'Tariff stacking' is creating problems for businesses

Imports from China are the most heavily affected

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

One of the results of President Donald Trump's back-and-forth trade war is that some business owners are paying much more than they had anticipated due to the economic phenomenon of tariff stacking, when separate tariffs are compounded. While tariff stacking is mostly being felt by Americans who import Chinese goods, business owners across the U.S. seem to be wary of the continuing trade war, no matter which country is importing goods.

What is 'tariff stacking'?

It is an economic scenario that occurs "when multiple tariffs apply to the same imported product under separate trade actions," according to the trade policy tracker Global Trade Alert. This can create "cumulative duties that increase the product's final effective rate," as is the case when Trump puts multiple tariffs on a country through executive actions.

However, not all tariffs stack on top of each other. Some "apply cumulatively, others are mutually exclusive," said Global Trade Alert. Trump's Executive Order 14289 established rules for tariff stacking whereby "certain tariff regimes supersede others and cannot stack."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How is this affecting American businesses?

It can cause small business owners to pay more than simply the initial cost of the tariffs, economic experts say. When Trump "adds a new tariff, the old ones don't go away," said Reuters. For many businesses, this means their "tariff bills are often far higher than the headline number touted in trade talks."

Tariff stacking is most often felt by companies that import Chinese goods because China has been one of the main targets of Trump's tariffs. The newest example is a deal between China and the United States that would see 55% tariffs on Chinese goods instead of the previous 30%. The White House downplayed the new tariffs' effect, saying that the "55% was not an increase on the previous 30% tariff on China because Trump was including preexisting tariffs," said The Associated Press.

But it is unclear whether this is true, as the 55% is "in part only an estimate of what the average preexisting tariffs were," said Reuters. For some, this could mean ambiguity. One example: John Hamer, the president of Rodgers Wade Manufacturing in Paris, Texas, who "isn't sure what his tariff total will be now," he told Reuters.

Even when Trump paused his steepest tariffs on China in May 2025, not much relief was offered to importers because stacking multiple import taxes sent the "true cost well above 30%," said CNBC. The "multiple layers of tariffs are a big problem for basic items like kids' backpacks that come largely from China," Dan Anthony, the president of Trade Partnership Worldwide, said to CNBC. "You're talking about rates of over 70%."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Other products don't have tariff rates quite as high, but are still facing significant upticks. Cotton sweaters "from China face a 46.5% tariff," while "women's bathing suits from China face a tariff of 54.9%" and "baby's dresses from China face a tariff of 41.5%," said CNBC. Some businesses are reportedly rethinking their models. "As a small business owner handling so much on my own, I can't afford the added stress," said Anjali Bhargava, the founder of spice company Anjali's Cup, to CNBC, adding that her company "will be discontinuing products as the special vacuum seal tins she uses sell out."

Justin Klawans has worked as a staff writer at The Week since 2022. He began his career covering local news before joining Newsweek as a breaking news reporter, where he wrote about politics, national and global affairs, business, crime, sports, film, television and other news. Justin has also freelanced for outlets including Collider and United Press International.

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

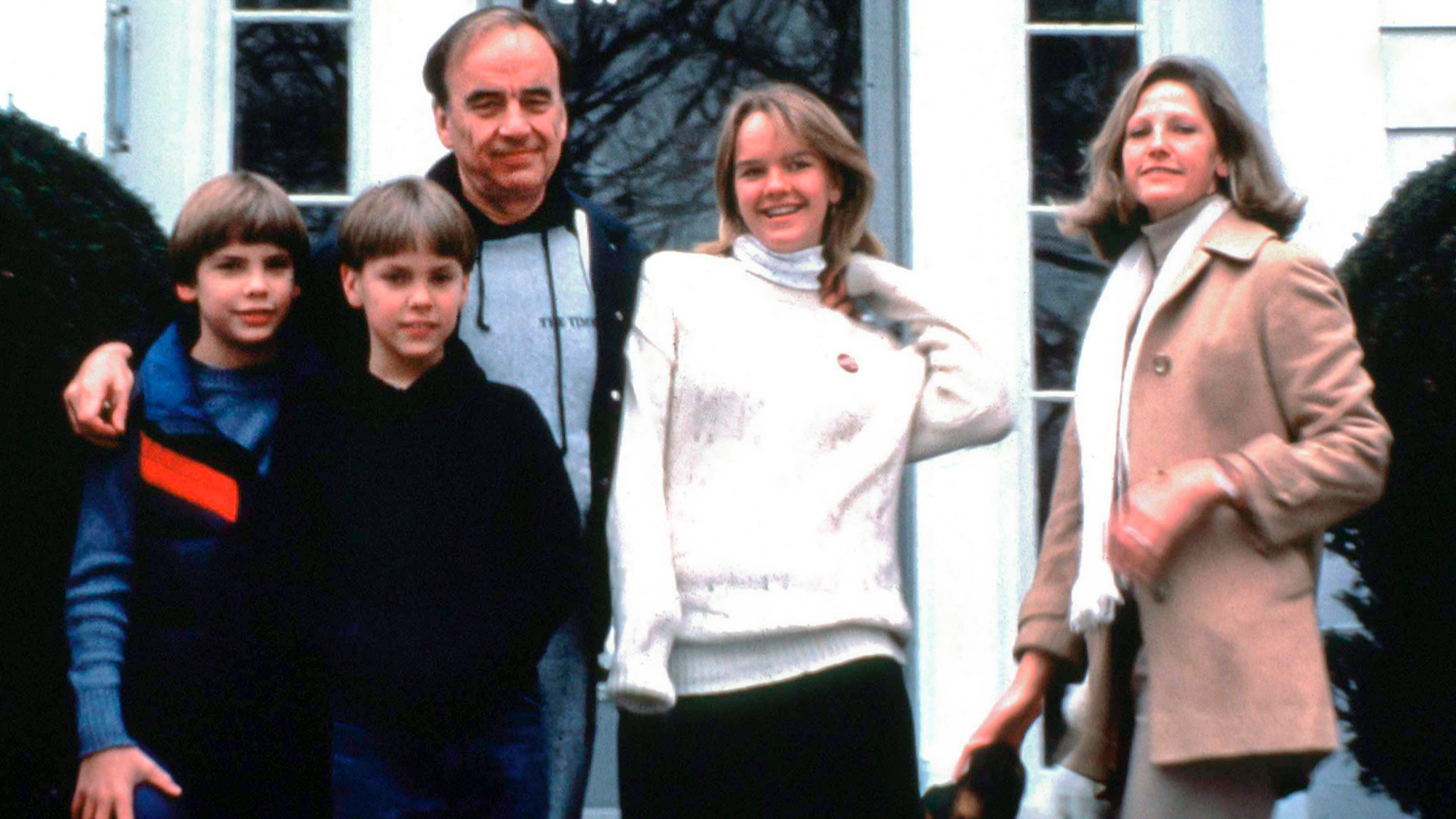

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Companies are increasingly AI washing

Companies are increasingly AI washingThe explainer Imaginary technology is taking jobs

-

Is the US in a hiring recession?

Is the US in a hiring recession?Today's Big Question The economy is growing. Job openings are not.

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Trump wants a weaker dollar, but economists aren’t so sure

Trump wants a weaker dollar, but economists aren’t so sureTalking Points A weaker dollar can make imports more expensive but also boost gold

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Will Trump’s 10% credit card rate limit actually help consumers?

Will Trump’s 10% credit card rate limit actually help consumers?Today's Big Question Banks say they would pull back on credit