising the federal funds rate and held it at 5.25 percent. Then in July of 2007, as things got worse, the Fed started cutting the rate.

What Cruz is talking about is a few months in the summer of 2008 when the Fed momentarily stopped cutting the federal funds rate, and let it sit at 2 percent.

The first oddity about this exchange is that Cruz is saying monetary policy wasn't loose enough in the summer of 2008. Generally speaking, Republicans and conservatives — including Cruz himself — usually think monetary policy is too loose, and is about to deliver runaway inflation. It's the left that usually argues monetary policy isn't loose enough.

What's equally interesting is that Cruz followed up his opening salvo by questioning the whole idea of allowing a group of human officials to unilaterally decide the course of monetary policy. Cruz cited the economic and financial crises we've had since roughly 1970, culminating with the Great Recession and the Fed's 2008 pause, and he quoted former Fed Chair Paul Volcker: "By now I think we can agree that the absence of an official rules-based, cooperatively managed monetary system has not been a great success."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Certainly, the officials who control Fed policy are no less vulnerable to human foibles than anyone else. They can fall to social pressure, ideological blinders, or simply balk in the face of unprecedented radical action — no matter how much the data may indicate that action is necessary. And on the merits, economist David Beckworth made a relatively compelling circumstantial case that you can see the damage the Fed's mid-summer 2008 pause did — the trend lines for employment and nominal income went into nosedives right around that time.

The Fed has a mandate to keep unemployment down, though how far down is left up to the Fed's judgment. It also has a mandate to keep prices stable, which the Fed has interpreted to mean 2 percent inflation annually. Frankly, it's done a much better job sticking to the "control inflation" part than the "keep unemployment down" part.

Moving to a regime with much stricter rules that leave Fed officials less room to use their subjective judgment — which is obviously what Cruz is gesturing towards — is an interesting idea. Something like nominal gross domestic product level (NGDPL) targeting could legally require the Fed to expend all efforts to keep the economy on a certain trend growth line in nominal terms. And that could conceivably require the Fed to tolerate much higher levels of inflation than it usually does, and to stimulate job growth much more aggressively.

But there are a lot of complications that are glossed over by simply calling for a more "rules-based" monetary policy. Sitting behind the federal funds rate is a whole host of tools the Fed uses, and there's no clear metric for telling it when to use what and when. Nor does a rules-based regime tell you, in itself, how much to prioritize low inflation over more jobs. And there's no guarantee the Fed can actually hit the targets a rules-based regime would give it.

For instance, as good a case as Beckworth makes that the Fed's timing stunk, it's hard to believe that was the core of the problem. Because shortly after the Fed began cutting rates again in 2008, it ran smack into the zero lower bound. You can see that in the graph above, too. Trying to cut interest rates below zero is largely uncharted territory, so the Fed just didn't, which meant it kept interest rates too tight by default for the next seven years. Quantitative easing was an effort to get around this problem, but it is largely experimental. Beckworth himself has argued the Fed didn't stomp on the quantitative easing gas pedal anywhere near hard enough. And something like an NGDPL targeting regime could have forced them to, depending on the design.

But this gets us back to Cruz's weird role here, because the senator has explicitly condemned quantitative easing as some crazy and irresponsible experiment. Beyond that, Cruz has made it clear that the kind of "rules-based" monetary policy he'd like is a return to the gold standard. But the structure of the gold standard is overwhelmingly biased towards keeping monetary policy too tight, rather than too loose. Had we been on a gold standard in 2008, the Fed's performance would have been infinitely worse.

Maybe Cruz doesn't realize that. Or maybe he's just a demagogue and doesn't care. But there's probably something else going on, too. The Great Recession started with Wall Street greed and the government's failure to properly regulate it. But as Paul Krugman noted, the Fed's failure to respond aggressively enough to the ensuing economic collapse often morphs, in right-wing narrative-making, into "the Fed caused the Great Recession." The effect is to remove behavior in the market, no matter how screwy or irresponsible or corrupt, from the bucket of things that can be defined as problems: At their most extreme, fans of a rules-based Fed hope that perfecting monetary policy will finally make laissez faire economics work the way it's supposed to.

In other words, Cruz is trying to reverse-engineer his way to the ideologically predetermined position that everything bad that happens in the economy is the result of government interference — no matter how tendentiously "interference" is defined.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.