Hillary Clinton's most admirable policy, explained

Three cheers for Clinton's fix to the child tax credit!

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Give Hillary Clinton credit: Having once assumed she'd have to best her Republican opponent on "ideas," Clinton now finds herself in a street fight with a know-nothing. And yet she keeps insisting on putting out new policies.

Her latest — though overshadowed in the media by the spectacular implosion of Donald Trump's campaign — is in many ways her most admirable. Basically, Clinton wants to revise and expand what's called the child tax credit (CTC).

In crude terms, the way any tax credit works is this: When you're doing your taxes, you first figure out how much taxable income you made, and from there, how much money you owe the government. Then the credit eliminates some dollar amount from what you owe. This distinguishes tax credits from tax deductions, which lowers how much money you must claim as "taxable income."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

That's essentially what the child tax credit does now — except there are a lot of complexities in how the dollar worth of the credit gets calculated.

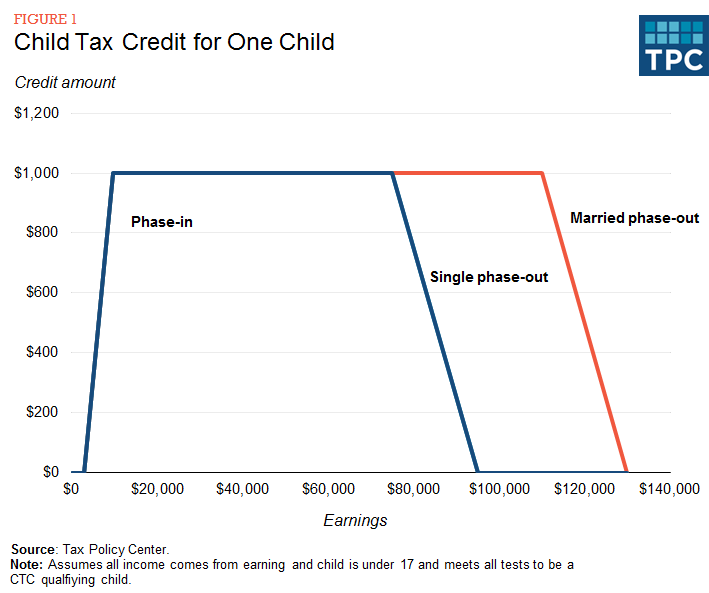

Say you want to use the credit. First off, you have to have a qualifying child under the age of 17. Next, your family has to make at least $3,000 in taxable income in a given year before you even qualify for the credit — if you make less than $3,000, you get nada. For every household that makes over $3,000 in taxable income, the value of the CTC rises at a rate of 15 percent of their taxable income, until it caps out at a ceiling of $1,000 per child. Eventually, if your family makes enough money, it phases out again at different points, depending on whether your family is single-parent or two-parent. Here's all that in chart form:

To put this practical terms: If you're a single mom with one kid and you make $2,500 in taxable income, the CTC doesn't help you at all. If you make $5,000 in taxable income, it'll knock $300 off your tax bill. (That's 15 percent of the $2,000 remaining after subtracting $3,000 from $5,000.) And if you make anywhere from roughly $10,000 to $80,000, it'll knock the full $1,000 off.

One last crucial detail: The CTC is also refundable, which means that if the CTC wipes out your tax liability without expending the full value of the credit, you get the remainder back. So if, say, you qualified for a $750 CTC, but only had a $600 tax bill to wipe out in the first place, you'd get a $150 check from the government. Refundability is what makes tax credits like the CTC and the earned income tax credit (EITC) such effective poverty-fighting tools.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Except the CTC isn't nearly as generous as the EITC. Worse, the CTC doesn't even apply to the very poorest of the poor. Both of these downsides is what Clinton is looking to change.

For children age 4 or under, Clinton wants to raise the ceiling for the CTC from $1,000 per child to $2,000 per child, and she wants to speed up the "phase-in" rate from 15 percent to 45 percent.

Finally, Clinton wants to eliminate the $3,000 threshold for qualifying. Instead, everyone's CTC would begin phasing in at the very first dollar of taxable income. And this last change would apply to everyone who qualifies for the CTC, not just families with children age 4 or under. So now our hypothetical household with $5,000 in taxable income would get a full CTC worth $2,000 — as opposed to a mere $300.

"That's really important," Rachel West, Associate Director for the Poverty to Prosperity Program at the liberal-leaning Center for American Progress, told The Week. "We found in our research that about one-in-four kids lived in families that didn't receive the full credit in recent years. That's disproportionately families with young children, but it's not totally families with young children."

Now, obviously raising the ceiling and speeding up the phase-in for every child under 17 would be even better. And Clinton probably took a pass at that out of fear it would be too politically ambitious. But accepting the downgrade in vision, this focus on the under-4 crowd makes sense: Families with young children tend to be at particular risk of falling into poverty, and we know good nutrition, social stability, and educational resources are all especially critical to childhood development in those early years. For families scraping by with that little, the extra $1,000 boost can make an enormous difference.

Unfortunately, even Clinton's proposal would still leave out families making so little they don't have any taxable income during a given tax year — largely because they're locked out of the labor force. It's difficult to measure how many households suffer this sort of deep poverty, but "it's a fairly small but non-trivial number," West says.

A better position would be to just eliminate the phase-in entirely — effectively turning the CTC into a child allowance. Increasing the maximum value of the CTC still higher, and extending those benefits to all kids, not just those 4 and under, would also be a big help.

Still, though Clinton could afford to be more ambitious, what she is proposing would be a massive improvement over the status quo. Three cheers for her.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred