Inflation down: will there be an interest rates cut?

Most analysts agree a cut is likely but developments in next fortnight crucial

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Speculation about a cut in interest rates has intensified after the UK’s inflation rate sank to its lowest level for more than three years.

Commentators said the chances of a rates cut at the end of January are higher after the rate of inflation dropped to 1.3% last month, down from 1.5% in November. The fall was met with surprise by City economists, who had expected the figure to remain steady.

The Guardian says the drop was “fuelled by struggling retailers offering a wider range of discounts in December”.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It comes hot on the heels of GDP data that had already sparked speculation of a cut in rates.

Melissa Davies, from the stock broker Redburn, said that “very soft UK inflation data for December leaves the door wide open for a Bank of England rate cut on 30 January”, when the Bank of England Monetary Policy Committee (MPC) is next due to meet.

Andy Verity, the BBC’s economics correspondent, said “city traders who spend their working lives trying to anticipate moves in interest rates are convinced” the Bank will cut the official interest rate.

Michael Sanders, an MPC member who has voted for a rate cut at the last two meetings, said yesterday: “Risk-management considerations favour a relatively prompt and aggressive response to downside risks at present.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

–––––––––––––––––––––––––––––––For a round-up of the most important business stories and tips for the week’s best shares - try The Week magazine. Start your trial subscription today –––––––––––––––––––––––––––––––

However, Ruth Gregory, the senior UK economist at Capital Economics, was more cautious. She said the figures “might be enough to tip the balance on the MPC towards an imminent rate cut”, but added that “everything now depends on the economic news over the coming weeks”.

Matthew Ryan, a strategy analyst at Ebury, has also encouraged the public to not get too carried away. “While we acknowledge that the chances of a cut later this month have undoubtedly increased in the past few days, we think that the market has slightly overreacted,” he said.

“It is worth stressing that the three BoE members... all noted that additional data would be required before they decide on whether to vote for lower rates.”

-

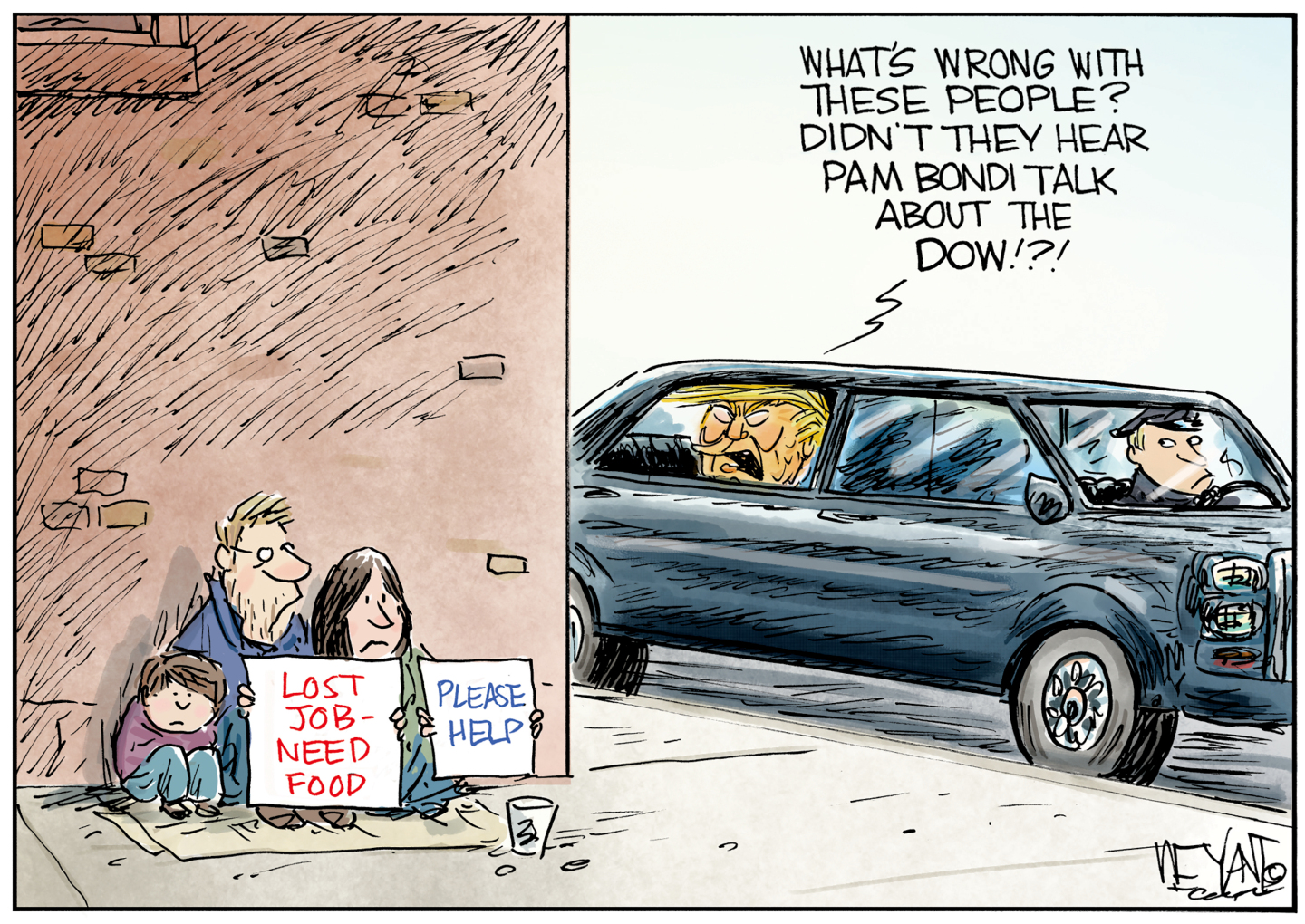

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more

-

The best music tours to book in 2026

The best music tours to book in 2026The Week Recommends Must-see live shows to catch this year from Lily Allen to Florence + The Machine

-

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ read

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ readIn the Spotlight A Hymn to Life is a ‘riveting’ account of Pelicot’s ordeal and a ‘rousing feminist manifesto’

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Will Trump’s 10% credit card rate limit actually help consumers?

Will Trump’s 10% credit card rate limit actually help consumers?Today's Big Question Banks say they would pull back on credit

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain

-

Is $140,000 the real poverty line?

Is $140,000 the real poverty line?Feature Financial hardship is wearing Americans down, and the break-even point for many families keeps rising

-

Fast food is no longer affordable for low-income Americans

Fast food is no longer affordable for low-income AmericansThe explainer Cheap meals are getting farther out of reach

-

Why has America’s economy gone K-shaped?

Why has America’s economy gone K-shaped?Today's Big Question The rich are doing well. Everybody else is scrimping.

-

Should Labour break manifesto pledge and raise taxes?

Should Labour break manifesto pledge and raise taxes?Today's Big Question There are ‘powerful’ fiscal arguments for an income tax rise but it could mean ‘game over’ for the government

-

From candy to costumes, inflation is spooking consumers on Halloween this year

From candy to costumes, inflation is spooking consumers on Halloween this yearIn the Spotlight Both candy and costumes have jumped significantly in price