America's putrid wage growth

People are getting jobs. But are the jobs everyone's getting any good? Do they pay well?

The American economy has finally pierced the psychologically significant 4 percent unemployment barrier, hitting 3.9 percent in April. That's the lowest jobless rate since 2000.

It is undeniably a good thing that so many Americans are working. Unfortunately, however, their wages are nothing to crow about.

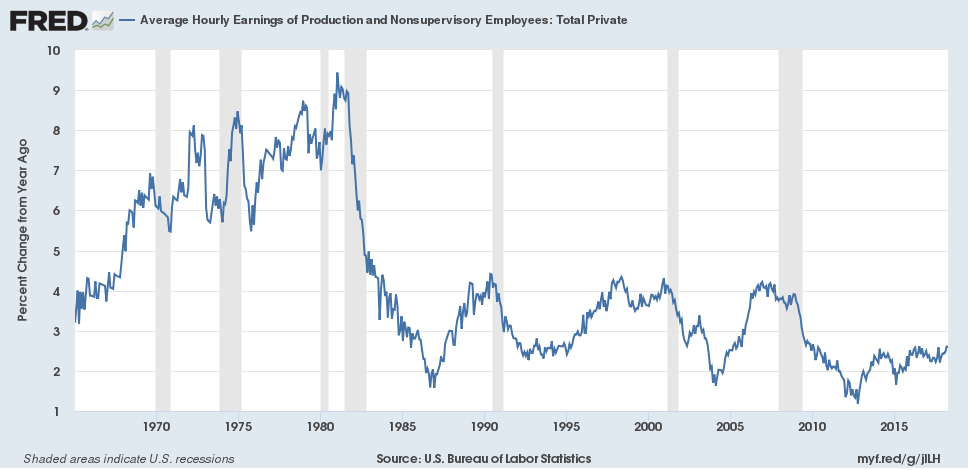

Average hourly wages for production and nonsupervisory workers (i.e. most people in the workforce) grew just 2.6 percent in the 12 months culminating in April 2018. That's certainly better than the 1.2-percent pit this metric hit in late 2012. But wages were growing at 4 percent at the peak of the last business cycle, just before the economy cratered in 2008. Wage growth also hit 4 percent during the late-1990s boom, and at the end of the 1980s business cycle before that.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

At this point, the unemployment rate may obscure more than it reveals. People are getting jobs. But are the jobs everyone's getting any good? Do they pay well?

Thus far the answer is largely no. And grappling with that fact requires an unpleasant review of economic policymaking over the last few decades.

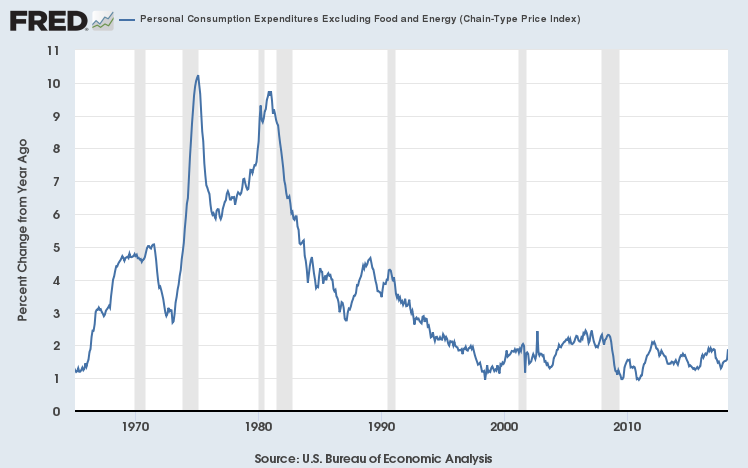

Price growth got out of hand in the 1970s, peaking at around 10 percent. Economic officials broke the price spiral around 1980. After that, inflation came back down to Earth, and eventually leveled off around 2 percent in the 1990s. This story is now almost universally hailed as one of the great accomplishments of modern macroeconomic policymaking.

I'm sure you sense a "but" coming.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Simply put, if you curtail inflation, you often also curtail wage growth. Here's average hourly wage growth for production and nonsupervisory employees over the same time period as the inflation chart above.

Looks awfully similar, no?

Many businesses hated high wage growth; it translates into higher labor costs. Not surprisingly, in the 1970s, an organized business lobby first really emerged on a national scale, pushing for deregulation and a rollback of worker power. Unionization levels began to decline in earnest, as businesses got serious about beating back labor. The turn toward right-wing economic policy began, culminating in the Reagan revolution.

Fed Chair Paul Volcker crushed inflation by hiking interest rates into the stratosphere. This set off a massive recession in 1981 — rivaling the 2008 collapse in some ways. Millions of working-class Americans were thrown out of jobs for years, and already-struggling unions went into a tailspin.

This devastation wasn't an unfortunate side effect. It was kind of the point.

Inflation can be caused by a lot of technical screwups. But in mainstream economic theory, the basic driver of inflation is low unemployment and high wage growth; if businesses can't keep productivity up, the wage increases can bleed into price increases.

This is the dirty secret of American macroeconomic policymaking since the late 1970s. Business lobbying, bipartisan drives for less public investment, Federal Reserve policy: All of it is built on the implicit assumption that properly managing the economy requires breaking workers' bargaining power and continuously swatting down their demands for better compensation.

People rarely speak in these terms, of course. It's too brutal, and policymakers aren't sociopaths. What's going on usually gets hidden under mounds of economic jargon. But straightforward language does occasionally slip out: Volcker himself literally said that "the standard of living of the average American has to decline" to beat inflation, and his colleagues celebrated mass wage reductions. That spirit continued though the 1990s, when Fed Chair Alan Greenspan said "traumatized workers" were what allowed strong growth to combine with low inflation. Even the ostensibly progressive Janet Yellen, long before she became Fed chair, described widespread job insecurity as a good thing, arguing that it would keep prices down.

This wasn't the result of a failed economic strategy. It was the result of a successful one. Now we have low unemployment and low inflation and booming business profits. And it's all made possible by widespread stagnation in living standards for everyone in the middle class on down. Workers can no longer put serious pressure on their employers: They've been scattered, demoralized, stripped of their unions, and transformed into disposable commodities.

The bright spot here is that wages do recover if given enough time. Labor markets do keep tightening. Old labor movements are slowly rebuilding, demanding hikes to the minimum wage, and using strikes to force better pay and conditions. Workers can reclaim what they have lost.

Time, and politics, will tell if they do.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The Mint’s 250th anniversary coins face a whitewashing controversy

The Mint’s 250th anniversary coins face a whitewashing controversyThe Explainer The designs omitted several notable moments for civil rights and women’s rights

-

‘If regulators nix the rail merger, supply chain inefficiency will persist’

‘If regulators nix the rail merger, supply chain inefficiency will persist’Instant Opinion Opinion, comment and editorials of the day

-

Trump HHS slashes advised child vaccinations

Trump HHS slashes advised child vaccinationsSpeed Read In a widely condemned move, the CDC will now recommend that children get vaccinated against 11 communicable diseases, not 17

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy