If Trump really wanted to help workers, here's how he'd reform the tax code

Step 1: Raise taxes on the rich

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

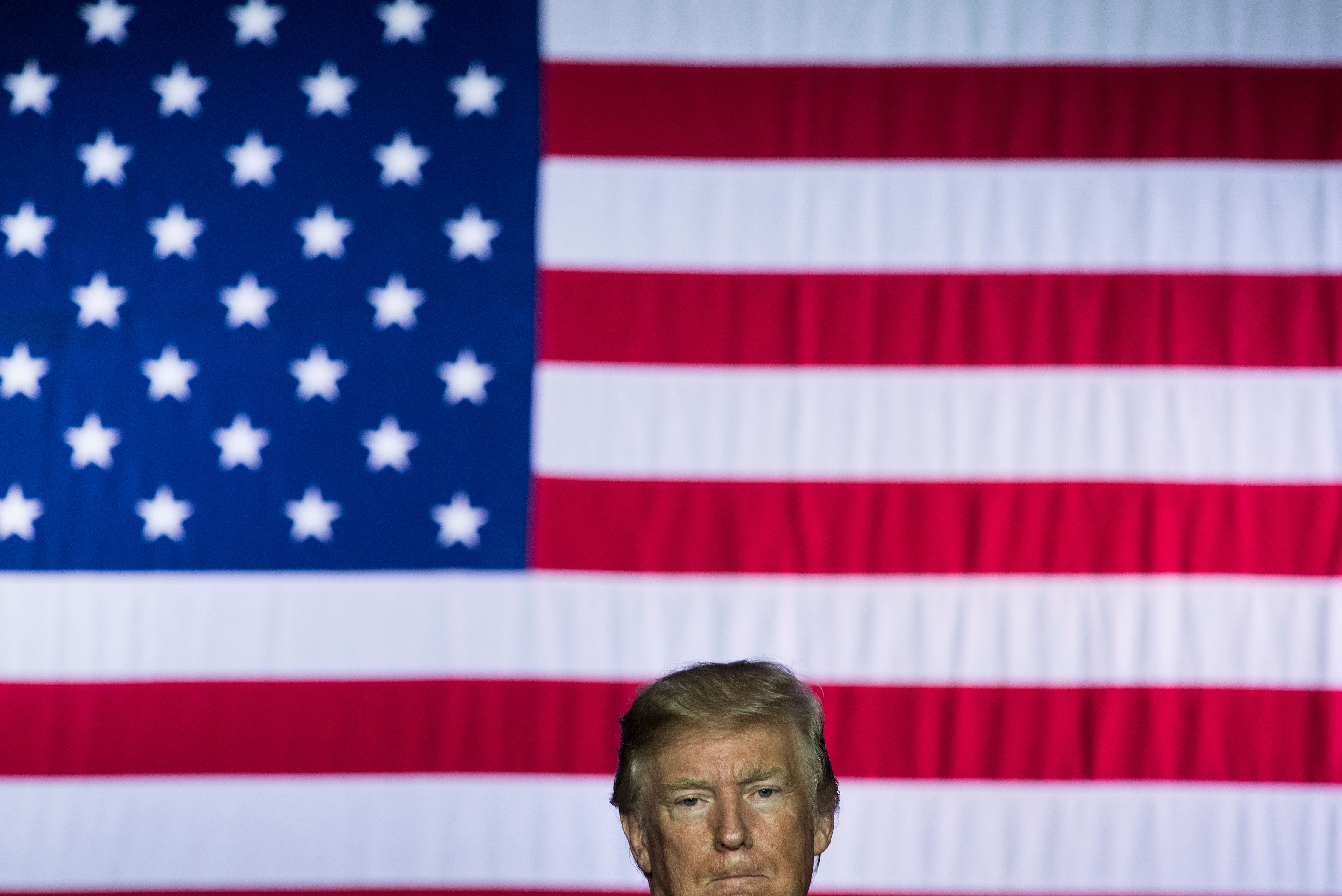

On Wednesday, President Trump and congressional Republicans released their long-awaited tax reform plan. Unsurprisingly, it was rather short on details. But the broad strokes are clear enough: fewer individual income tax brackets and a lower top rate, along with big cuts to taxes on business profits. Not exactly in line with Trump's supposed mission to create a new, more populist, more worker-friendly GOP.

But that raises a question: What would populist, pro-worker tax reform even look like? Let's sketch it out.

Individual income taxes

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

As is, we have seven brackets in the individual income tax, with rates running from 10 percent to 39.6 percent. These rates are progressive, so the top bracket only applies to the money you make over $418,400. Trump and the GOP want to reduce the tax code to three tax brackets, with rates of 12 percent, 25 percent, and 35 percent. The dollar cutoffs for the brackets remain unspecified. (They hinted they might add a fourth bracket if the effects of the plan seem too tilted in favor of the rich.)

Overall, this is the exact opposite of what populist tax reform would do. What we need are lots more brackets. Then we could target different tax rates more precisely to different levels of income — lower taxes for low-income and working-class Americans, and much higher ones for the rich. If we had 1960's income tax structure today, for example, people would pay 59 percent on the money they made immediately above $418,400— not 39.6 percent. But above that would be more than 10 more brackets, topping out at a whopping 91 percent on all income over roughly $3.3 million.

Even if you think 91 percent is too high, 39.6 percent is far too low: Since 1980, nearly all the growth in the economy has gone into higher incomes for the top five percent — and especially the top one percent.

Trump and the GOP argue that fewer brackets make the tax code simpler. That claim seems to make sense on its face, but it's actually balderdash. The complexity of the tax code isn't figuring out which tax bracket you fall into — it's created by the endless loopholes and deductions in what counts as taxable income in the first place. Once you know what your taxable income is, figuring out which brackets you fall into and your final tax liability is the least complicated part. In fact, in most advanced Western economies, the government does all the calculating for you. You just check their final work and either challenge it or sign off on it. This saves regular citizens an enormous amount of hassle come tax-filing season. That's another idea a true populist tax reform should include.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Capital gains

Now let's talk about capital gains, like dividend payments from stocks or money earned from selling financial assets. The vast majority of this money goes to the wealthy, and it's been the primary driver behind the rise in inequality in the last decade or two. While some of these capital gains are taxed as regular income under the individual income tax, others — qualifying dividends, long-term capital gains, and more — are taxed at a special low rate of 15 percent. (Though it jumps to 20 percent for high earners.)

One populist reform would be to raise that rate. But the simplest fix is arguably to just treat all capital gains as regular income, and tax them under our new more populist individual income tax structure. Why should the money earned by rich people's investments be taxed at an artificially low rate?

Corporate taxes

Remember that all the money that corporations take as profits ultimately get spit out as capital gains to individual shareholders. So you actually can make a case for cutting the corporate tax rate — as the Republicans want to do, from 35 percent to 20 percent — if you counterbalance it by increasing tax rates on capital gains.

Then there are "pass through" businesses — the vast majority of businesses in America, which "pass" their revenue on to their owners to be taxed as individual income. Trump wants to drop their top tax rate to 25 percent, on the grounds that they should pay roughly what corporations pay. But if we subject all capital gains to the individual income tax, we've effectively already equalized that treatment. So no need to change the "pass through" rate — or to even have the "pass through" category, really.

Deductions and exemptions

Trump's plan hand-waves about repealing some deductions and exemptions, but gives no specifics.

There are two big deductions in the tax code that overwhelmingly benefit the well off and drive up inequality: the mortgage interest deduction, and the deduction for employer contributions to health coverage. Scrapping them entirely would be ideal — that's the way to really level the playing field and help lower- and middle-class workers. But if that's too big a political lift, you could also convert them both into refundable tax credits — while making sure the credits also apply to people who rent rather than own and to people who buy individual health coverage themselves. Properly designed, this conversion would eliminate the unfairness in these deductions, and give lower-earning Americans way more help.

Other tax breaks do help working Americans, though. And these should be drastically expanded. Consider the earned income tax credit: It's currently rather stingy, and gives almost no help at all to single people without children. The child tax credit should also be ramped way up: It's also far too stingy, it's not sufficiently refundable, and the way it phases in actually leaves the poorest families with children out in the cold.

The big picture takeaway is this: Trump's tax plan assumes that demand in the economy is already as high as it needs to be; rather, the problem is taxes — especially taxes on rich Americans and big corporations — holding back the supply side of the economy. The evidence suggests this is backwards: The country still suffers from drastically depressed demand, and that's what's throttling the economy.

Obviously, this means low-income and working-class Americans should get the tax relief. But it's also an argument for raising taxes on the rich: People often respond to high tax rates by not sending money through the channels where it'll get hit by those rates. So high taxes force the money back down the income ladder.

To create a truly populist, pro-worker tax reform — something millions of Americans expected Trump to do — you have to begin from that basic understanding.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred