The Republican tax bill is a trainwreck

The Republicans totally bungled this bill. And they're going to suffer for it.

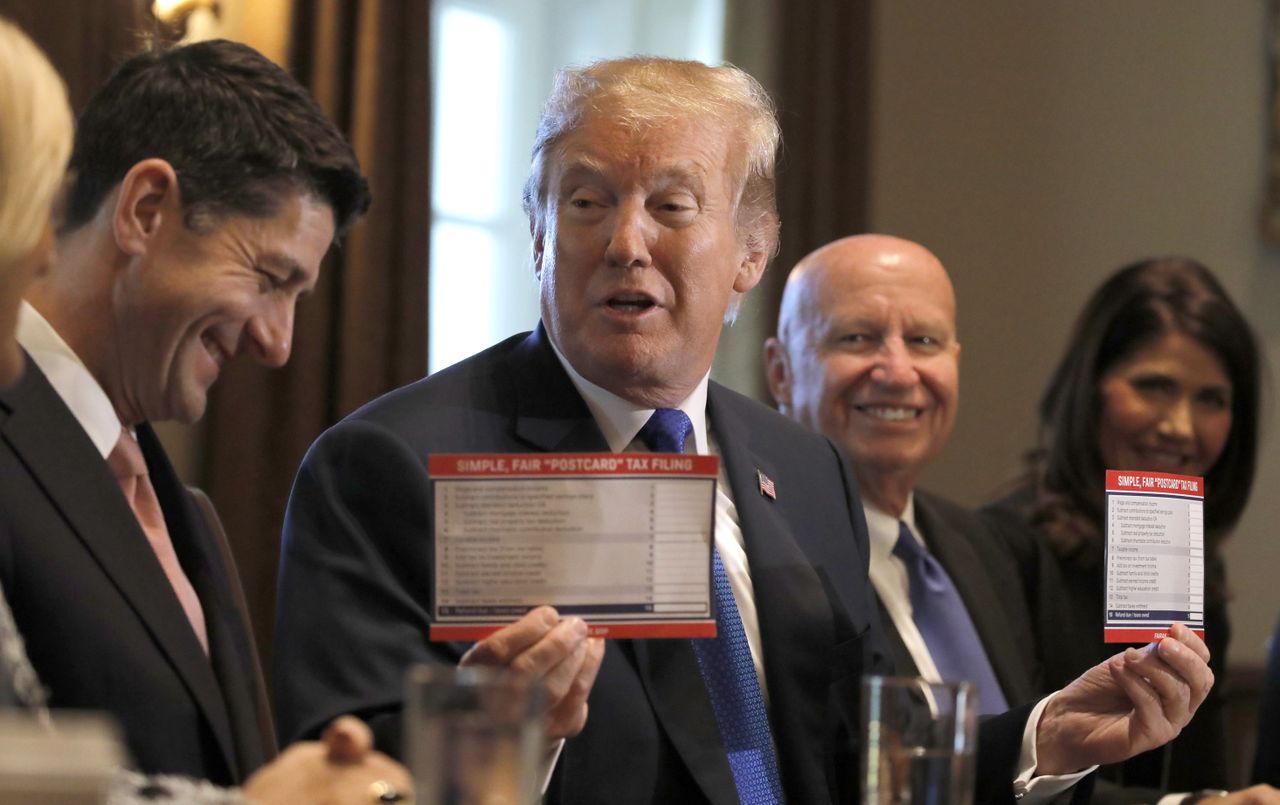

At the GOP's press conference announcing the release of their tax cut bill, one Republican member of Congress noted that it has been exactly seven years since they took back control of the House in the 2010 election, and now they're delivering on the promise they made back then.

So after seven long years, this mess is what they came up with?

Before we go further, we should acknowledge that they made a few hard choices and inserted some provisions that were destined to be unpopular, for which they deserve a bit of credit. But the deeper you go into this topic, the more you realize why it is that doing genuine tax reform usually takes a matter of years. And yet Republicans believed they could put it together in a few weeks and everything would work out.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It has been a mess up until now, a slapdash bill that validates almost every criticism Democrats make of Republicans. And it's only going to get worse.

The reason tax reform ordinarily takes so long isn't just that the government's finances are very complex, with many moving parts — though that's true. The more important reason is that if you're trying to make real changes, there are going to be winners and losers along the way. You're going to have to navigate all those competing interests and do some careful negotiation to get buy-in so all the stakeholders — interest groups, constituencies, members of Congress — don't turn on you. It's a sensitive balancing act, and one of the reasons previous tax reform efforts have been bipartisan is that when both parties are committed to the end goal, you have a lot more room to maneuver.

This version of tax reform, however, is taking place solely among Republicans, it's happening very quickly, there are lots of potentially controversial provisions in the plan they released Thursday, and they're in a position where making changes is going to be extremely hard.

That's because of the complicated procedural rules that govern this legislation. The Senate passed a budget resolution that allows Republicans to increase the deficit by $1.5 trillion over the next 10 years with this tax bill, but no more. While the bill hasn't been scored yet, Republicans say that it will be within that limit. But now imagine that one of the controversial provisions — for instance, the elimination of the deduction for state and local income and sales taxes (SALT) — generates so much outrage that they decide they need to drop it. The trouble is that eliminating that deduction is paying for a huge chunk of the tax cuts. So if they wanted to keep it as it is, they'd have to find more revenue to stay under that $1.5 trillion limit. And doing that is likely to generate even more opposition.

They're already getting heat for the choices they've made to pay for the tax cuts. The powerful associations representing realtors and home builders have come out against the bill, because they believe the state and local deduction encourages people to buy houses; they're also unhappy that the bill caps the deduction for property taxes at $10,000 and lowers the cap on how much mortgage interest you can deduct. The National Federation for Independent Business, the largest small business lobby and a reliable ally of Republicans, also came out against the bill when they realized the change to how "pass-through" income is taxed wouldn't be as generous as they hoped.

Observers have noted that elimination of the state and local taxes would hit blue states particularly hard, since on average they have higher income taxes (and some states, mostly Republican ones, have no income tax at all). This is to some degree a giant middle finger to the blue states, and no doubt makes Republicans more amenable to what is for many people a tax increase (which Republicans claim they always hate). But it creates a political problem, which is that there are still a lot of Republican members of the House from blue states like California and New York — members who were already looking at a potentially difficult re-election in 2018, when Democrats will likely be turning out in large numbers to oppose President Trump. Those members are now going to have to ask themselves whether they're willing to vote for a large tax increase on their constituents. Even if they vote no, they may still get punished at the polls by voters angry at the GOP.

That's not to mention all the pushback the bill is likely to get from people affected by changes like the elimination of the tax deductions for student loan interest and large medical expenses. The net result is that as fervently as Republicans want to pass this bill — both because they believe in tax cuts and because they're convinced that not passing it would be a political disaster — there's no guarantee that they can hold on to all their members in the face of that pressure.

I can't say whether Republicans really believe it when they say that this package of tax cuts will supercharge economic growth to such a degree that not only will it pay for itself but it will create a paradise of prosperity for all. Maybe they do. But between now and the day when those riches are showered down upon us all, this bill could wind up being a nightmare for them in all kinds of ways.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Paul Waldman is a senior writer with The American Prospect magazine and a blogger for The Washington Post. His writing has appeared in dozens of newspapers, magazines, and web sites, and he is the author or co-author of four books on media and politics.

-

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisis

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisisUnder the Radar The goal is to provide 'more housing, better regulation and greater aid,' said Spain's prime minister

By Justin Klawans, The Week US Published

-

Crossword: January 22, 2025

Crossword: January 22, 2025The Week's daily crossword

By The Week Staff Published

-

Codeword: January 22, 2025

Codeword: January 22, 2025The Week's daily codeword puzzle

By The Week Staff Published

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

By Sorcha Bradley, The Week UK Published

-

US election: who the billionaires are backing

US election: who the billionaires are backingThe Explainer More have endorsed Kamala Harris than Donald Trump, but among the 'ultra-rich' the split is more even

By Harriet Marsden, The Week UK Published

-

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

By Harriet Marsden, The Week UK Published

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

By Harriet Marsden, The Week UK Published

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?

By The Week UK Published

-

Will 'weirdly civil' VP debate move dial in US election?

Will 'weirdly civil' VP debate move dial in US election?Today's Big Question 'Diametrically opposed' candidates showed 'a lot of commonality' on some issues, but offered competing visions for America's future and democracy

By Harriet Marsden, The Week UK Published

-

1 of 6 'Trump Train' drivers liable in Biden bus blockade

1 of 6 'Trump Train' drivers liable in Biden bus blockadeSpeed Read Only one of the accused was found liable in the case concerning the deliberate slowing of a 2020 Biden campaign bus

By Peter Weber, The Week US Published

-

How could J.D. Vance impact the special relationship?

How could J.D. Vance impact the special relationship?Today's Big Question Trump's hawkish pick for VP said UK is the first 'truly Islamist country' with a nuclear weapon

By Harriet Marsden, The Week UK Published