How Saudi Arabia is trying to become less reliant on oil

Largest Arab economy unveiling plan for infrastructure and industry makeover

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Saudia Arabia is set to unveil plans for an infrastructure and industry makeover as part of a bid to become less reliant on crude oil sales.

The world’s leading oil-exporting nation is seeking 1.6trn riyals ($425bn) of investment in railways, airports and industrial projects by 2030, reports Bloomberg.

Crown Prince Mohammed bin Salman, who is “responsible for the biggest overhaul of the Saudi economy in its modern history”, is expected to present the plans today, the news site says.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So why is Saudi Arabia trying to reduce its dependence on oil?

“It may seem surprising that such an oil-rich state - 16% of global oil reserves; 13% of global oil supply - should be trying to turn its back on the commodity that took it from poor desert kingdom to wealthy world player,” says Sukru Cildir, a Lancaster University PhD student researching the oil politics of Iran and Saudi Arabia.

But the fall in oil prices over the past few years has hit the country’s public finances hard, as Cildir explains in an article on The Conversation.

“At one stage oil prices plummeted from US$140 to less than US$30 a barrel, leading to rising unemployment, an increasing budget deficit, and dwindling financial reserves,” he says. “An IMF [International Monetary Fund] report on the kingdom’s finances even floated the possibility of bankruptcy, should Saudi Arabia fail to urgently restructure its economy.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Just how reliant is it?

According to Forbes, the petroleum sector currently accounts for roughly 87% of the kingdom’s budget revenues, 42% of GDP, and 90% of export earnings.

What is the kingdom doing to diversify?

The crown prince, who assumed de facto leadership in 2017, has vowed to steer the economy away from its crude dependence with a reform plan called Vision 2030. This aims to transform the way that the kingdom generates income and how it spends its resources.

The latest part of the plan is designed to bolster industries such as mining, energy and logistics.

Speaking ahead of today’s unveiling, Energy Minister Khalid Al-Falih said that projects worth 70bn riyals are “ready for negotiations” under the country’s National Industrial Development and Logistics Programme (NIDLP).

Will it work?

“In some ways, Saudi Arabia is retreading very old ground. Five-year plans for diversifying the economy have been regularly trotted out since the 1970s – they just haven’t worked particularly well,” says Cildir on The Conversation.

Bloomberg notes that the latest infrastructure push will also “test investor faith after the killing of Jamal Khashoggi sparked global outcry”.

Other commentators have warned that centralised economic plans have never been very successful and that the Saudi government needs a more laissez-faire stance.

“Building a sustainable private sector has to be a bottom-up exercise, not one imposed by government,” The Independent’s Hamish McRae wrote in September.

“What Crown Prince Mohammad is seeking to do is impressive and important. But there is the danger of disappointment arising from the way he is doing it.”

