How Ronald Reagan zapped a recession with massive government spending

Study finds that Reagan's recovery was faster than Obama's because of — gasp! — more government spending

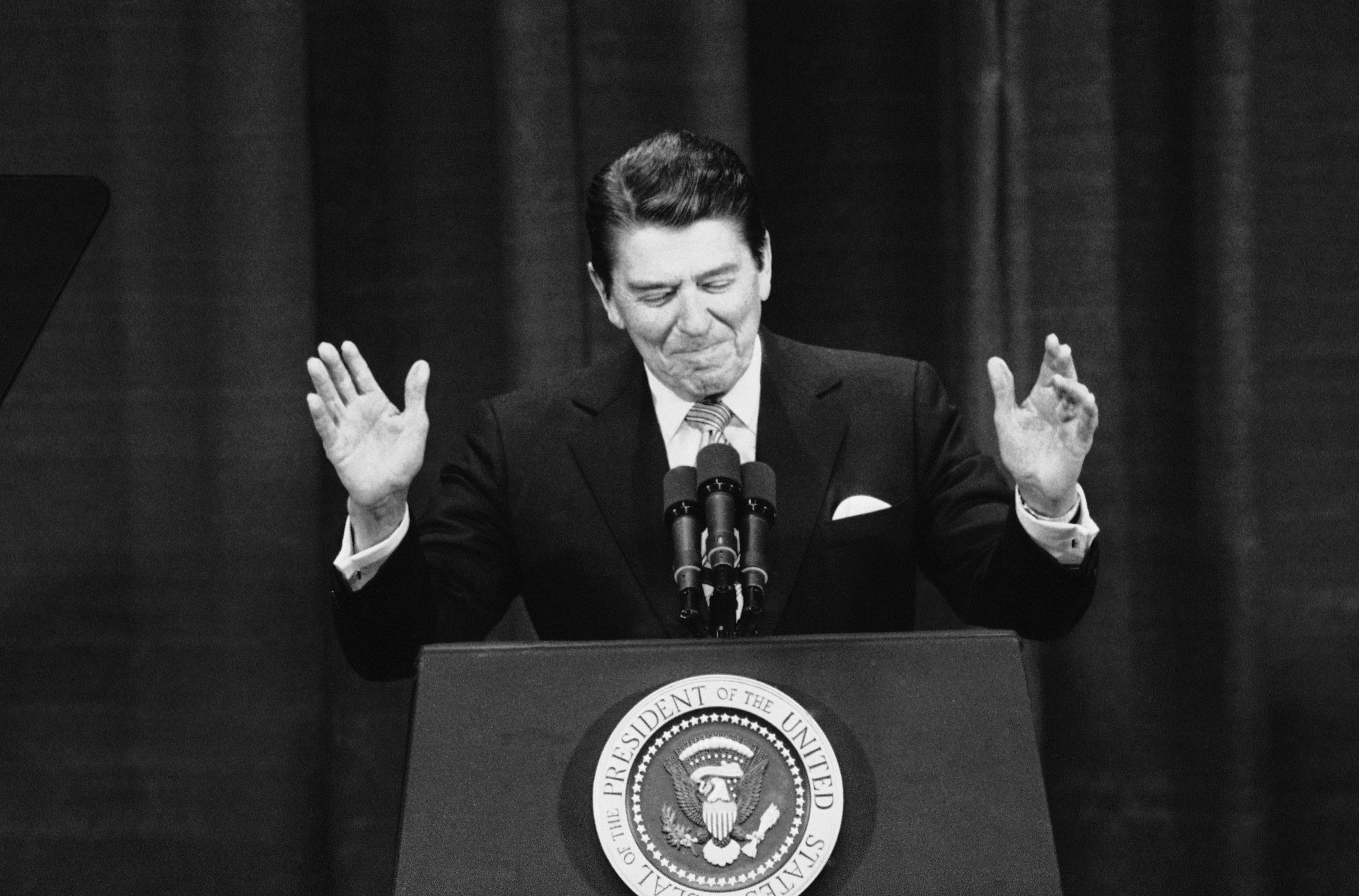

No one is more associated with the conservative cause of small government than Ronald Reagan.

He entered office in 1981 insisting that government deficits were too high, that taxes had to be cut, that spending had to shrink. His inaugural address declared "government is not the solution to our problem; government is the problem." His 1988 farewell address reiterated that "man is not free unless government is limited." Name-checking Reagan and these commitments has pretty much been an entry requirement for politicians into the GOP ever since.

But as people have noted over the years, there's a tension between Reagan's rhetoric and what actually went down between his inaugural and farewell speeches. Both the national debt and the size of the federally employed workforce rose during Reagan's tenure. Government spending grew as a share of the economy, then returned to exactly where it was when Reagan started.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But what's most interesting about this contradiction is that, in all likelihood, Reagan's failure to deliver on his own small government rhetoric is a big part of why the famed Reagan economic boom happened.

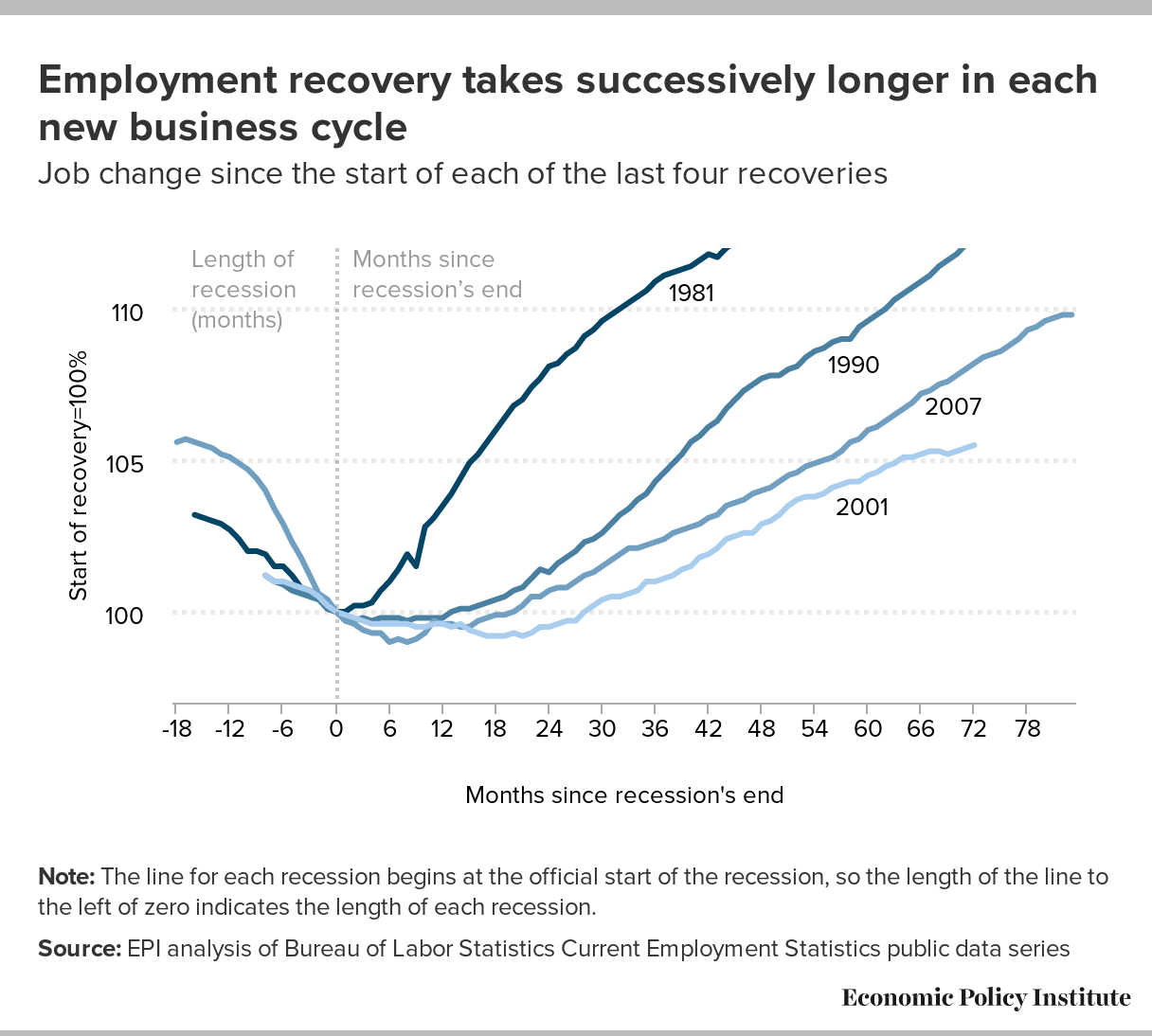

The Economic Policy Institute just released a paper, authored by their research and policy director Josh Bivens, looking back at the country's last four recessions. People have poked through this data before, but the numbers are nonetheless eye-popping. From the lowest depths of the 1981 recession, it took just 30 months for the job supply to grow by 10 percent. After the 1990 recession, it took twice as long. The 2001 recession was so sluggish it never reaches the 10 percent mark within Bivens' time window. The recovery from the Great Recession only barely hit the mark after 80 months.

The 1981 recession and recovery exhibits the classic pattern that economists grew accustomed to after the mid-century: A sharp downturn followed by an equally steep rise. But ever since 1981, the rises have become more and more gradual, with both the post-2001 and post-2007 recoveries growing at an abysmally slow rate.

But the Great Recession was also different from the 2001 collapse: It was much deeper. Biven's calculations put the output gap — the difference between where the economy is in the worst of the recession and where it would otherwise be — at 7.1 percent for the 2008 crisis. It was just 2.6 percent in 1991 and 1.8 percent in 2001.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This is where the comparison between the Great Recession and Reagan's 1981 recession really stands out: Reagan's recession was even deeper, with an output gap of 7.6 percent. But the reason Reagan isn't remembered for presiding over a grinding seven-year Great Recession like President Obama is the comparative speed of the recovery Reagan enjoyed.

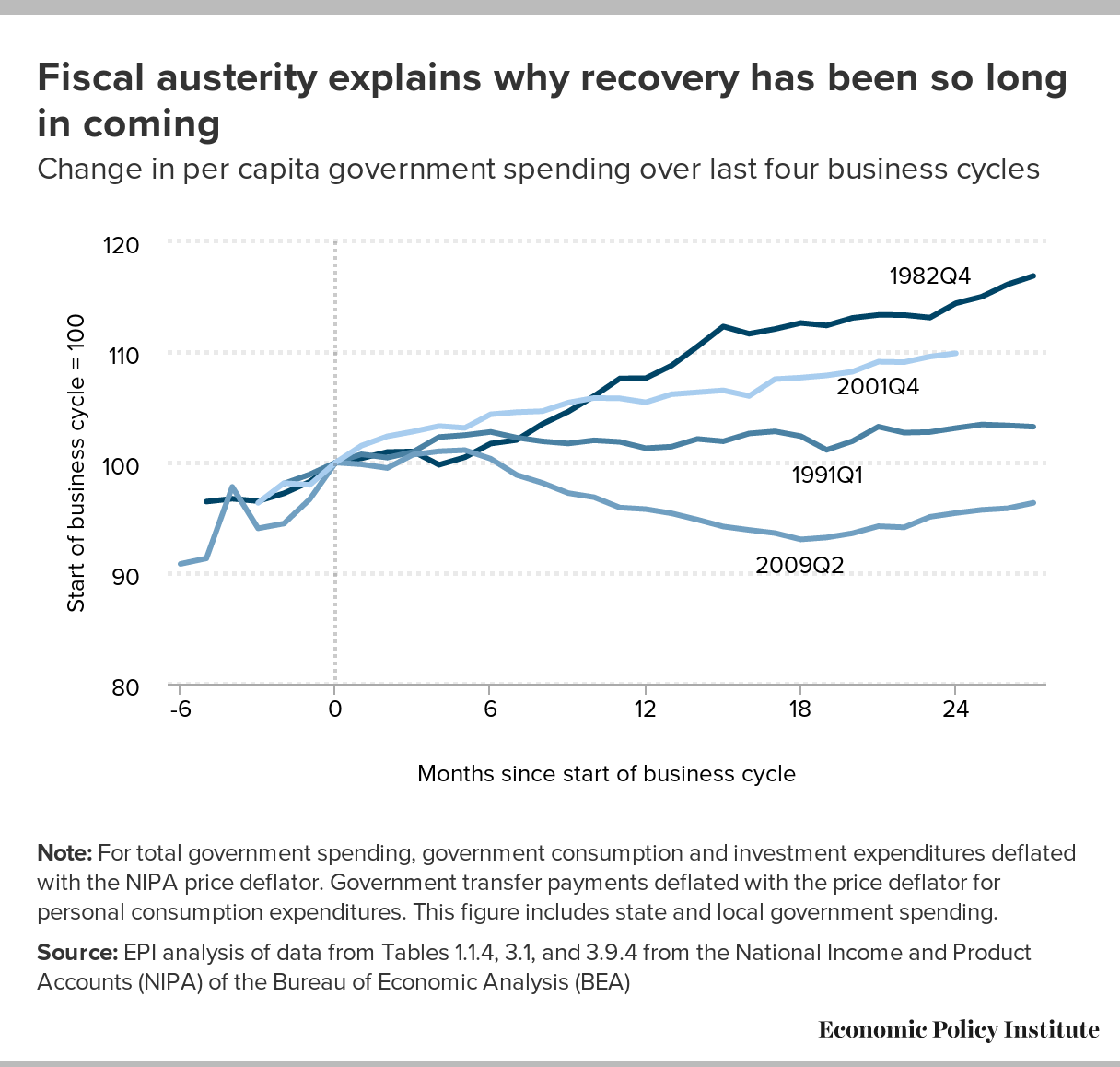

According to Bivens, the reason for that difference boils down to two words: government spending.

Over the 24 months that followed the start of Reagan's recovery, government spending per person — combining federal, state, and local levels — grew almost 15 percent. But 18 months after the Great Recession, per person government spending had declined 7 percent. Twenty-four months in, it was still 3.6 percent lower than at the start of the recovery.

Had government spending during Obama's tenure behaved the same way it did during Reagan's, government spending would currently be roughly one trillion dollars higher than it is. With that amount of extra money, "you're way beyond what I think anybody says the remaining output gap is in the economy," Bivens told The Week. By his calculations, the output gap would probably have closed completely sometime in 2013.

So does this mean we would've done better with a Ronald Reagan 2.0 in the White House rather than Barack Obama?

Doubtful. The president does not wield unilateral power over taxation and spending. And Reagan faced a Democrat-controlled House his entire tenure. The Senate was controlled by Republicans for most of Reagan's time in office, but the GOP was a different party back then. So Congress often fought Reagan hard when his budget proposals called for spending cuts. Sometimes Republicans even partnered with Democrats to overrule Reagan's vetoes of spending measures with Congressional supermajorities.

On top of it all, Reagan himself was hesitant to cut the biggest welfare state programs like Social Security and Medicare, and focused more on cutting targeted programs for the poor and vulnerable. And those cuts were swamped by Reagan's massive Cold-War-era buildup in military spending. "If I was in charge of the world, that is not how I would choose to increase spending to boost recovery," Bivens said. "But it does boost recovery."

The result of that collision of forces was the Reagan-era increase in spending. Ironically, it was not until Republicans retook the House and Senate under Bill Clinton, a Democratic president, that per capita government spending stopped growing. Funnily enough, it grew again under George W. Bush, but at a more modest rate than under Reagan. Then it went into reverse when the Democrats retook the White House with Obama, and the GOP consolidated its hold on Congress.

And if you look at the two graphs above, the gradual slowdown in government spending in each successive era tracks the slowdown in the speed of each respective recovery.

More than anything, Reagan planted the seed of the idea of small government as an ideological goal, but it never bore fruit on his watch. Since then, both parties have become more partisan and ideologically rigid. But the Congressional Republicans that Clinton and Obama had to contend with really went off into the right-wing stratosphere. And over the same period, the Federal Reserve's power to boost recoveries by changing interest rates slowly vanished, leaving government spending as the only remaining option.

So Reagan may have presided over an enviable recovery with an enviable increase in government spending. But he arguably also helped usher in the grand ideological reorientation in American politics that gave us the new era of stagnant spending.

"On the fiscal front we've largely messed up this recovery," Bivens concluded. "I hope we've absorbed that lesson for the next time."

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

What you need to know about last-minute travel

What you need to know about last-minute travelThe Week Recommends You can book an awesome trip with a moment’s notice

-

Saudi Arabia could become an AI focal point

Saudi Arabia could become an AI focal pointUnder the Radar A state-backed AI project hopes to rival China and the United States

-

Crossword: October 29, 2025

Crossword: October 29, 2025The Week's daily crossword

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: who are US billionaires backing?

Democrats vs. Republicans: who are US billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'