The GOP's head fake on taxes

Don't fall for it. Keep your eye on the ball.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

President Trump — a New York plutocrat if there ever was one — fancies himself a populist defender of the common working American. This self-created image, of course, is in direct contrast with the tax reform plan Trump is cooking up with congressional Republicans. This incongruity seems to be making the party nervous — and they're trying to disguise their real intentions.

A key part of the plan is a cut in the top individual income tax rate, from 39.6 percent to 35 percent. Slashing the income tax rate for the wealthiest Americans is broadly unpopular. So, as Axios reported on Sunday, Republicans are considering leaving the 39.6 percent rate in place for incomes of $1 million or more. Sounds good, right? Soak the rich!

But don't be fooled. This wouldn't be a substantive concession by the GOP to the realities of inequality and populist anger. It would be a mere fig leaf.

Article continues belowThe Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The individual income tax works like so: There are seven tax brackets, each with a cutoff point at a particular income level. The higher brackets pay a higher tax rate. The first bracket, from $0 to $9,325, pays 10 percent. The next bracket, from $9,325 to $37,950, pays 15 percent, and so on up to the seventh bracket, which pays 39.6 percent on everything above $418,400. (If you're filing jointly as a married couple, the cutoff points are higher.)

If you only made $9,000 this year, you'd pay 10 percent tax on all your income. But if you made $20,000, you'd pay 10 percent on just the first $9,325 of that. The remaining $10,675 would fall into the range of the second bracket, so you'd pay 15 percent on that. The system continues the same way for higher incomes that fall into higher and higher brackets.

Trump and the GOP want to knock the seven brackets down to three, with rates of 12 percent, 25 percent, and 35 percent. We don't know what the income thresholds would be yet, but obviously there's really no way this doesn't work out to a big tax cut for the wealthy. So the "fix" they're considering is adding a fourth bracket with the old 39.6 percent rate, that kicks in only for incomes of $1 million or more.

But this little adjustment would barely shift the overall effects of the tax plan at all. "Taxpayers with total income exceeding $1 million would receive an average tax cut of $138,000 in 2018" under the original GOP framework, the Institute on Taxation and Economic Policy explained in an analysis. "If this modification is made to the framework, the average tax cut for this group would be $128,000."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

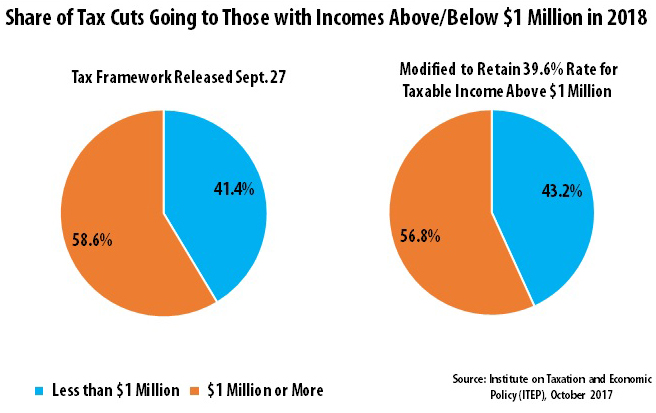

The results are even more stark when you look at the total pie of money that would be freed up by the tax cuts, and who gets what slice of that pie.

People who make over $1 million are a tiny slice of the American population — a fraction of a percentage point. But they'd get a whopping 58.6 percent of the benefits from the original three-bracket framework. If the new fourth bracket is added in, that amount drops to 56.8 percent. It hardly matters at all.

There are two reasons why the rich are going to make out so well in the GOP's plan.

The straightforward part is that the tax plan does a lot of stuff besides changing the individual income tax. It would significantly cut the federal tax on corporate profits — a change that overwhelmingly benefits the wealthy. The estate tax, which is only paid by the richest of the rich, would be eliminated entirely. And the plan would cut the federal tax rate for "pass through" businesses to 25 percent. A lot of wealthy individuals could subsequently rejigger their tax filings and claim to be small businesses, thus allowing them to pay significantly less than the 39.6 percent or even the 35 percent rate.

Here's the second, wonkier part: As I explained, if you make $1 million a year, you don't just pay the top tax rate on all of it. You pay all the tax rates on the various chunks of your income that fall into each bracket. So reducing the individual income tax from seven brackets to three or four, and lowering most of the rates for those brackets, will confer a big benefit on people making $1 million or more, even if you leave in that top 39.6 percent rate.

This illustrates an important point about tax reform strategies. The more brackets you have, the more precisely you can target different income levels with different rates. Back in the midcentury for example, the individual income tax boasted 20 or 30 brackets. So if you want to lower the tax burden on working-class Americans without letting the rich off the hook — ostensibly the populist goal the GOP is pursuing — you want more tax brackets, not less. Specifically, what the GOP would really need to do is add more tax brackets above $1 million, with tax rates significantly higher than 39.6 percent.

Republicans might protest that adding tax brackets increases the complexity of the tax code. But that complexity comes from the various deductions, loopholes, and carve-outs that go into calculating what your taxable income is in the first place. Once you've figured that out, calculating which brackets you fall into, and by how much, requires five minutes and some basic algebra, regardless of whether you've got three tax brackets or 30.

It's possible that some day the Republicans could come up with a tax cut plan that's genuinely worker-friendly. But this latest iteration isn't it.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.