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

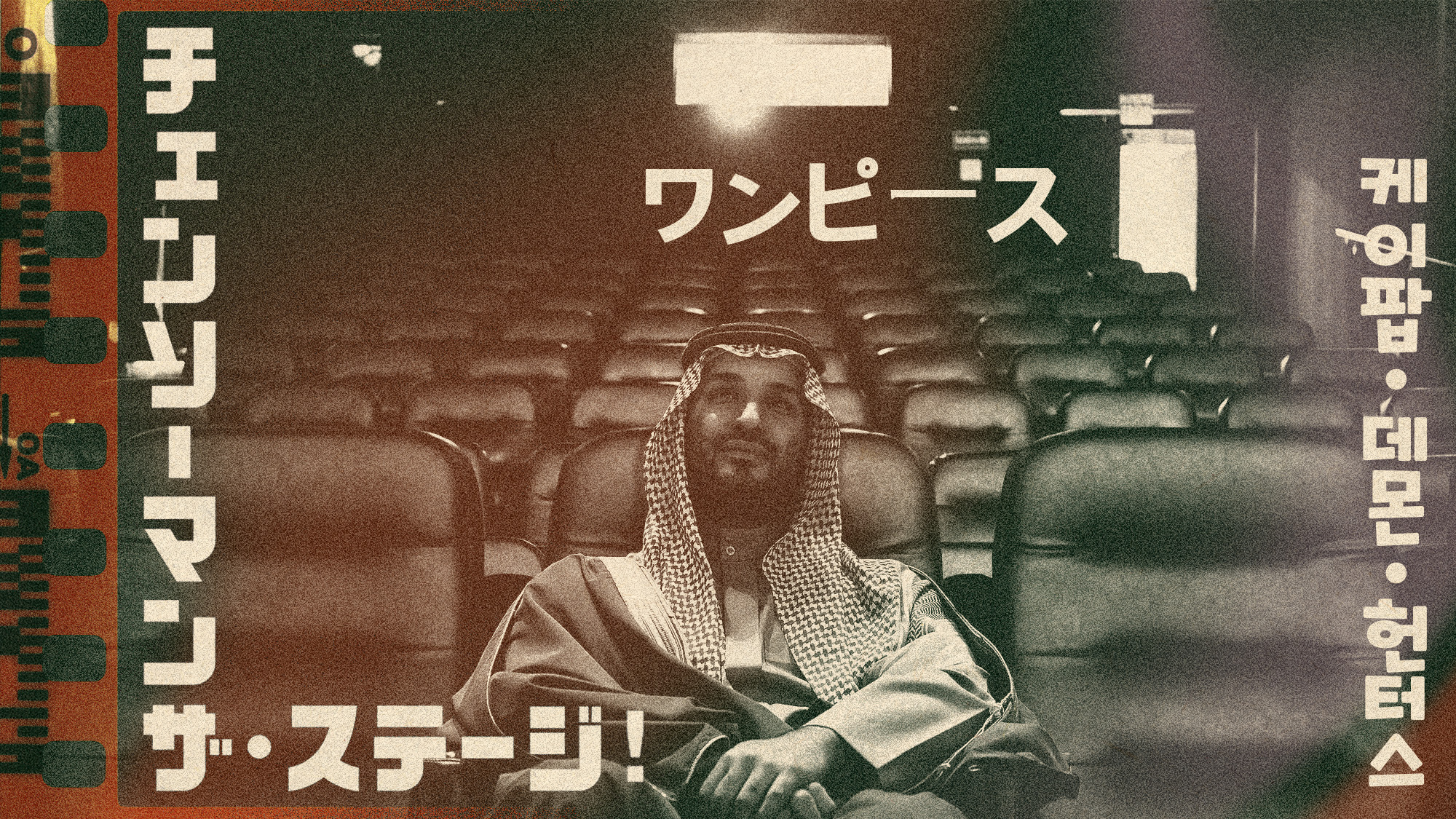

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Will latest Russian sanctions finally break Putin’s resolve?

Will latest Russian sanctions finally break Putin’s resolve?Today's Big Question New restrictions have been described as a ‘punch to the gut of Moscow’s war economy’

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

What Saudi Arabia wants with EA video games

What Saudi Arabia wants with EA video gamesIn the Spotlight The kingdom’s latest investment in gaming is another win for its ‘soft power’ portfolio

-

Is the EU funding Russia more than Ukraine?

Is the EU funding Russia more than Ukraine?The Explainer EU remains largest importer of Russian fossil fuels despite sanctions aimed at crippling Kremlin's war effort

-

Big Oil doesn't need to 'drill, baby, drill'

Big Oil doesn't need to 'drill, baby, drill'In the Spotlight Trump wants to expand production. Oil companies already have record output.

-

Why do Russian oil bosses keep dying?

Why do Russian oil bosses keep dying?Under the Radar There have been 'at least 50' mysterious deaths of energy company executives since Putin ordered Ukraine invasion

-

Recent mega-mergers could signal a turning point for the US oil industry

Recent mega-mergers could signal a turning point for the US oil industryTalking Point Both Chevron and Exxon have recently spent billions to acquire smaller oil companies