UK economy at highest risk of recession since 2007 crash

Resolution Foundation warns Britain can do little to evade a recession, and is ill-equipped to protect itself in the event of one

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The British economy is at its highest risk of recession in over a decade, and needs active policy in an attempt to prevent a downturn, and, crucially, to mitigate damage in the event of one, a new report from the Resolution Foundation has found.

The report brings attention to the declining pound, an expanding deficit, uncertainty over Brexit, and poor domestic and international growth - plus the fact that UK recessions tend to happen on average every ten years - as factors that indicate a recession could be due “in the next few years”.

James Smith, the author of the report, warns further that policies put in place to overcome the last recession, namely close-to-zero interest rates and vast amounts of quantitative easing, are still in place: “The problem for the incoming government and the Bank of England... is that many of the tools used to fight the last downturn are either spent or severely blunted.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Financial Times sheds light on the low growth the UK economy is currently facing, and how close it already is to a technical recession: “The latest official data… suggests that growth in the second quarter will tumble from the first quarter rate of 0.5 per cent close to zero. Not much additional bad news would be needed to show a contraction on the quarter. A recession is defined as two negative quarters.”

The report also argues that the cause of many previous recessions, though different, reside in international, not domestic economic issues - significant when taken alongside the currently sluggish global economy.

Indeed, the Guardian places the report in the context of the Governor of the Bank of England Mark Carney’s ominous words about the state of the global economy. “Earlier this month… Mark Carney warned that there had been a ‘sea change’ in the world’s financial markets, driven by pessimism about the economic outlook.”

The Resolution Foundation developed a gauge for “recession risk” based on the slope of the government bond yield curve, which has been an accurate predictor of past recessions.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

As Bloomberg reports: “Resolution calculates that the past five recessions cost an average of one million jobs in the UK. The last financial crisis would have been 12% worse, equivalent to 8,000 pounds per household, without a strong response from the British government and financial sector.”

The problem is that, as far as a response goes, there are few measures left to tackle the next recession.

William Gritten is a London-born, New York-based strategist and writer focusing on politics and international affairs.

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Is the US in a hiring recession?

Is the US in a hiring recession?Today's Big Question The economy is growing. Job openings are not.

-

Is the UK headed for recession?

Is the UK headed for recession?Today’s Big Question Sluggish growth and rising unemployment are ringing alarm bells for economists

-

Why has America’s economy gone K-shaped?

Why has America’s economy gone K-shaped?Today's Big Question The rich are doing well. Everybody else is scrimping.

-

Is the US in recession?

Is the US in recession?Today's Big Question ‘Unofficial signals’ are flashing red

-

Doing the hustle: Are side gigs a sign of impending recession?

Doing the hustle: Are side gigs a sign of impending recession?In the Spotlight More workers are 'padding their finances while they can'

-

Frozen pizza sales could be a key indicator of a recession

Frozen pizza sales could be a key indicator of a recessionThe Explainer Sales of the item have been increasing since the pandemic

-

Trump tariffs: five scenarios for the world's economy

Trump tariffs: five scenarios for the world's economyThe Explainer A US recession? A trade war with China? How 'Liberation Day' could realign the globe

-

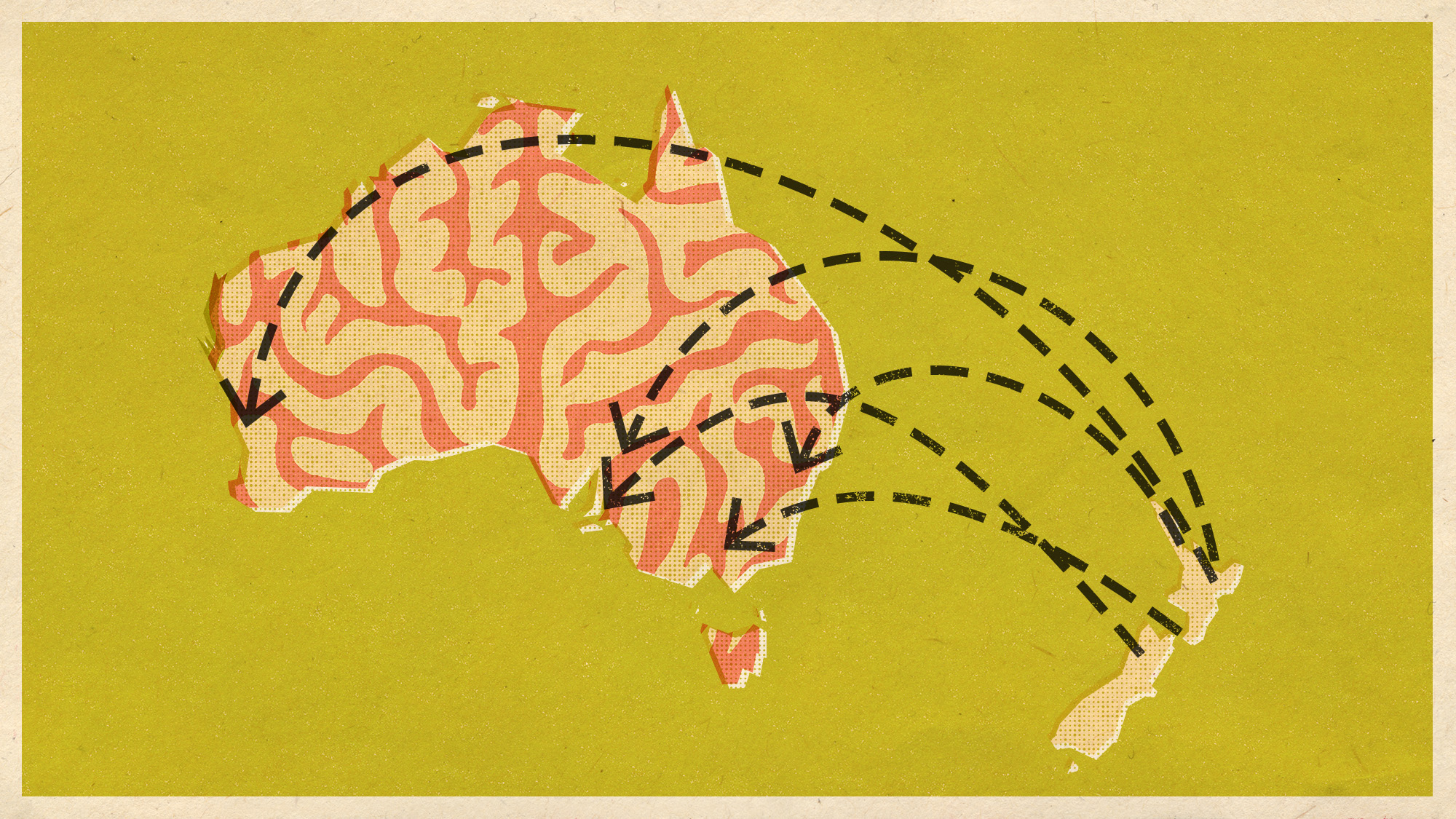

'Brain drain' fear as record numbers leave New Zealand

'Brain drain' fear as record numbers leave New ZealandUnder The Radar Neighbouring Australia is luring young workers with prospect of better jobs