How the Republican tax bill takes from the rich to give to the extremely rich

The top 20 percent of Americans might hate the Republican tax cut bill. The top 0.01 percent will love it.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The House Republicans' tax reform plan has arrived. And as it turns out, the people it aims to please aren't the infamous 1 percent, the upper class, or even millionaires.

Instead, they're multi-multi-millionaires and billionaires — the top 0.1 percent or even the top 0.01 percent.

This rarified group has poured gobs of money into Republican campaigns in recent years. And they expect a return on their investment.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

First up is a cut in the federal tax rate that corporations pay on their profits — from 35 percent to 20 percent. Republicans have dutifully argued this cut will help ordinary workers by encouraging companies to expand and create jobs, but this is nonsense. The tax savings would largely go to dividends and other payouts to stock owners. And since wealth ownership in this country is even more unequal than income, the benefits of this cut overwhelmingly go to the richest of the rich.

Second is the elimination of the estate tax. This cut is transparently meant only for the richest of the rich. As it is, the tax doesn't even kick in until an inheritance is worth at least $5.49 million ($10.98 million for a married couple), and then the 40 percent rate only applies to the money above that threshold. So no one needs this tax to go away except the top tiny fraction of the 1 percent. The GOP would soften the blow to revenue by delaying its complete elimination for six years, and just increasing the threshold in the meantime. But the end result is the same.

Third is a change in the federal tax for what's called "pass through" businesses. Instead of sending profits to shareholders, these companies pass their profits through as income to their owners, so the money currently gets hit by the regular individual income tax instead of the corporate profits tax. Now, the House GOP intends to leave the top 39.6 percent individual income tax rate in place for people making $1 million and above. So the Republicans want to at least minimize the imbalance between that and the new 20 percent corporate tax rate by cutting the pass-through rate to 25 percent.

This is where it gets a little wonky.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There's actually a huge amount of inequality among pass-through businesses, so only a tiny fraction pay the top income tax rate as it is. (And even fewer will pay it under the GOP's changes to the individual income brackets and rates.) So the whole idea that this is a tax break for small businesses is nonsense.

But on top of that, defining who counts as a "pass through" business is tricky, and it's entirely possible that rich individual filers could rejigger their tax paperwork to claim to be a pass through business. To avoid that, the GOP has inserted some pretty complex rules, which rather hilariously undercut the claim that they're "simplifying" the tax code. But those rules will also likely guarantee that people who actually work full time in the small business they own will still pay the normal income tax rates — only passive investors, who are disproportionately wealthy, will see the full benefits of the lower 25 percent rate. (Along with, say, real estate moguls like a certain sitting U.S. president.)

Now, the House GOP throws up a lot of smoke and mirrors: It leaves the 39.6 percent individual income tax rate in place for millionaires — though that doesn't actually do anything. And it messes around with a lot of deductions and a few credits and such.

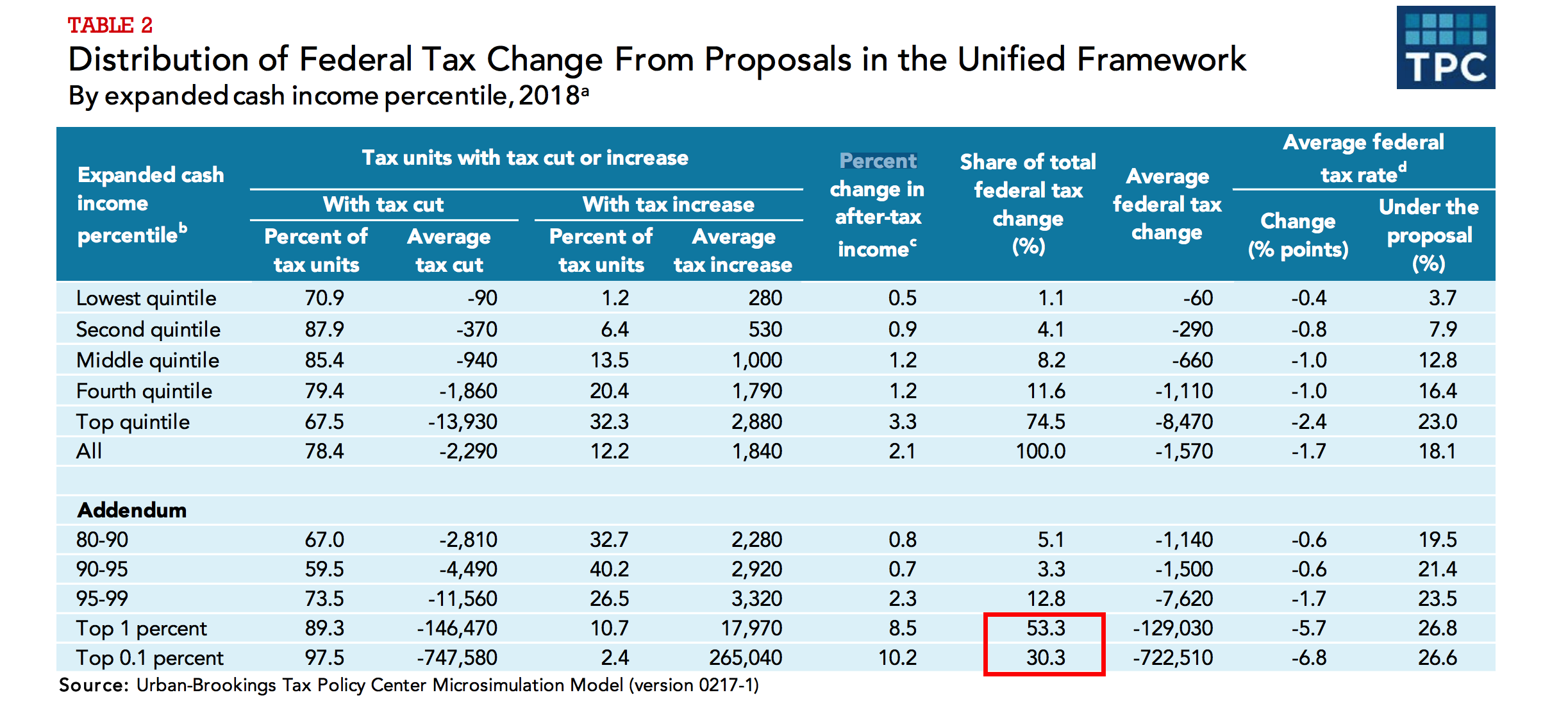

But the effect of those three provisions just overwhelms everything else. The Tax Policy Center (TPC) released a preliminary assessment of the Republicans' tax plan a few days ago. It's not exact; the earlier GOP plan contained these big ticket items, but was short on details.

So TPC had to make some guesses. But its analysis gives you the general contours.

It's not just that the top 1 percent get half of the money freed up by this tax plan in 2018. It's the the top 10th of the 1 percent gets almost a third! And those portions expand by 2027.

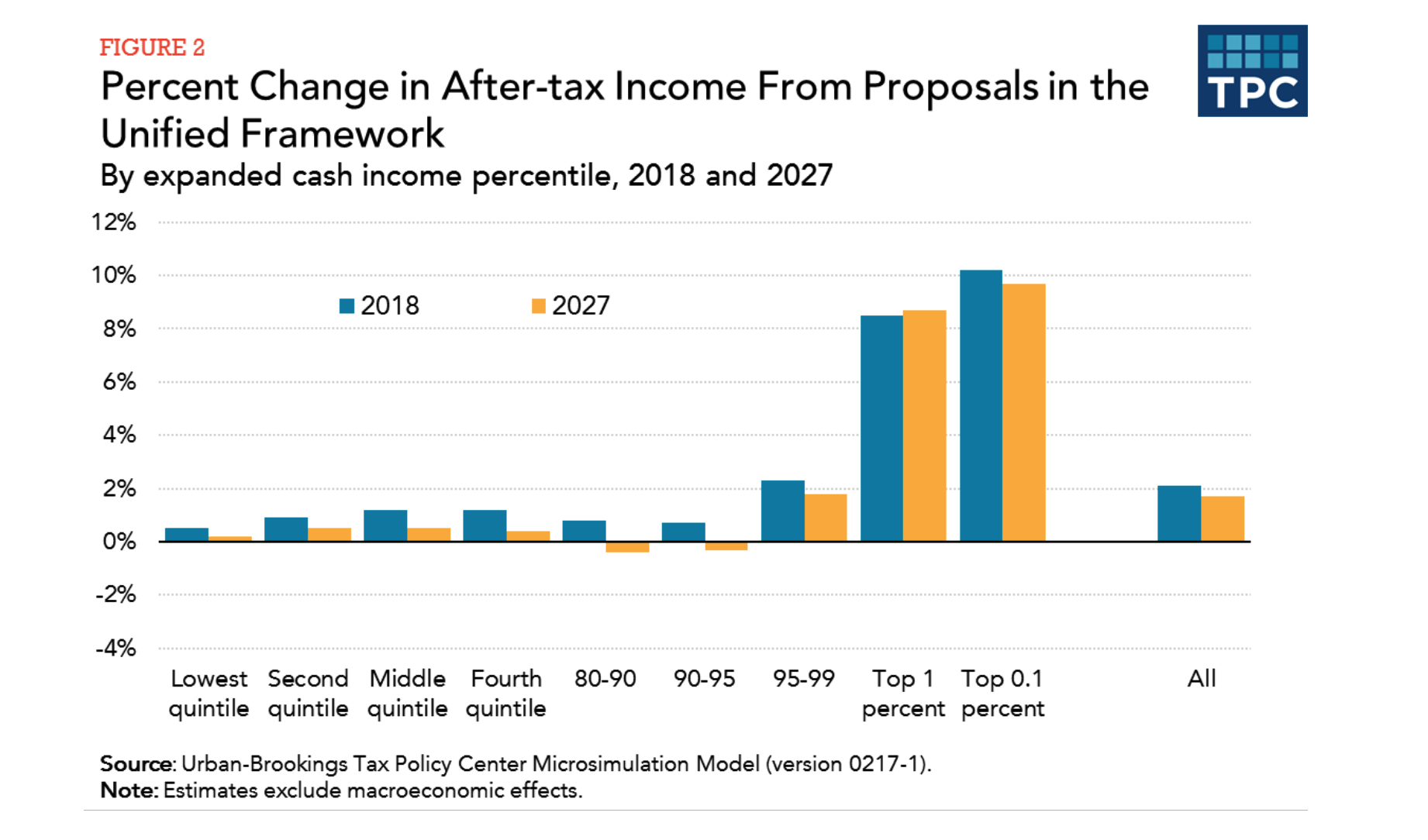

Another funny thing about this tax plan is who it risks pissing off: Namely, people in the top 20 percent or so. Not the uber wealthy, per se, but definitely the well-off and the upper class.

The House GOP plan actually gets rid of a lot of the deductions in the federal tax code for local and state property taxes. All that remains is the deduction for property taxes, which will be capped at $10,000. It eliminates deductions for medical expenses and for interest people have to pay on their student loans. It allows current homeowners to keep the full deduction on their mortgage interest payments, but caps the deduction for future mortgages at $500,000. Also, the plan would effectively double the standard deduction, bringing it to $12,000 for individuals and $24,000 for couples. And it monkeys around a bit with the Child Tax Credit and a few other things to make a show of helping Americans of more modest means.

The way this all hashes out is the bottom 80 percent of Americans see very modest gains from this plan, while people in between the top 80 and top 95 percent actually lose a bit of money by 2027. Meanwhile, the top 1 percent and top 0.1 percent make out like bandits.

Now, the top 20 percent is infamous for both its political clout and its jealous guardianship of its tax benefits. Politically speaking, this is not a group you want to piss off.

By going forward with full repeal of the estate tax, the Republicans also risk losing at least one of the two key moderates they need to hold in the Senate.

What this tell us is that the one group the Republicans absolutely are not willing to piss off is the big money donors they rely on to fund their campaigns. These are, once again, the richest of the rich. And this rarified group is reportedly furious over the lack of progress the GOP has made with its legislative agenda. Which is why the bill's core provisions all aim to deliver that rarified class the biggest payday possible. Everything else is window dressing.

That window dressing will give right-wing apparatchiks and Republican politicians cover to claim they're being populists: sticking it to upper-class urban professionals, and pissing off special interest groups like home builders and realtors, and so on. But don't be fooled. The Republicans have to find revenue raisers somewhere to keep the budget shortfall in their plan from growing too big, and imperiling its ability to survive the Senate's procedural hurdles.

The GOP's angry billionaire patrons must be appeased.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred