Global oil storage almost ‘overwhelmed’ as price plummets

Industry facing ‘toughest month ever’ as demand hits 25-year low

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Global oil prices have continued to slump as the world’s energy watchdog warned that even the biggest production cuts in history will not offset the largest fall in demand for a quarter of a century.

The price for Brent crude, the global benchmark, dropped by more than 5% to $28 a barrel yesterday, while US oil prices “tumbled to 18-year lows of $19.20 a barrel after the quickest rise in surplus oil supplies in history”, The Guardian says.

The rise in surplus supplies means that ships as well as pipelines and storage tanks holding surplus oil could be “overwhelmed” within weeks, according to warnings by the International Energy Agency (IEA).

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Demand could fall to lows not seen since the mid-1990s, the agency has said, adding that the oil industry is facing “the toughest month of the toughest year in its history”.

So what happened to oil prices - and is there an end in sight?

What happened?

The coronavirus pandemic has seen oil demand collapse, falling well below last year’s average by 29m barrels per day to hit levels not seen since 1995.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

“Even assuming that travel restrictions are eased in the second half of the year, we expect that global oil demand in 2020 will fall by 9.3m barrels a day versus 2019, erasing almost a decade of growth,” the IEA said.

The sharp collapse in oil demand has left the market oversupplied with enough crude to overwhelm storage facilities.

According to The Guardian, oil inventories in the US climbed by more than 19m barrels in the last week, the biggest one-week increase in history.

The pandemic has further exacerbated fluctuations in oil prices after Russia and Saudi Arabia kicked off an price war in early March. This came after Moscow torpedoed an Opec deal to cut production as demand fell in response to the coronavirus outbreak.

In response, Saudi Arabia, the de-facto head of Opec, went on the offensive.

Rather than restricting supplies, handing the Russians the chance to expand their market share, the kingdom opened it taps, flooding the market and sending oil prices plummeting at unprecedented speed.

Last week, Trump tweeted that he had spoken to Saudi crown prince Mohammed bin Salman and expected Riyadh and Moscow to cut output by as much as 15m barrels a day, prompting a surge in prices.

However, the uptick was short-lived and analysts predict that the situation could become worse during the coming months.

“When we look back on 2020 we may well see that it was the worst year in the history of global oil markets,” Faith Birol, director of the IEA, said.

–––––––––––––––––––––––––––––––For a round-up of the most important business stories and tips for the week’s best shares - try The Week magazine. Start your trial subscription today –––––––––––––––––––––––––––––––

Is this volatility new?

Oil prices have been on a roller-coaster ride over the past few years, peaking in 2014 and then plummeting, before making a steady recovery only to be hit by further geopolitical turmoil – all with huge consequences for the global economy.

In the heady days of June 2014, Brent Crude hit $115 a barrel. What followed became known as the Great Oil Bust, when prices dropped by roughly 40% in the six months to December 2014, and continued to fall to below $30 in January 2016.

The price collapse “mainly reflects too much supply chasing too little demand”, explained The Washington Post. Even small shifts in the supply-demand balance can result in significant price changes.

Surging US shale oil production, which had increased by 3.5 million barrels a day from 2008, coincided with lower-than-expected global demand and the lifting of US economic sanctions against Iran by Barack Obama – all contributing to price drops.

Since its 2016 nadir, geopolitical turmoil and a US-China trade war drove oil prices up to a four-year high of $86.07 a barrel in 2018. But the price of crude subsequently crashed, amid a deepening sense of global economic gloom and fears of oversupply in the oil market.

What impact do dramatic oil price changes have?

The Wall Street Journal explains that higher oil prices “hurt consumers and squeeze businesses that rely on energy to make or transport their products”. However, in a country such as the US, those losses are offset by the gains oil industries reap from higher prices.

“Where surging oil prices would do the most damage is in countries that rely on energy imports, such as China and Japan, the world’s second- and third-largest economies after the US,” says the newspaper.

By contrast, declines in oil prices signal a massive transfer of wealth from producers to consumers, estimated at about $1.5trn annually by economist Edward Yardeni.

Markets Insider says “the continued fall in oil and gas prices will have a profound impact on the income of economies dependent on natural resources”.

Oil-producing countries such as Russia, Venezuela and Saudi Arabia are highly dependent on energy prices to pay for public services.

The International Energy Agency’s Dr Fatih Birol and Secretary General of the OPEC Mohammad Sanusi Barkindo say a dramatic drop in oil income is “likely to have major social and economic consequences, notably for public sector spending in vital areas such as healthcare and education”.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Trump wants a weaker dollar, but economists aren’t so sure

Trump wants a weaker dollar, but economists aren’t so sureTalking Points A weaker dollar can make imports more expensive but also boost gold

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

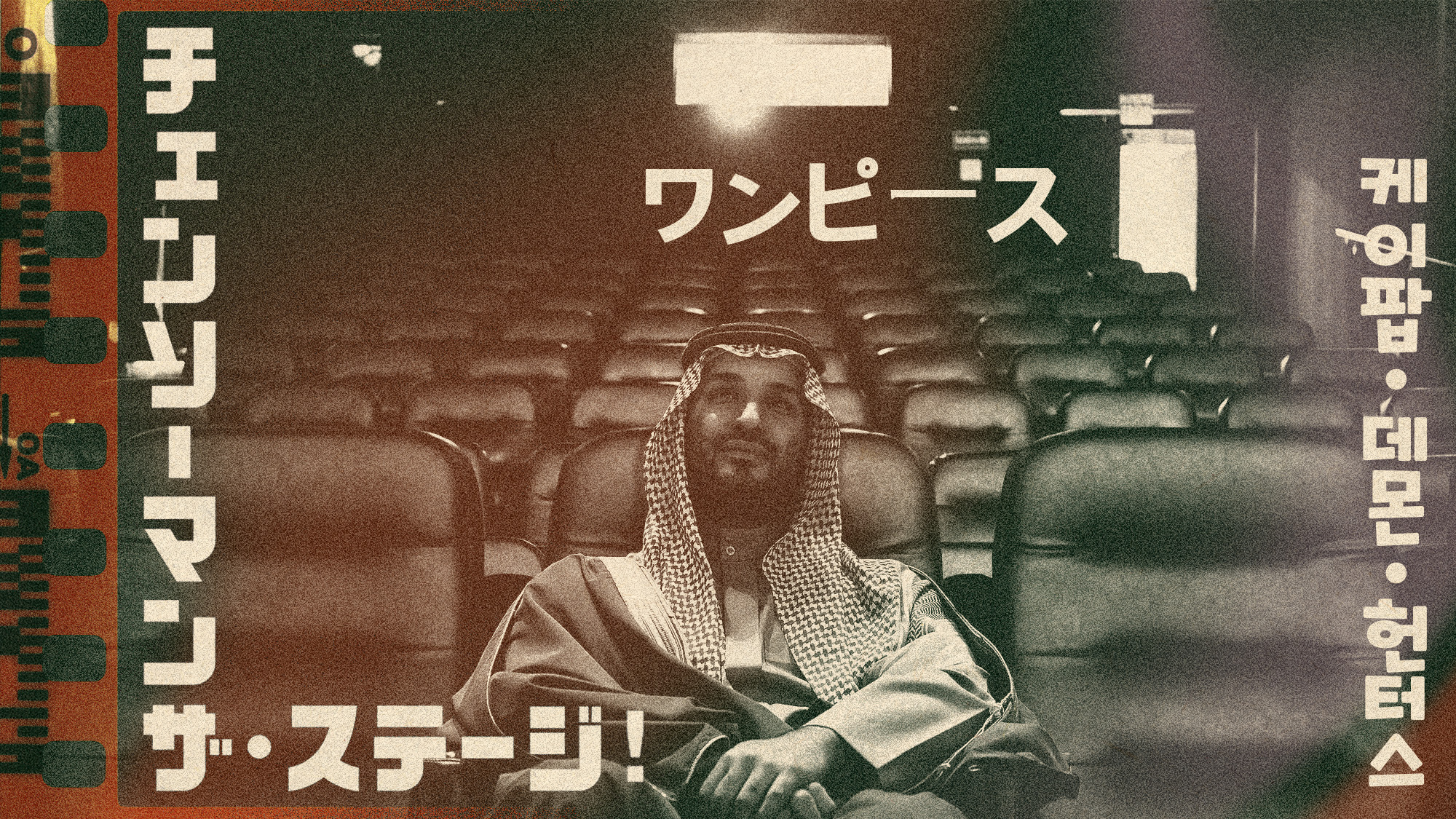

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Phish food for thought: Ben & Jerry’s political turmoil

Phish food for thought: Ben & Jerry’s political turmoilIn the Spotlight War of words over brand activism threatens to ‘overshadow’ the big ice cream deal