Why cutting the corporate tax rate won't help American workers

It's easy enough to imagine a world in which this would help. But we don't live in that world.

A massive tax cut for wealthy corporations probably sounds like the polar opposite of pro-worker populism. But President Trump is hoping he can convince Americans that the two things go together just fine. And he isn't wrong — not exactly.

The White House and congressional Republicans are hoping to slash the federal tax on corporate profits from 35 percent down to 20 percent. Trump himself says he wants to go as low as 15 percent. He argues companies will take those savings and plow them right back into new jobs and higher wages for regular working Americans. And it's true, there are scenarios where such a thing might happen — just not in the America we live in today.

Economists have long debated what happens when taxes on corporate profits are cut. Some say that if a company's owners are already under market pressure to expand jobs and increase pay as much as they can, then profits are already reduced to just whatever they can spare after those demands are met. In that case, if the government lets a company keep more of its profits, the extra money will actually go to workers. If this is the case, then it's workers who are actually bearing the brunt of the corporate tax burden.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Conversely, if companies don't feel that market pressure, and have freedom to expand their profit margins, it's wealthy shareholders who will get the extra money from the tax cut. In this case, it's shareholders that bear the burden of the existing corporate tax.

Not surprisingly, opinions about which of these cases is correct tend to break down along partisan lines.

Left-leaning groups like the Center on Budget and Policy Priorities estimate that shareholders shoulder the majority of the burden, and will thus get the benefits of Trump's tax cut. There's evidence of this from ostensibly nonpartisan institutions, too. The Treasury Department estimated workers pay 19 percent of the corporate tax, and shareholders pay the rest. The Congressional Budget Office (CBO) looked at some economic modeling and concluded workers only pay 25 percent of the corporate tax burden.

On the other side, Treasury Secretary Steven Mnuchin recently told Fox News that "most economists believe that over 70 percent of corporate taxes are paid for by the workers," despite his own department's previous analysis. And the conservative Heritage Foundation argued that "when corporate taxes are cut, workers receive almost all of the benefit through higher wages."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Let's try and adjudicate between these claims.

First off, keep in mind that businesses don't create jobs and hike pay out of the goodness of their hearts: They like profit margins and will increase them at workers' expense if they can. They only put money into jobs and pay if they feel they must do so to compete and to increase sales.

But if demand throughout the economy is depressed, sales won't increase in response to investment, and companies won't feel a whole lot of competitive pressure to battle over market share. So why bother creating new jobs? Meanwhile, since companies aren't fighting over scarce labor, workers don't have any leverage to make demands on their employers. Businesses can give them a smaller cut of revenue, and will take out any extra money for shareholders instead. And you get the exact same stagnant growth in jobs, wages, and GDP that conservatives blame on corporate taxes.

Now, investment by companies across the U.S. economy really has collapsed since roughly 1980, as Heritage rightly points out. The problem is, the corporate tax rate also fell significantly over that same time period, while corporate profits reached near historic highs. If workers really have been paying the majority of the corporate tax, you'd expect company investments to increase as the tax fell. And you certainly wouldn't expect such a massive rise in profits as investment dropped. Capitalist theory says the desire for higher profits incentivizes more investment, so the two should rise together.

The data isn't consistent with a story in which corporations want to invest more, but are held back by the demands of the IRS. It is consistent, however, with a story in which aggregate demand is low, owners and shareholders have all the power, and workers have no leverage to demand pay increases.

It's not hard to imagine a world in which cutting the corporate profits tax really would be a populist move that benefited workers. But that's not the world we live in, and it's not one we've lived in for quite a while. Instead, whenever a company gets a windfall, the money goes to wealthy shareholders, CEOs, and the lucky members of the upper class.

In this world, cutting the tax on corporate profits will likely just make a bad situation worse.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

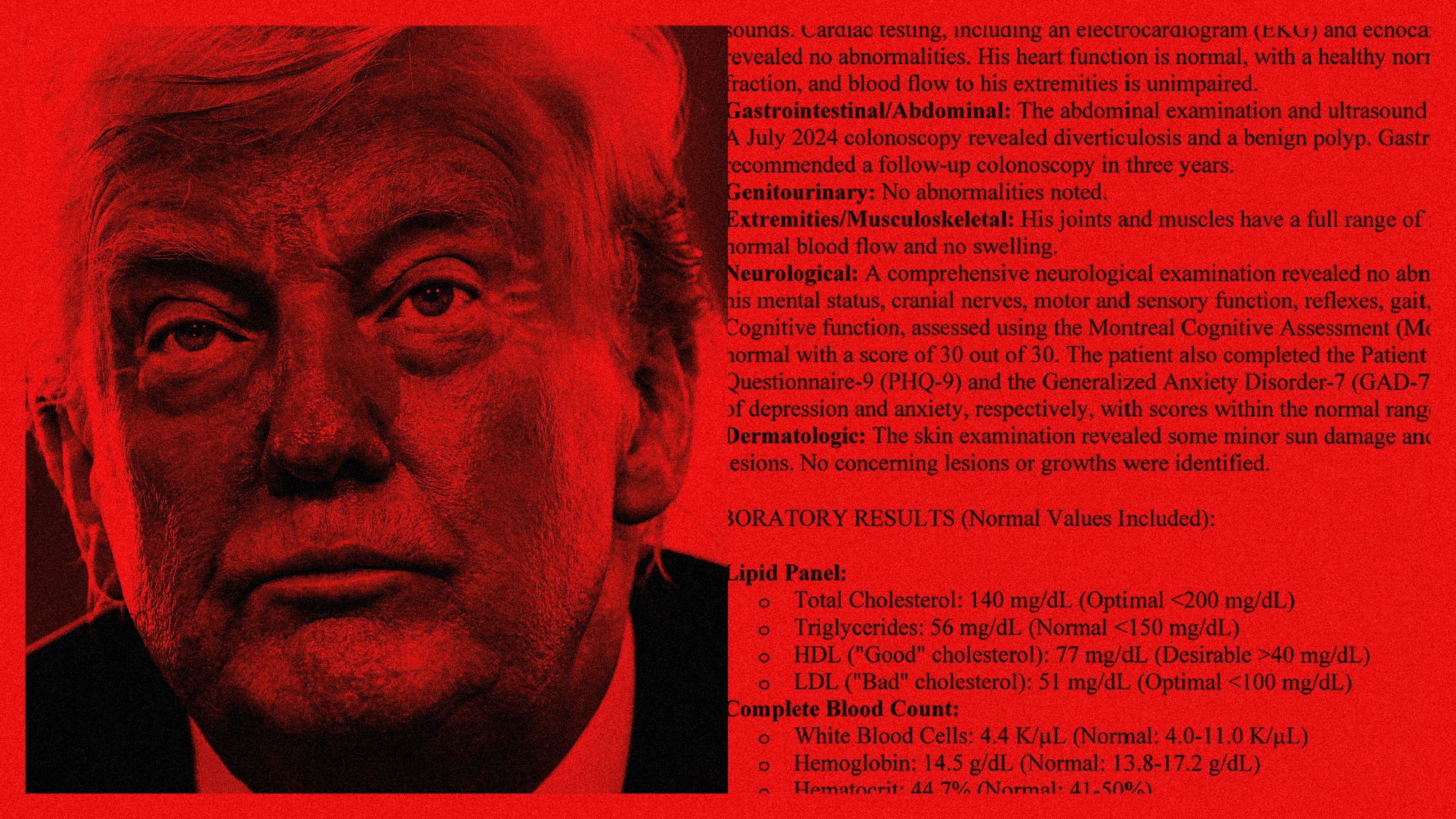

Why are Trump's health rumors about more than just presidential fitness?

Why are Trump's health rumors about more than just presidential fitness?TODAY'S BIG QUESTION Extended absences and unexplained bruises have raised concerns about both his well-being and his administration's transparency

-

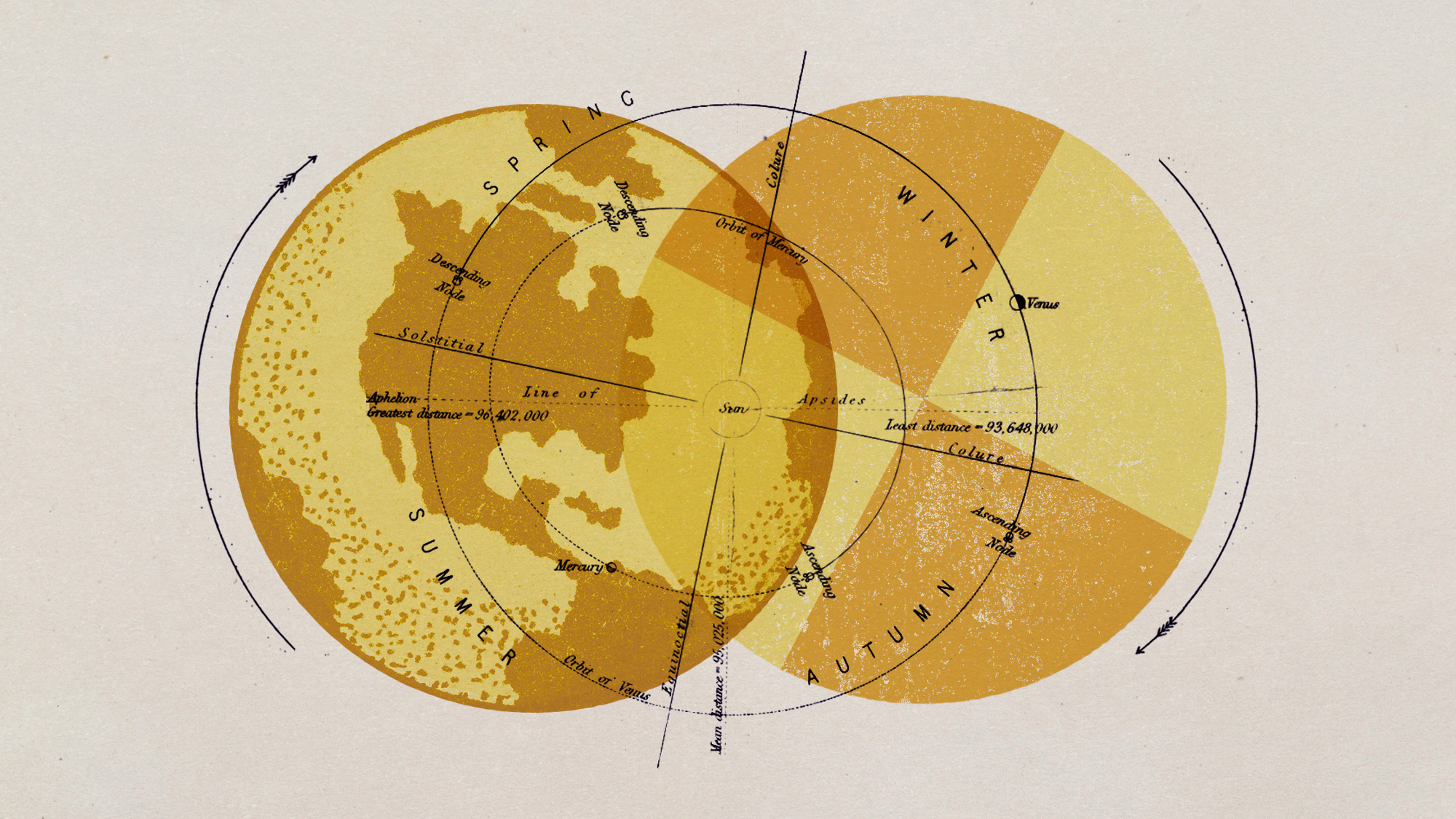

Earth's seasons have gone wackadoodle

Earth's seasons have gone wackadoodleUnder the radar It may have impacted biodiversity and evolution

-

How much does it cost to move? Here's how to budget and save.

How much does it cost to move? Here's how to budget and save.the explainer Factors like move distance and the weight of your furnishings can affect the total cost — but there are several ways to economize

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy