Global oil demand forecast lowered for 2020 and 2021

IEA report says jet fuel demand remains the major source of weakness

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The global oil demand forecast for 2020 and 2021 has been revised down by the International Energy Agency (IEA) due to rising Covid-19 cases and weakness in the aviation sector.

In its August market report, the IEA says oil demand forecast for this year is expected to fall by 140,000 barrels per day (bpd) to 91.9 million bpd - eight million bpd down year-on-year. In 2020 demand will be 39% below the 2019 level.

The oil watchdog has also revised down its 2021 global demand estimate by 240,000 bpd to 97.1 million bpd, mainly due to “aviation sector weakness”.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In a statement the IEA said: “For road transport fuels, demand in the first half of 2020 was slightly stronger than anticipated, but for the second half we remain cautious and the upsurge in Covid-19 cases has seen us downgrade our estimates, mainly for gasoline.

“For diesel, there is evidence that the recovery in business and industrial activity combined with ongoing growth in e-commerce are supporting trucking activity as more goods are delivered to customers. Jet fuel demand remains the major source of weakness.

“Revised data show that in April the number of aviation kilometres travelled was nearly 80% down on last year and in July the deficit was still 67%. With few signs that the picture will improve significantly soon, we have downgraded our estimate for global jet fuel and kerosene demand.”

The Guardian reports that the impact of the coronavirus has “triggered major downgrades” for oil price forecasts among the world’s biggest oil companies.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

BP revised down its own oil forecasts by almost a third to an average of $55 a barrel between 2020 and 2050. Shell cut its oil price forecasts from $60 a barrel to an average of $35 a barrel this year, rising to $40 next year, $50 in 2022 and $60 from 2023.

Mike Starling is the former digital features editor at The Week. He started his career in 2001 in Gloucestershire as a sports reporter and sub-editor and has held various roles as a writer and editor at news, travel and B2B publications. He has spoken at a number of sports business conferences and also worked as a consultant creating sports travel content for tourism boards. International experience includes spells living and working in Dubai, UAE; Brisbane, Australia; and Beirut, Lebanon.

-

The Week contest: AI bellyaching

The Week contest: AI bellyachingPuzzles and Quizzes

-

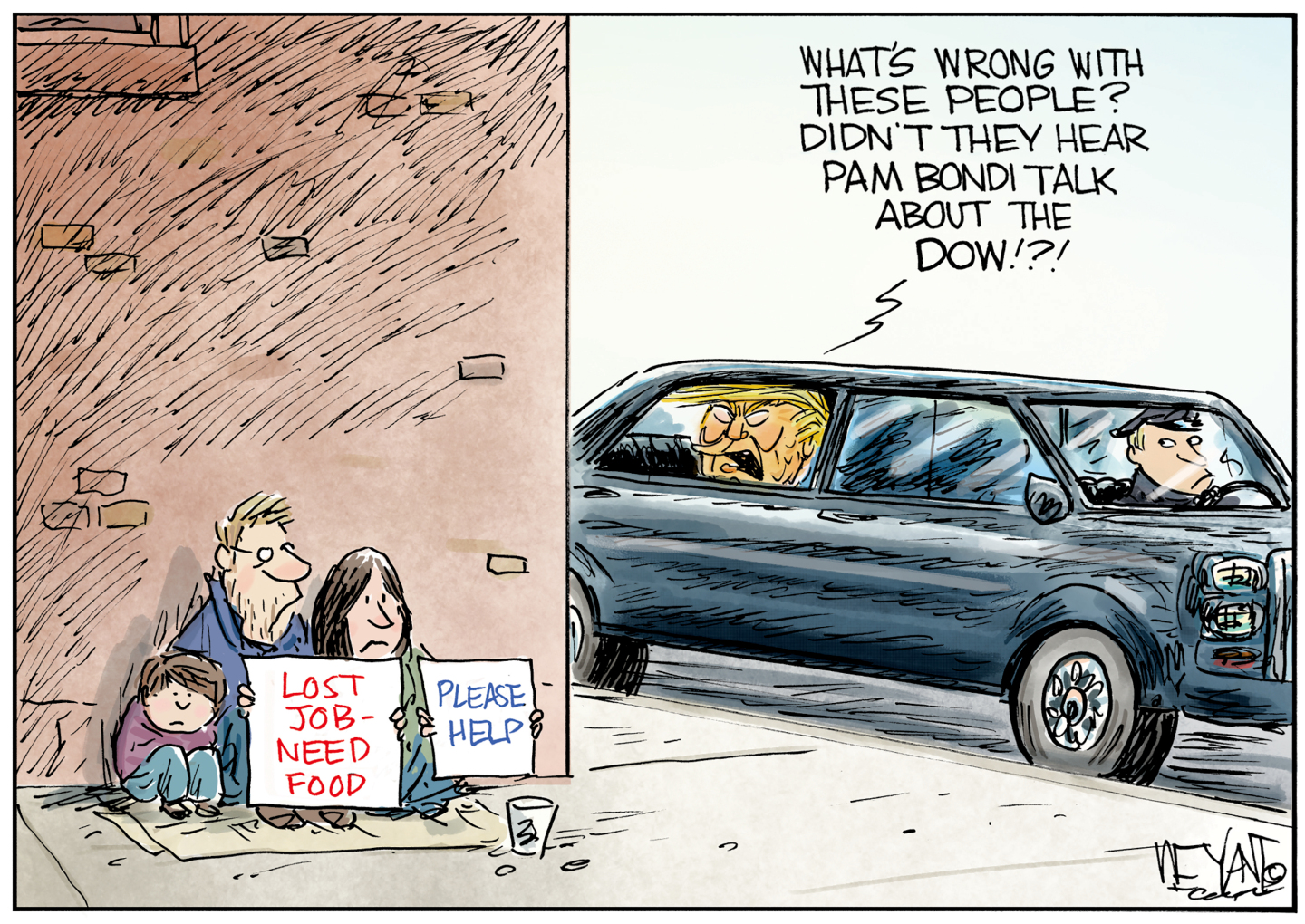

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more

-

The best music tours to book in 2026

The best music tours to book in 2026The Week Recommends Must-see live shows to catch this year from Lily Allen to Florence + The Machine

-

Will latest Russian sanctions finally break Putin’s resolve?

Will latest Russian sanctions finally break Putin’s resolve?Today's Big Question New restrictions have been described as a ‘punch to the gut of Moscow’s war economy’

-

Is the EU funding Russia more than Ukraine?

Is the EU funding Russia more than Ukraine?The Explainer EU remains largest importer of Russian fossil fuels despite sanctions aimed at crippling Kremlin's war effort

-

Big Oil doesn't need to 'drill, baby, drill'

Big Oil doesn't need to 'drill, baby, drill'In the Spotlight Trump wants to expand production. Oil companies already have record output.

-

Why do Russian oil bosses keep dying?

Why do Russian oil bosses keep dying?Under the Radar There have been 'at least 50' mysterious deaths of energy company executives since Putin ordered Ukraine invasion

-

How might the Israel-Hamas war affect the global economy?

How might the Israel-Hamas war affect the global economy?Today's Big Question Regional escalation could send oil prices and inflation sky-high, sparking a worldwide recession

-

Recent mega-mergers could signal a turning point for the US oil industry

Recent mega-mergers could signal a turning point for the US oil industryTalking Point Both Chevron and Exxon have recently spent billions to acquire smaller oil companies

-

Has Saudi Arabia lost control of oil prices?

Has Saudi Arabia lost control of oil prices?Today's Big Question Kingdom goes it alone to cut production, risking tension with US and reigniting cooling inflation in Europe

-

US angered by Opec+ oil cut

US angered by Opec+ oil cutSpeed Read Energy prices to rise further as producers slash supply by two million barrels a day