Oil price continues to tumble: will petrol get cheaper?

As Covid-19 cripples the economy, lower fuel prices and reduced inflation may provide some relief

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The global oil industry is facing a perfect storm as demand plummets because of the coronavirus pandemic at the same time as a spat between Saudi Arabia and Russia causes supply to skyrocket.

The oversupply means countries are running out of storage space for their excess of black gold, in what consultancy IHS Markit calls “the most extreme global oil supply surplus ever recorded”.

The price now stands at around $27, having risen from just over $20 a barrel on 18 March - the lowest price in 18 years. Analysts have speculated that the crisis could see the price of oil drop below an unprecedented $10 a barrel.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Will UK consumers reap the benefit?

The drop in oil prices “will be felt most keenly by drivers”, says The Telegraph. “Bill payers will also benefit in coming months, with lower global energy prices and a cut to the Ofgem price cap from April expected to reduce gas and electricity costs.”

As the coronavirus lockdown massively reduces travel and economic activity, with people staying isolated at home, UK fuel faces a double impact similar to the global industry: a reduction in demand and abundance of supply. Earlier this week, Morrisons and Asda slashed up to 12p from the price of fuel.

It was, says The Sun, the UK's “largest ever single price cut”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What’s more, as oil prices plummet, a number of industries will see their operating costs reduce. This, coupled with the reduced consumer demand, has resulted in a slowed rate of inflation.

Data from the Office for National Statistics recorded that consumer price inflation slowed to 1.7% in February from 1.8% the previous month, and this slowing rate should be of some help to consumers as the economy stutters as a result of Covid-19.

It was, said Howard Archer, chief economic adviser at EY Item Club, “a small step in the right direction for consumer purchasing power”.

He added: “Inflation looks certain to fall back markedly over the coming months which will provide some much-needed help for consumers and the economy.”

–––––––––––––––––––––––––––––––For a round-up of the most important business stories and tips for the week’s best shares - try The Week magazine. Get your first six issues free–––––––––––––––––––––––––––––––

Who loses?

“It is no exaggeration to say the oil industry faces its gravest crisis of the past 100 years,” says the Financial Times.

In the UK, the North Sea oil industry supports about 250,000 workers, and while the larger companies may be able to survive the plummeting prices, job cuts are likely to follow as costs are reduced.

The oil price war has already “wiped billions from the value of UK companies”, reports The Guardian, “and could threaten the long-term survival of weaker firms”.

Deirdre Michie, the chief executive of Oil and Gas UK, said the global price collapse has left the UK’s oil industry “in a paper-thin position”.

William Gritten is a London-born, New York-based strategist and writer focusing on politics and international affairs.

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Putin’s shadow war

Putin’s shadow warFeature The Kremlin is waging a campaign of sabotage and subversion against Ukraine’s allies in the West

-

Media: Why did Bezos gut ‘The Washington Post’?

Media: Why did Bezos gut ‘The Washington Post’?Feature Possibilities include to curry favor with Trump or to try to end financial losses

-

How might the Israel-Hamas war affect the global economy?

How might the Israel-Hamas war affect the global economy?Today's Big Question Regional escalation could send oil prices and inflation sky-high, sparking a worldwide recession

-

Recent mega-mergers could signal a turning point for the US oil industry

Recent mega-mergers could signal a turning point for the US oil industryTalking Point Both Chevron and Exxon have recently spent billions to acquire smaller oil companies

-

Has Saudi Arabia lost control of oil prices?

Has Saudi Arabia lost control of oil prices?Today's Big Question Kingdom goes it alone to cut production, risking tension with US and reigniting cooling inflation in Europe

-

US angered by Opec+ oil cut

US angered by Opec+ oil cutSpeed Read Energy prices to rise further as producers slash supply by two million barrels a day

-

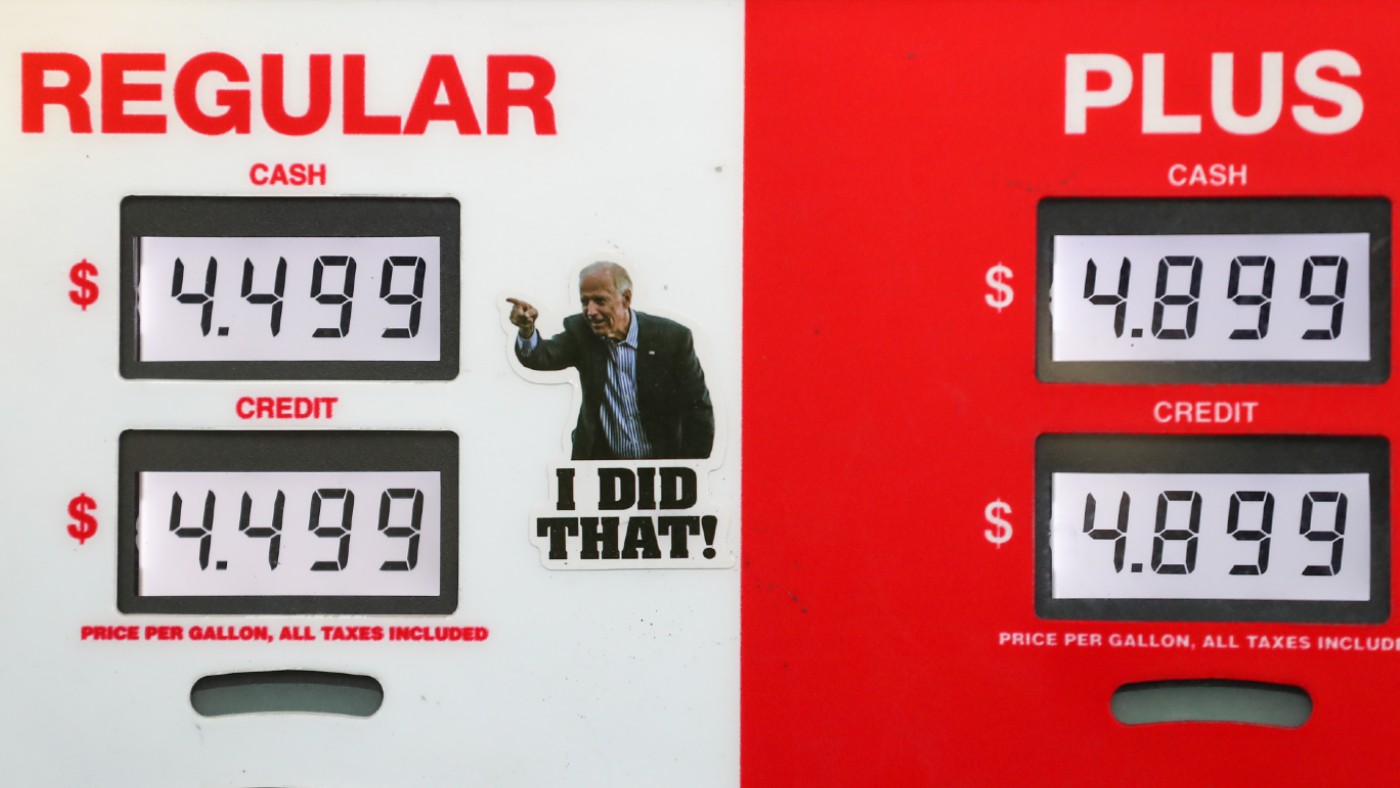

Record petrol prices in the US: who should carry the can?

Record petrol prices in the US: who should carry the can?In Depth Conservatives are blaming Biden for the high cost of petrol as if there’s some ‘dial in the Oval Office’ that he uses to set prices

-

Global oil demand forecast lowered for 2020 and 2021

Global oil demand forecast lowered for 2020 and 2021Speed Read IEA report says jet fuel demand remains the major source of weakness

-

Are US-Iran tensions flaring again?

Are US-Iran tensions flaring again?In Depth Trump threatens military action over Twitter

-

Can a deal be struck to raise oil prices?

Can a deal be struck to raise oil prices?In Depth Opec+ will convene today over video link in a bid to boost crude