The Republican tax bill is in serious trouble

The math just looks impossible to add up

Is the Republican tax bill going down?

While House Republicans passed their version of the bill on Thursday, both the House and the Senate must ultimately pass the same thing before it can become law. And in the latter chamber, several Republicans have already put the bill in serious trouble.

In a surprise announcement Wednesday, Sen. Ron Johnson (R-Wis.) came out against the bill because it gives a better deal to big corporations than small businesses. The latter "are the engines of innovation and job creation throughout our economy, and they should not be left behind,” Johnson said. "Unfortunately, neither the House nor Senate bill provide fair treatment, so I do not support either in their current versions."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Meanwhile, the Senate bill might have also lost the support of Sen. Susan Collins (R-Maine) over a provision that would kill the tax penalty that enforces ObamaCare's individual mandate. That could potentially result in 13 million more people without health insurance, and hike premiums by 10 percent, according to the Congressional Budget Office. "This [tax] bill is a mixture of some very good provisions and some provisions I consider to be big mistakes," Collins said.

Several other Republican senators — like Jeff Flake (Ariz.), John McCain (Ariz.), and Bob Corker (Tenn.) — also sound like they're waffling. But Johnson and Collins stand out for the specificity of their objections, which shed light on how the very design of the bill inevitably led to this impasse.

The centerpieces of the GOP tax plan are a few big tax cuts: the cut to the profits tax paid by C-corporations, cuts to individual tax rates, repealing the alternative minimum tax, and attempts to cut the taxes paid by small businesses and other "pass-through" companies. These all overwhelmingly benefit the wealthy. And while the House and Senate might take different approaches, the goals remain the same.

The problem is that Republicans decided to pass this legislation without any help from Democrats. So the Senate GOP is using reconciliation, a procedural tool that lets them avoid the 60-vote threshold of the filibuster. But bills passed by reconciliation can't add to the deficit after a decade and have to remain within a certain threshold before then. And in an earlier debate over future budget blueprints, the Senate GOP pegged that golden number at $1.5 trillion.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So the party needs to raise revenue to offset the massive cuts it wants to make. That means a tax hike on someone, which means clear winners and losers. But those losers are someone's constituents. And the Republican Senate can only afford to lose two votes, putting it in a very, very precarious position.

The math is simply hard to make work.

Winning back Johnson, for example, would require further cuts to the taxes paid by small businesses and possibly making those cuts permanent. But that would endanger both the bill's short-term and long-term budget constraints. Meanwhile, if they reinstate ObamaCare's individual mandate to pacify Collins, the GOP loses about $300 billion over 10 years — and pisses off some hardcore right-wing senators in the process.

That brings us to other Republican senators, like Flake and Corker. Both sound like they're uncomfortable with adding $1.5 trillion to the national debt. "I'm still working with folks to see if there's some way to be assured as it relates to the deficit issue that we're not going to create harm," Corker said. "There's other senators who themselves want to ensure that we're doing something to strengthen our country relative to the deficits."

"I'm not a yes, I'm not a no," he added.

Republicans' devotion to fiscal balance has proved to be paper-thin in the past, so Corker and Flake might just cave. But if they don't, and insist that $1.5 trillion in the first decade is too much, then their party will have to find even more revenue raisers to sweeten the deal.

Then there's Sen. John McCain (R-Ariz.), who like Collins was one of the three Republicans to vote down the ObamaCare repeal effort. He's been pretty noncommittal on the tax bill, and the move to kill the individual mandate may not sit well with him either.

Finally, there's an even larger problem looming behind all this. To comply with reconciliation, most of the Senate bill's changes expire after 10 years. The few things that survive include the cut to the corporate profits tax, and an adjustment to how the government calculates inflation. That second part may sound wonky, but the practical result is that Americans up and down the income ladder will be pushed into higher tax brackets faster.

The result? After 2027, the Senate bill would raise taxes on basically all households making less than $75,000, relative to current law. Meanwhile, half of all the benefits of the tax bill would be going to households making $1 million or more by that time.

To say that's not a good look is a massive understatement.

Basically, the Republican Party appears hellbent on delivering a massive tax cut payday for its big-money donors. The ugly politics and budget math of that means they have to perform the most treacherous of high wire acts.

And the GOP's balance is looking pretty shaky.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

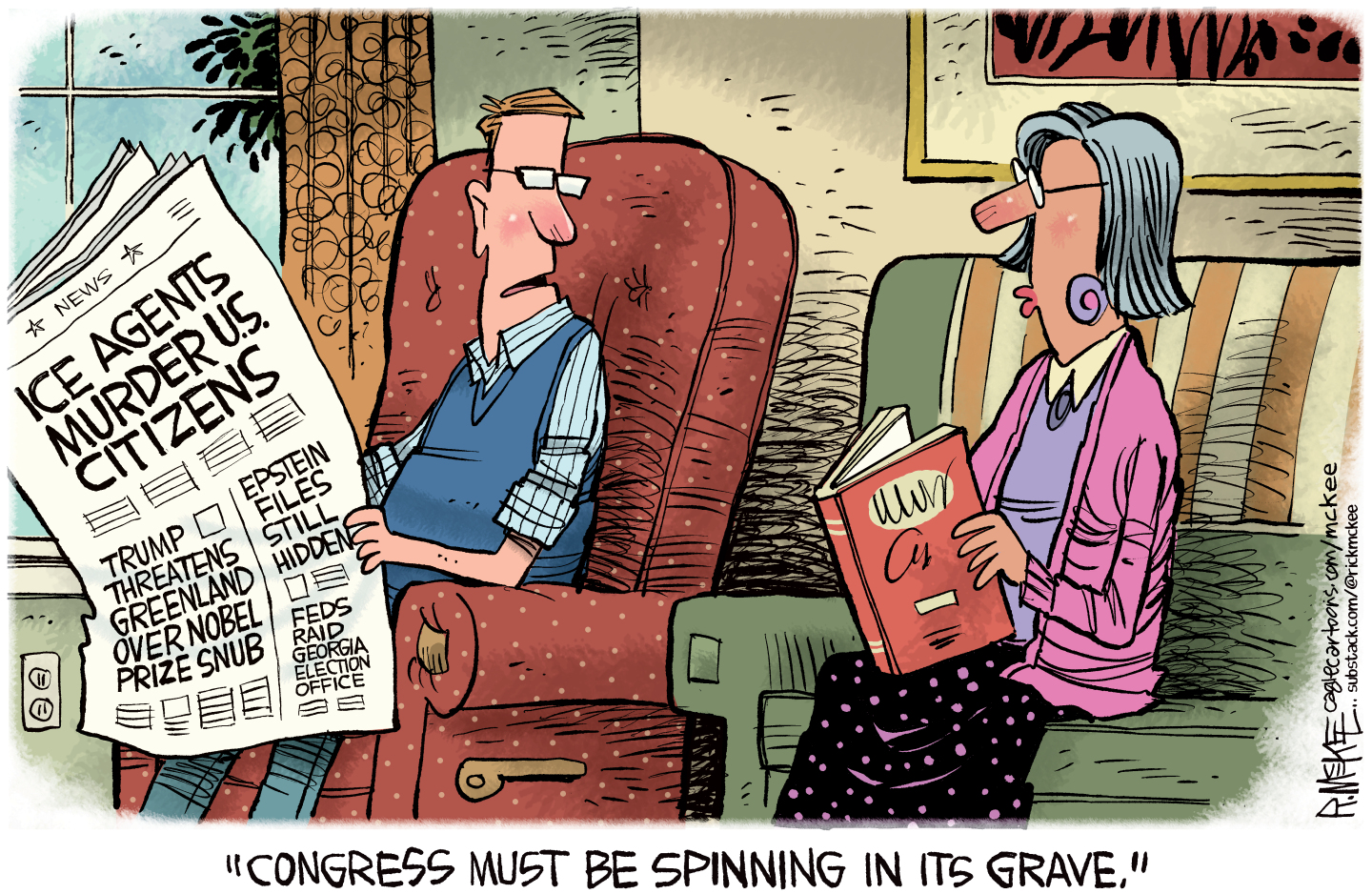

31 political cartoons for January 2026

31 political cartoons for January 2026Cartoons Editorial cartoonists take on Donald Trump, ICE, the World Economic Forum in Davos, Greenland and more

-

Political cartoons for January 31

Political cartoons for January 31Cartoons Saturday's political cartoons include congressional spin, Obamacare subsidies, and more

-

Syria’s Kurds: abandoned by their US ally

Syria’s Kurds: abandoned by their US allyTalking Point Ahmed al-Sharaa’s lightning offensive against Syrian Kurdistan belies his promise to respect the country’s ethnic minorities

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred